Contents:

- Jewellery in the Digital Era

- Top 10 Brands

- Top 10 Influencers of Jewellery Brands

- Unlocking Brand Loyalty with Ambassadorships

- Content That Captivates

- Case Study: Tiffany & Co.’s Rise to the Top

- Insights: 5 Key Market Opportunities

- The Gen Z Opportunity for Jewellery Brands

- The Gender Shift

- The Fashion Extension

- India’s Coming of Age

- Combining URL with IRL

- Top 50 Brand Ranking

- Methodology

- About Karla Otto & Lefty

Introduction: Jewellery in the Digital Era

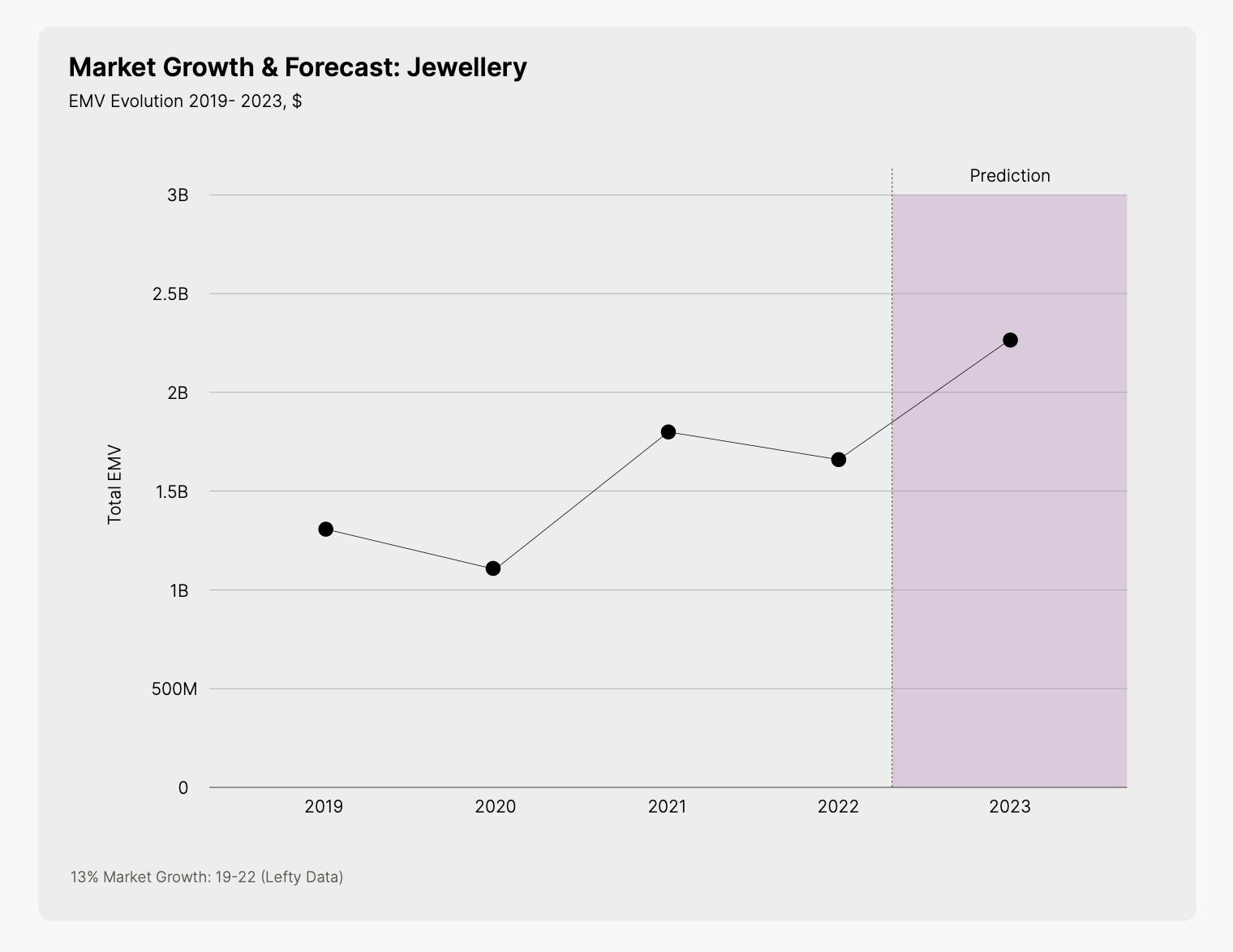

Covid-19 Propelled Luxury Jewelry into the Digital Sphere

Traditionally, the jewelry buying journey has been a brick-and-mortar experience centered around sentiment and in-store interaction. Buyers would naturally want to touch and try on high-value pieces. However, in recent years, the sector has undergone a period of rapid digitization, accelerated by the pandemic.

Jewelry Didn't Lose Its Shine Throughout the Pandemic

As stores shuttered and overseas travel halted (which, pre-pandemic, accounted for up to 30% of the jewelry market's spend), brands were forced to pivot their digital marketing strategies and sales online, leaning more heavily on influencer marketing and celebrity endorsements to maintain sales and foster brand relevance in an increasingly digital era.

The Growth of Jewelry Markets

The Growth of Jewelry MarketsSelf-Gifting and Zoom-Ready Styling

As it transpired, consumers were not deterred by jewelry's digitization, with those who were fastest to adapt to online shopping seeing an uptick in sales. In the US alone, spending on jewelry grew by 27.5% YoY in 2021, while the global market saw a compound annual growth rate of +7% YoY. According to a survey by The Plumb Club in 2021, 39% of consumers said spending more time at home during the pandemic inspired them to buy more jewelry, with 41% leaning towards pieces that could be seen on screen.

Sales are Set to Scale

What's more, online visibility clearly equates to sales power. With the jewelry market's current value sitting at just under $270Bn, a projected 8.5% growth rate will send that number sky-high to $518Bn by 2030, according to Grand View Research. Digital sales of jewelry are predicted to grow 18-21% by 2025 alone, meaning there's plenty at stake for brands expanding into the digital space.

The Digital Opportunity

Since lockdown measures were lifted, footfall has increased in stores, showing a slight plateau in Earned Media Value (EMV) throughout 2021-2022. However, Lefty data shows there's been a period of investment across Social Network Service (SNS) channels in Q1 of 2023, with EMV increasing by 32% compared to the same period in 2022. An uptick in visibility and market growth presents a critical opportunity for the jewelry category. Brands must align digital marketing strategies with the sentiments of a burgeoning generation of jewelry consumers. This can be achieved by working with the right online communities through a clear creative strategy that balances the physical allure of jewelry with the boom of influencer marketing.

The Art of the Story

Ultimately, storytelling via digital and influencer marketing is a central component in engaging audiences while showcasing the savoir-faire of leading jewelry brands: "Beyond the technical prowess of the jewelers and the magnificence of the gems, the Maisons are also putting extra efforts in developing enticing storytelling around the creations," comments Xavier Cagnion, GM at K2 in China. "It's no different from seeing a painting in a new light once understanding the inspiration behind it, or the process of the creation is explained to us more vividly. Sharing stories remains the best way to create emotional proximity, while preserving the exclusivity," surmises Cagnion.

Harnessing the Power of Influencers

With the ever-growing importance of digital marketing for jewelry brands, influencer marketing for jewelry brands has become an essential tool. Identifying the right partners on the right jewelry influencer marketing platforms is key to a successful campaign. Partnering with established influencers who resonate with your target audience allows you to leverage their credibility and reach to showcase your jewelry pieces in an authentic and engaging way.

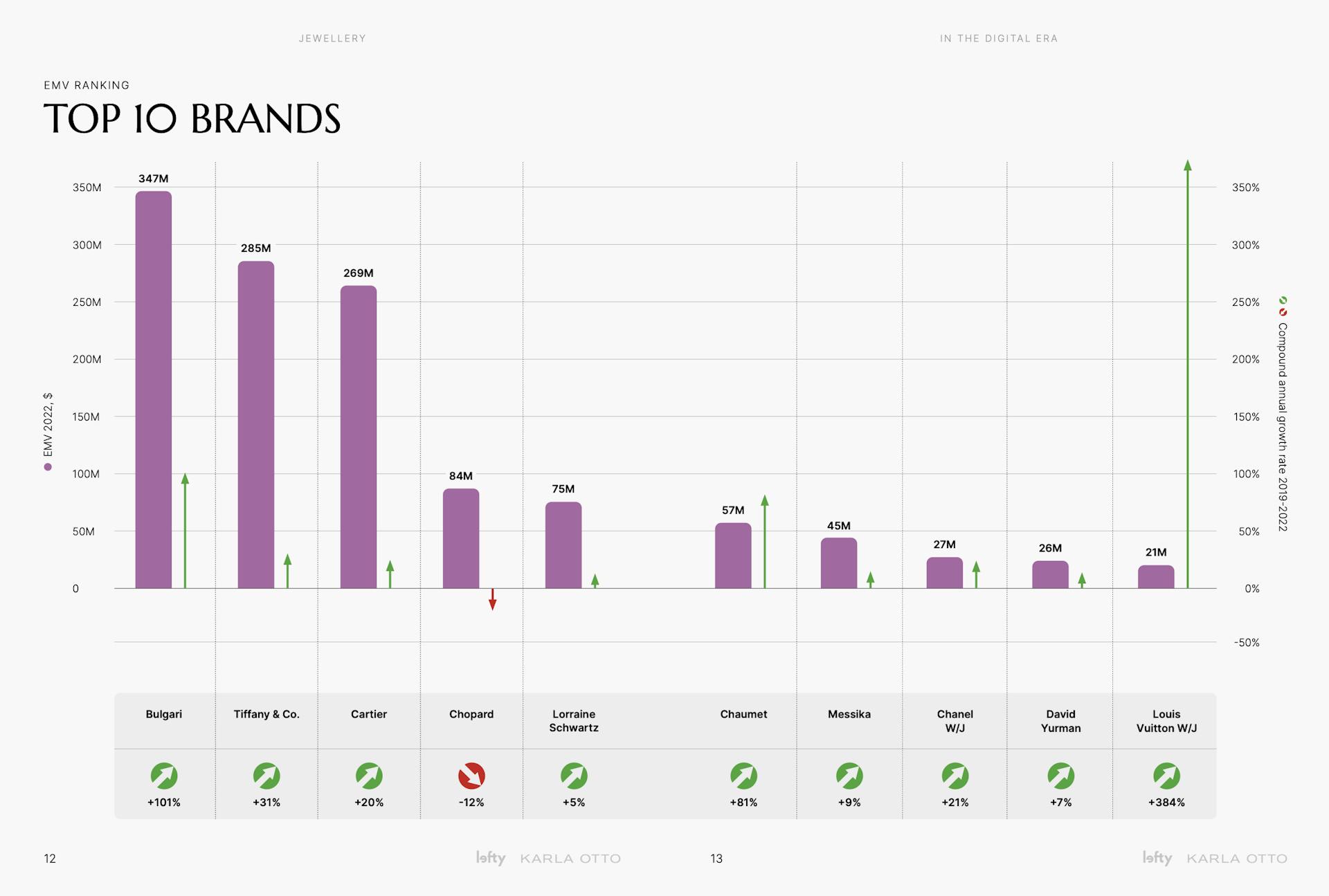

Top 10 Brands

Top 10 Jewellery Brands

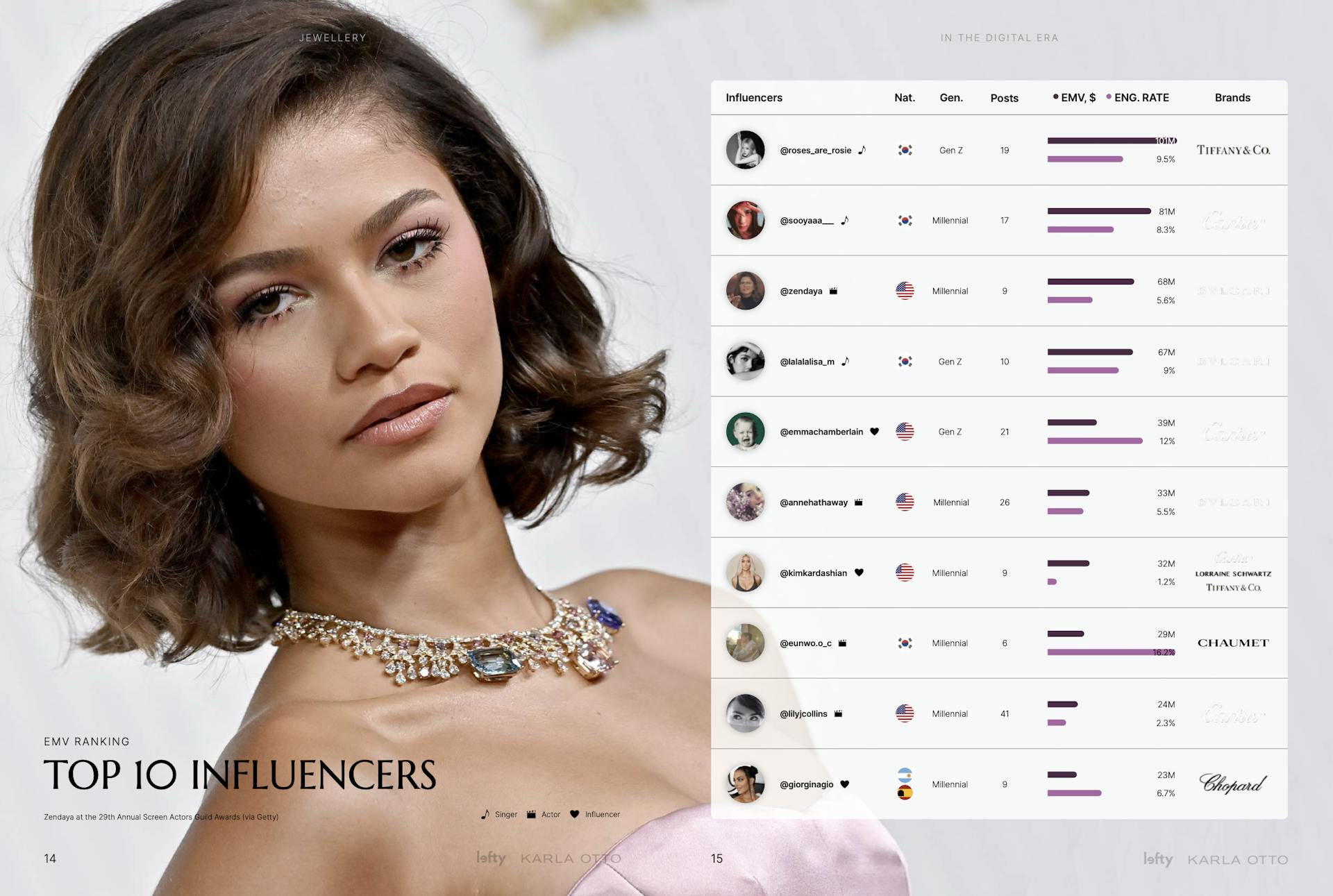

Top 10 Jewellery BrandsTop 10 Influencers

Top 10 Jewellery Influencers

Top 10 Jewellery InfluencersUnlocking Brand Loyalty with Ambassadorships

Leading Brands Have Close Relationships With Influencers

Leading luxury jewellery brands are turning to unique influencers and brand ambassadors to build their online presence. Brands like Tiffany & Co., Bulgari, and Cartier understand that successful relationships with influencers require longevity to create meaningful engagement and drive EMV. As such, these brands have created "ambassador squads" comprised of exclusive partners that can actively assist in building brand awareness and loyalty – long-term investments with guaranteed returns.

Bulgari: In 2020, Bulgari signed its first brand ambassador, Lisa of K-pop girl group BLACKPINK. Lisa remains the brand's highest visibility driver three years later, generating $66.8M EMV in 2022 alone. Like Tiffany & Co., Bulgari has set its sights on a digital strategy catered towards Millennials and Gen-Z, partnering with beloved actresses Anne Hathaway, Zendaya, and Priyanka Chopra on numerous campaigns.

Cartier: Cartier has successfully tapped into the Gen-Z market by partnering with popular celebrities like Jisoo from BLACKPINK, YouTube sensation Emma Chamberlain, and Lily Collins from "Emily in Paris." Adding to their impressive portfolio, Cartier has expanded into the APAC region by teaming up with Bollywood star Deepika Padukone. These collaborations have been a crucial factor in increasing Cartier's visibility, with brand ambassadors responsible for over 50% of their total EMV in 2022.

Cartier has set the bar for brand ambassadorship programs, boasting an impressive 57% of their 2022 EMV attributed to their ambassadors' posts. What's remarkable is their standout success with BLACKPINK's Jisoo, who single-handedly generated a whopping 45% of the brand's total EMV with just 12 high-impact posts and 24 stories.

High Jewellery’s Halo Effect

Top jewellery brands' high jewelry pieces epitomize luxury, beauty, and sophistication. Often seen adorning the necks, ears, and wrists of A-list KOLs at red-carpet events, these mesmerizing pieces are a sight to behold. Despite only representing a small fraction of the brands' collections, their visual impact and star power make them a powerful tool for storytelling and captivating audiences. Brands strategically use high jewelry pieces in their activations and content to drive significant engagement and EMV. For them, it's not about selling but creating an emotional connection and capturing the imagination.

The Red Carpet Effect

While fine jewellery brands rely heavily on brand ambassadors to gain visibility, the quality and quantity of their content are equally important when determining their success. An analysis of the top influencers for leading fine jewellery brands shows that, while campaign-related content is the most numerous and generates the highest EMV overall, posts related to red-carpet events come in a close second and benefit from an average engagement rate 30% higher than campaign posts.

With the frenzy that major red-carpet events generate, it's no surprise they generate the most significant engagement; they offer a one-of-a-kind medium to showcase fine jewellery. For audiences online, anticipating seeing their favorite celebrities and influencers wearing their most dazzling ensembles generates extra excitement; this enthusiasm can quickly translate into increased engagement and EMV for associated jewellery brands. As such, events like the Met Gala, Cannes, or Academy Awards grant brands a unique opportunity to showcase their luxury pieces while reaching a broad online and offline audience.

For the past few years, Tiffany & Co., Cartier, and Bulgari have employed activations that successfully blend branded campaigns with red-carpet events. In a strategic effort to build relationships with their most exclusive clientele, the brands each organized large-scale brand exhibitions and galas, inviting their top clients and brand ambassadors. These opulent events were designed to display new pieces from their collections while also celebrating the brands' iconic histories. Guests witnessed the beauty of marquee pieces and experienced a synergy between these top jewellery brands and glamorous red carpets.

These large-scale activations have become an successful way for brands to drive engagement and EMV, with many posts related to Tiffany & Co., Cartier, and Bulgari's events ranking among their highest EMV-generating posts in 2022. This success is likely due to the same "red-carpet effect" that generates excitement among audiences when seeing stars on the red carpet and celebrities posting more than usual about an activation, creating genuine content and a compelling story on social media. Moreover, celebrity interaction and posting content with one another facilitates significant engagement as they leverage their followings to create increased visibility. For Tiffany, Cartier, and Bulgari, an average of 16% of their total 2022 EMV can be attributed to these activations, demonstrating their efficacy and powerful effect on audiences.

- Tiffany & Co.: Vision and Virtuosity: $36.4M (13% of ‘22 EMV)

- Cartier: Beautés du Monde: $63.5M (24% of ‘22 EMV)

- Bulgari: Eden Garden of Wonders: $40.3M (12% of ‘22 EMV)

Beyond the technical prowess of the jewelers and the magnificence of the gems,the Maisons are also putting extra effort into developing an enticing storytelling around the creations or the collections; It’s no different from seeing a painting under a totally different light once the inspiration behind it or the process of creation is explained to us more vividly. Sharing stories remains the best way to create the emotional proximity while preserving the exclusivity.

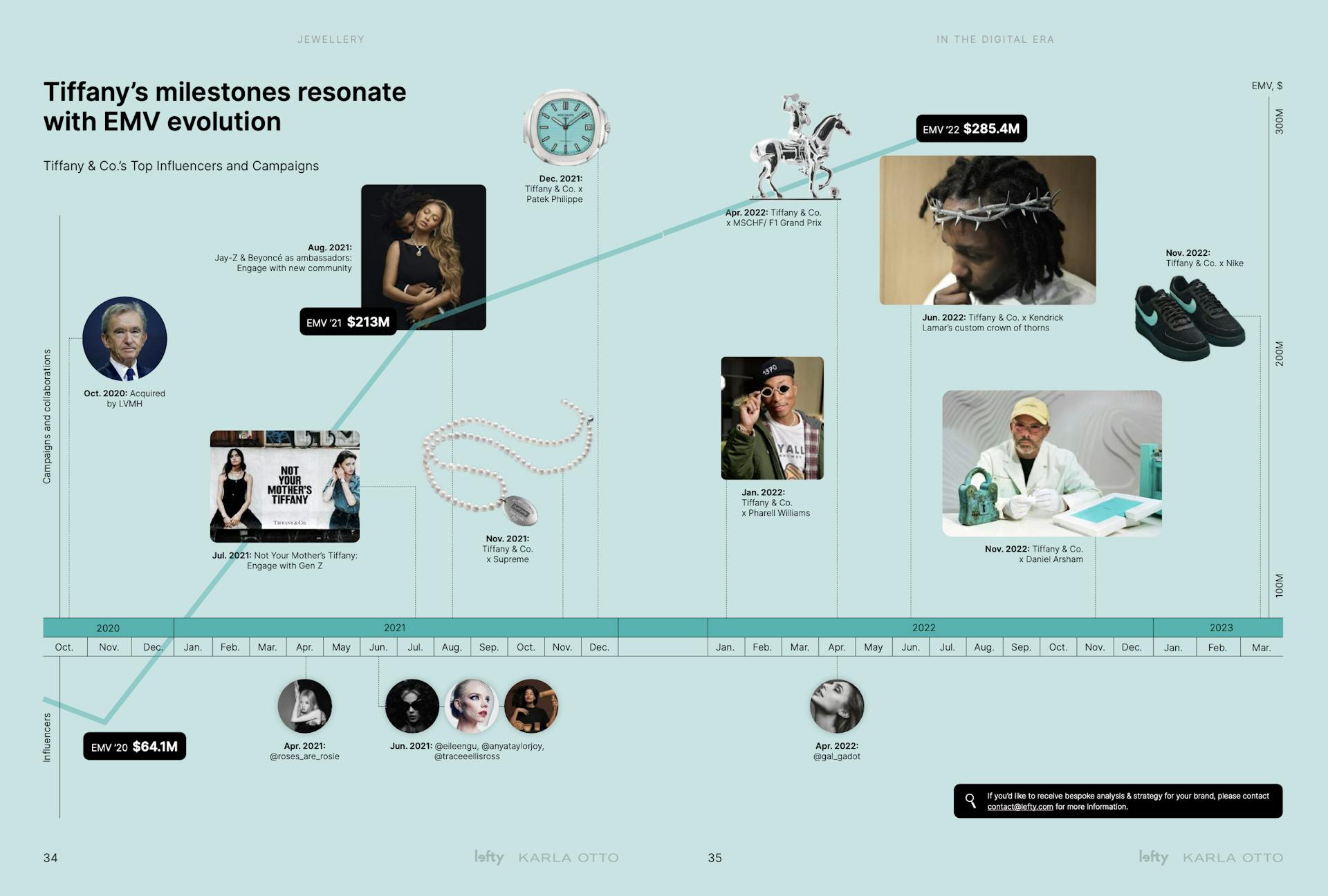

Case Study: The Rise of Tiffany & Co

Since their LVMH acquisition in 2020, Tiffany & Co. has been laser-focused on obtaining the gaze of a younger demographic to capture Gen Z’s rising spending power and challenge rival brands. A remix of their executive and design team on acquisition caused a major stir in strategy, which according to Lefty data, has paid off: Tiffany & Co’ EMV has skyrocketed Lefty x Karla Otto unpack their climb to the top: Tiffany's Milestone

Tiffany's Milestone

Tiffany's MilestoneThe brand’s latest marketing campaigns make no secret about shaking off its corporate image, mixing smaller-scale activations with blockbuster campaigns and collaborations, all focused on capturing the GenZ gaze. In 2021, the ’Not Your Mother’s Tiffany’ campaign quite literally spelled out its ‘out with the old, in with the new’ intentions and was met with a sour response from its core customers who felt alienated by the brand’s new direction. Later that year, Jay-Z and Beyoncé fronted a campaign, followed by a strew of buzzy collaborations with a high-low strategy, from catwalk collaborations with Fendi to a range of streetwear ready jewellery with Supreme.

Most recently, Tiffany’s partnership with sportswear giant Nike marked its first collaboration with a mass-market brand. The collaboration, consisting of a $400 Nike Air Force 1 alongside a line of silver-plated shoe-care accessories, sparked controversy and divided opinion around the execution of the idea and the purpose of the product. Still, its limited edition range sold out on release day and has since been seen across resale sights for quadruple the retail value. According to Lefty’s data, despite mixed opinion, the Nike x Tiffany collaboration reached 13.9 million users across social media and generated an EMV of $2.98M.

In the past two years, the luxury brand has enlisted the help of several young and relevant rising stars, including actor Anya Taylor-Joy, K-Pop sensation Rose, and skier Eileen Gu as brand ambassadors. In addition, Tiffany has teamed up with a diverse group of creatives, including Luar designer Raul Lopez, actor Jenna Ortega, and influencers Brittany Xavier and Chriselle Lim for paid campaigns. The brand has embraced a fresh and youthful vibe, positioning itself as a stylish and accessible option to court Millennials and Gen Z.

Tiffany’s strategy clearly works in terms of financial return. In January 2023, LVMH stated Tiffany had a “record year” in 2022, “driven by increasing desirability,” with the brand’s high jewellery revenue doubling.

Many industry insiders have weighed in with commentary around the heritage brand alienating its more conservative customer - but as it seems, any media reaction is validating not only sales but the share of voice, with its EMV increasing by 31% YoY between 2021-22.

Insights: 5 Key Market Opportunities for Jewellery Brands

5 Key Market Opportunities

5 Key Market OpportunitiesThe Gen Z Opportunity

The digitisation of jewellery marketing has boosted visibility and broadened the audience demographic. Lefty data shows that Millennials - and Gen Z in particular - are the most engaged by jewellery content across platforms, with 18-34-year-olds making up 84% of audiences, with almost half of that segment between ages 18-24. “This generation are statistically the heaviest social media users,” states Ross, adding “But what’s interesting is that now Millennials are becoming parents, the digital flux is getting even younger; it won’t be long before we see the upsurge in the Gen Alpha audience as a new target market for luxury brands.”

Although Millennials are currently the luxury market’s core spenders, Gen-Z is set to overtake Millennials by 2030, set to represent 80% of the commercial market. In fact, this generation is already spending money on luxury goods. According to a report by Bain & Co, the average age of this generation's first luxury purchase is 15; 3-5 years lower than their Millennial counterparts. “Rising wealth and digital accessibility are opening up the world of luxury far younger,” surmises Ross, “Brands should invest in a robust and relevant digital strategy to meet Gen Z where they spend the most time, alongside working with the right community to foster relevance and authenticity.”

Gen Z differs from their counterparts because of their unique - and predominately digital - path to purchase. According to a recent report from Google, nearly 40% of Gen Z now heads straight to social media for product reviews and recommendations, cutting out the traditional search engine. “This generation is savvy to a hard sell, so traditional advertising and product placement just doesn’t cut it,” explains Annika Bear, Lefty’s Marketing Manager to Europe. “This is why influencer marketing is imperative for the jewellery category; Gen Z audiences want authentic reviews and recommendations from like-minded communities,” surmises Baer.

The Gender Shift

According to Lefty data, more people identifying as male in Millennial and Gen Z categories engage with jewellery content than in any other generation. “This indicates a wider societal shift around self-expression, style, and gender identity,” Karla Otto’s Ross explains.” “Consumers, especially those of Gen Z and Millennial demographics, no longer think about gender in a binary way, but as an all-inclusive consideration.”

Many heritage brands are leaning into unisex lines to tap into the growing demand for genderless products. From 2020 onwards, Louis Vuitton launched LV Volt, Bulgari launched gender-neutral line B.zero1 Rock and Viper, while Cartier’s love bracelet is pitched to both markets. However, unisex lines are traditionally created in minimalist, precious metal styles to appeal to all. Those limitations are shifting as an appetite grows for jewellery that explores a more flamboyant edge that caters to a wider spectrum of gender identities.

According to a study by Irregular Labs, this is particularly relevant for Gen Z, of which 25% expect their gender identity to change during their lifetime, presenting an opportunity for jewellery brands to move the needle on convention. Leading brands such as Bourcheon are showcasing the idea of a more decorative approach to gender-fluid jewellery, regularly featuring men and women in their campaigns wearing the same collections. Meanwhile, both Boucheron and Bulgari have dropped gender segmentation from their e-commerce site, instead on self-expression and style.

Expect to see this continue to shift as gender becomes an increasingly fluid concept. “This idea feels more commonplace in fashion-jewellery ranges,” explains Ross. “Pearls are a good example of how we’ve seen the jewellery industry reflect more gender-fluid trends,” Highly influential KOL’s such as Harry Styles, Sam Smith, Timothee Chalamet, and Tyler the Creator have flipped the stereotype of pearls as a female-only aesthetic on its head. At the time of publishing, #pearls has reached 1.4Bn views on TikTok, cementing the importance of this particular trend amongst Gen Z.

The Fashion Extension

Historically, the timeless appeal and mastery of slow-craft renowned of the jewellery industry versus the changing tastes of fashion is why heritage Maisons have long dominated the landscape, but Lefty data shows that fashion brands are beginning to take a bigger slice of the pie. Both Louis Vuitton and Chanel are within Lefty’s Top 10 fine jewellery brands by EMV, with Louis Vuitton increasing by +348% YoY and Chanel by +21% YoY, signaling a shift in consumer tastes towards a more trend-driven mindset in the market.

Conversely, heritage jewellery brands and emerging jewellers are increasingly positioning ranges at a demi-fine price-tag, perfect for an upcoming generation of jewellery buyers who want to make their first luxury purchase without breaking the bank. This shift signals a ripe opportunity for more brands to enter the space in both directions.

Additionally many heritage jewellery brands are putting greater weight into accessories to broaden their market appeal, drive bigger margins and capture the consumer who wants to buy into trends over tradition.

Cartier, Chopard, and Bulgari have extended their range of accessories to tap into the jewellerification of their brand identity via hardware and trims, some of which can even be repurposed as a piece of jewellery. Bulgari has utilised the collaboration model with various fashion designers, from Nicholas Kirkwood, Alexander Wang, Ambush’s Yoon Ahn, and Mary Katrantzou to tap into the tastes of the fashion-follower market. Meanwhile, Cartier worked alongside Emily in Paris star Lily Colins to promote their line of bags to tap into the burgeoning entertainment economy and foster relevance amongst a fashion-forward audience.

A combination of a rapidly evolving digital landscape combined with longstanding cultural tradition has created a highly engaged audience throughout Southeast Asia.

Lefty identifies that Indonesia, Thailand, India, Philippines and Malaysia account for over 30% of the global distribution of online audiences engaging with content produced by jewellery brands.

Jewellery holds immense significance in SE Asia and is deeply embedded in the region’s traditions and customs. Across these regions, jewellery is not simply seen as a fashion statement, but also plays a role in religious and ceremonial practices, often passed down as heirlooms for generations to come.

This is an audience where heirloom and non-branded jewellery play a significant role, however, the notion that more people are engaging with the content of leading jewellery brands could demonstrate a shift in the wider market.

The Rise of India

According to Lefty data, 6.23% of digital audiences engaging with top luxury jewellery brands’ content are from India. This is thanks to a vast improvement in the country’s online infrastructure, which has enabled consumers to discover brands on a global scale. Additionally, the country has a growing young and affluent population, with India set to overtake China as the country with the largest number of millennial consumers by 2023, while it’s luxury economy is forecast to grow by +3.4% YoY to a value of $6.1Bn this year, according to Euromonitor. Leading luxury brands are entering the Indian market: Valentino and Balenciaga are expanding this year, while Galeries Lafayette is set to open a new department store in Mumbai and Delhi. Dior’s Gateway of India show in Mumbai, and the opening of The Nita Mukesh Ambani Cultural Centre in the city has furthered India’s reputation as a burgeoning market for luxury brands as a whole.

The jewellery market plays a significant cultural and commercial role in India, as the country is responsible for 29% of global jewellery consumption. This is largely driven by India’s bridal market, equating for roughly half of the countries near $50Bn annual spend on jewellery per year. Tradition and heirloom jewellery are a core component of the market and factors that brand’s should be aware of before marketing to the Indian consumer. “ In India, its customary for families to have a personal jeweller who creates bespoke jewellery for them, starting as early as a newborn's first piece,” comments Dipesh Dapala, Co-Founder of The Quode. Lefty’s Anushka Baluni adds, “While branded pieces may be suitable for everyday wear, occasionwear is where customs and traditions come into play, and family jewelers understand the history and significance behind these pieces.”

Baluni notes that within the Hindu religion, precious metals such as gold and silver have particular significance, adding “There are specific festivals (Dhanteras and Diwali) where purchasing jewellery and precious metal items is practiced and is believed to bring wealth and prosperity. This is a great period for brands to capitalize, while remaining sensitive to their traditions.”

So, how to capture the Indian market while remaining sensitive to tradition? “In India, celebrities and sports personalities hold great sway, and the diverse market has also propelled the influencer industry to prominence,” states Anushka Baluni of Lefty. “Collaborating with Indian influencers can help brands effectively communicate with their target audiences and boost brand awareness whilst being sensitive to the culture and traditions of the region,” she futhers

Across the luxury jewellery scene, leading brands such as Cartier signed Deepika Padukone as a regional brand ambassador, who has since drove $2.46M in EMV for the brand. While, Bulgari co-designed a necklace with Priyanka Chopra Jonas only available to Indian consumers, generating $1.39M in EMV

Combining URL with IRL

Although digital strategies will remain an imperative investment for brands, now that the pandemic’s footfall impact has eased, in-store experiences will once again recapture market spend. Creating opportunities for consumers to interact with products across both physical and digital channels will make luxury jewellery more accessible and further influence purchase decisions and relay brand storytelling. Many brands have been doubling down on virtual experiences or services that capture the attention of Gen Z while combining IRL and URL experiences for a more holistic brand journey.

Augmented Reality in the Physical World

A 2022 study by Crowd DNA of nearly 5,000 Gen Z, 93% of participants wanted to use AR (Augmented Reality) for immersive shopping experiences. Many jewellery brands, such as Tiffany and Cartier, have been quick to react, working alongside Snapchat with a series of virtual try-on experiences that allow users to try the jewellery at home and learn about the brand heritage via interactive storytelling.

Cartier has leaned into storytelling the brand heritage of its iconic Tank watch, using an AR filter to transport the user to the Pont Alexandre III bridge in Paris. The virtual experience allows the user to see and try on four iterations of the timepiece from different eras of its 106 year history, allowing users to interact with their virtual surroundings while discovering the product

Bvlgari celebrated the 75th birthday of their iconic Serpenti in an interactive collaboration with teamLabs. The Serpenti comes to life outside their flagship store in Ginza, activated by a QR code accessible outside the store. Users can customise the pattern and colour shown on the snake via the Bulgari website, which is then projected onto the store.

To cement its position amongst the ever-online Gen Z, Bulgari partnered with Asia’s biggest Metaverse platform, Zepeto, to create a fully interactive environment that also taps into the power of influencer marketing. The metaverse environment encompasses interactive games that allow users to dress their avatars in the label’s heritage luxury. Bulgari worked alongside brand ambassador Lisa of BLACKPINK, turning the star into an avatar so fans could take selfies and interact with the K-Pop star.

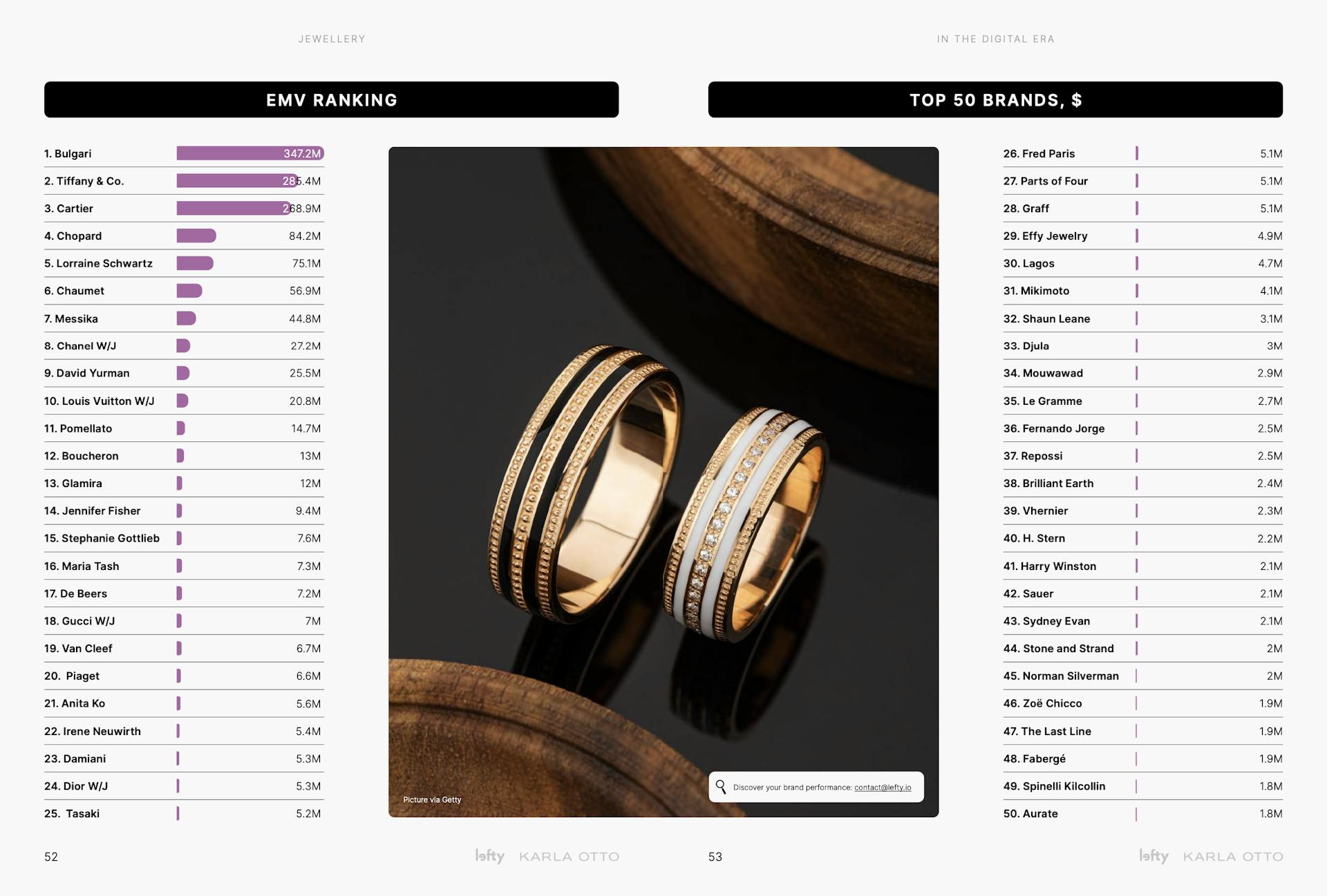

Top 50 Jewellery Brands

Top 50 Jewellery Brands

Top 50 Jewellery Brands

Methodology

This study is based on the influencer marketing and digital marketing of branded high jewellery, fine jewellery and fashion brands who have entered the high or fine jewellery categories. This study analyses more than 8,066 influencers on Instagram with over 10,000 followers who have tagged the Instagram account of one of the jewellery brands analysed in this study. The influencers presented in this study have been identified thanks to Lefty’s proprietary algorithms, which identify and attribute content to a brand based on @ mentions.

Suppose an influencer does not directly mention a brand using a specific hashtag (ex. #brandfw23) or tagging the brand’s account in-caption or in-post (ex. @brandofficial). In that case, Lefty will not be able to retrieve the post and will not be attributed to the brand’s total performance.

On Instagram, this study focuses its analysis only on Instagram in-feed posts (Posts, Videos, Carousels) and does not look at Instagram stories. Collaborative posts between accounts are only attributed to the account which initiated the collaboration.

Lefty defines Earned Media Value (EMV) as the equivalent ad spend of the impressions gained. The EMV is calculated by estimating the number of impressions of each post and associating a Cost Per Impression (CPM) of $100 on Instagram. The formula used is:

(Impressions * CPM) / 1000.

Even though the list of influencers retrieved aims to be exhaustive, some influencers who have posted content for brands may not be considered in the present study.

Additionally, this study does not include Chinese social networks and does not consider the EMV generated on platforms such as Weibo.

Note: Discrepancies in engagement, the number of likes, shares, or comments on posts may appear due to content continuing to be interacted with on Instagram after the date of the data being downloaded from Lefty.

About Lefty & Karla Otto

About Lefty

Created in 2015, Lefty is a platform that helps brands optimise their influence

marketing programs. Based on proprietary, state-of-the-art technology, Lefty

supports brands with influencer identification, management and reporting

of their influencer marketing campaigns. Discover more at lefty.io or contact

contact@lefty.io.

About Karla Otto

Founded in 1982, Karla Otto is a full-service brand-building agency, operating

from thirteen cities across the globe. Karla Otto’s service is unparalleled. Blending the best of fashion, beauty, design, lifestyle, and arts & culture, we offer

a panoramic view of opportunities and the ability to execute complex ideas.

Our loyal network and unrivalled approach to culture and community enables

us to take brands to brave new territories. Discover more at karlaotto.com or

contact insights@karlaotto.com.