Introduction

During Menswear Fashion Week in June, thousands camped overnight outside the Palais de Tokyo, Paris, ahead of Hedi Slimane's S/S23 Celine show. But it wasn't the brand they were waiting to see. Crowds outside of fashion shows are not rare in Paris; however, the arrival of three guests caused uproar around the event. Crowds had unanimously gathered to glimpse Lisa from the K-Pop girl group 'BLACKPINK,' 'BTS member Kim Tae-Hyung, and actor Park Bo-gum.

Seated inside, industry guests were left bemused as the stars were greeted with waves of adulation. What they were witnessing, however, has become more commonplace. For several seasons, KPop stars have been a dominant force during show season, scattered amongst the front row and walking the runway. According to Lefty data, out of the top 100 influencers attending Men's Fashion Week, 13% were South Korean; however, 13% generated almost 60% of the season's overall EMV, equating to over $62M. A key casting trend now and into the future, Karla Otto x Lefty joins forces to understand the who, the why, and what's next in the K-Pop phenomena.

"K-Pop Stars generated nearly 60% of the overall EMV of Menswear Fashion Season, equating to $62M in EMV."

The History of Hallyu

90s K-Pop group.

90s K-Pop group.After the fall of authoritarianism in South Korea in the late 1990s, when regions such as China had previously censored domestic and foreign media, Korean film, television, and music began re-circulating throughout Asia. This opened this media genre to a broader audience, creating the birth of the 'Korean Wave,' or 'Hallyu' as it's widely known.

Following the 1997 financial crisis, South Korea's Ministry of Culture invested heavily in creative industries to strengthen local culture and build on home-grown talents. As such, a surge of creativity happened in the region, with Korean films and dramas airing across APAC and creating a regional phenomenon. One of the most impactful dramas was 'Winter Sonata,' credited with an 884% increase in Japanese tourism to the region of Gangwon-do, where the drama was filmed.

Girl's Generation in 2007.

Girl's Generation in 2007.In the 2000s, South Korean culture circulated rapidly thanks to an influx of digitization. Japan, in particular, resonated with the music of one artist, Kwon Bo-ah, or BoA. Her music was so popular that she was hailed 'The Queen of K-Pop.' BoA broke into the music industry at 14, managed and trained by SM Entertainment, who taught her Japanese to impact the region during social and political tensions between the two nations. Her music served as a cultural envoy and paved the way for other musicians, such as TVXQ/DBSK and EXO, to ride the Korean Wave across APAC with outstanding success.

One such group was Girls Generation, founded in 2007. It resonated with fans for its music and image of self-empowerment, equality, and human rights. Its lyrics soon became anthems for political protest, female empowerment, and LGBQT+ rights, striking a chord with marginalized Asian communities. These themes now run central throughout much of K-pop music and have enabled many groups to have a globally diverse fan base.

KPop has become an economy in its own right, helping transform the region's image of one once devastated by War to that of cultural modernity and thought leader in the digital sphere. According to a report by The Korea Foundation, the foreign market for South Korean pop music and culture roughly doubled between 2015 and 2019. However, Hallyu's power is only just getting started.

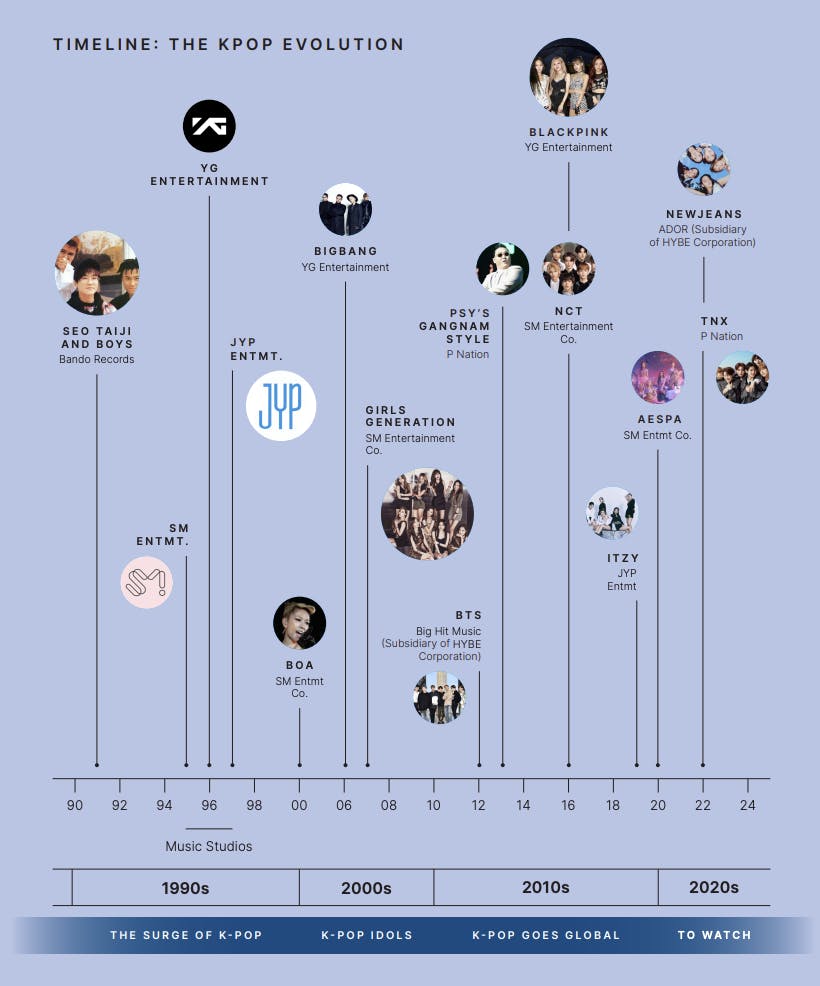

Timeline: The Evolution of K-Pop

A timeline of the impact of K-Pop.

A timeline of the impact of K-Pop.K-Pop Today

Breaking the Globe

BTS

Since their launch in 2013, BTS has been hailed as the first K-Pop group to enter the American market. Their success has been compared to The Beatles; their music accounts for 1⁄3 of all K-Pop-related streaming in the USA. In addition, the band is now a familiar face on the American TV circuit, having featured on shows such as Jimmy Kimmel, America's Got Talent, and Ellen DeGeneres, amongst others. Such is their success; BTS has become an economy in its own right, reportedly bringing in $3.6B annually to the South Korean market.

Their impact has moved beyond personalities and into politics, with the band launching a partnership alongside the United Nations aimed at youth empowerment and anti-violence, as well as being invited to The White House in 2022 to speak with Joe Biden and Kamala Harris on anti-Asian hate crimes. Locally, so treasured are the group that many are questioning if the group — who contribute so much to the economy — should have been exempt from South Korea's compulsory military service.

BTS being interviewed

BTS being interviewedBLACKPINK

Since their launch in 2016, Blackpink has been dubbed ‘the biggest girl group in the world.’ Formed by YG Entertainment, the four-piece group includes Lisa, Jennie, Jisoo, and Rosé.

The girls come with a roster of ‘firsts’ under their belt. The first group to hit 1bn plays on YouTube; the first K-Pop girl group to play at Coachella; the first girl group to feature on Forbes 30 under 30 list. Their tours sell out within seconds, and media outlets have reportedly had to quadruple print copies when they feature on the cover. Blackpink is known for breaking into the West thanks to integrating Western lyrics into their music alongside collaborations with famous artists such as Lady Gaga, Selena Gomez, and Cardi B.

Now a mainstay on the Fashion Week circuits, an appearance at a fashion show has impacted a brand’s reach. According to Lefty data, Lisa’s appearance at the Celine show generated almost $30M of EMV — accounting for nearly 40% of the entire season’s EMV overall.

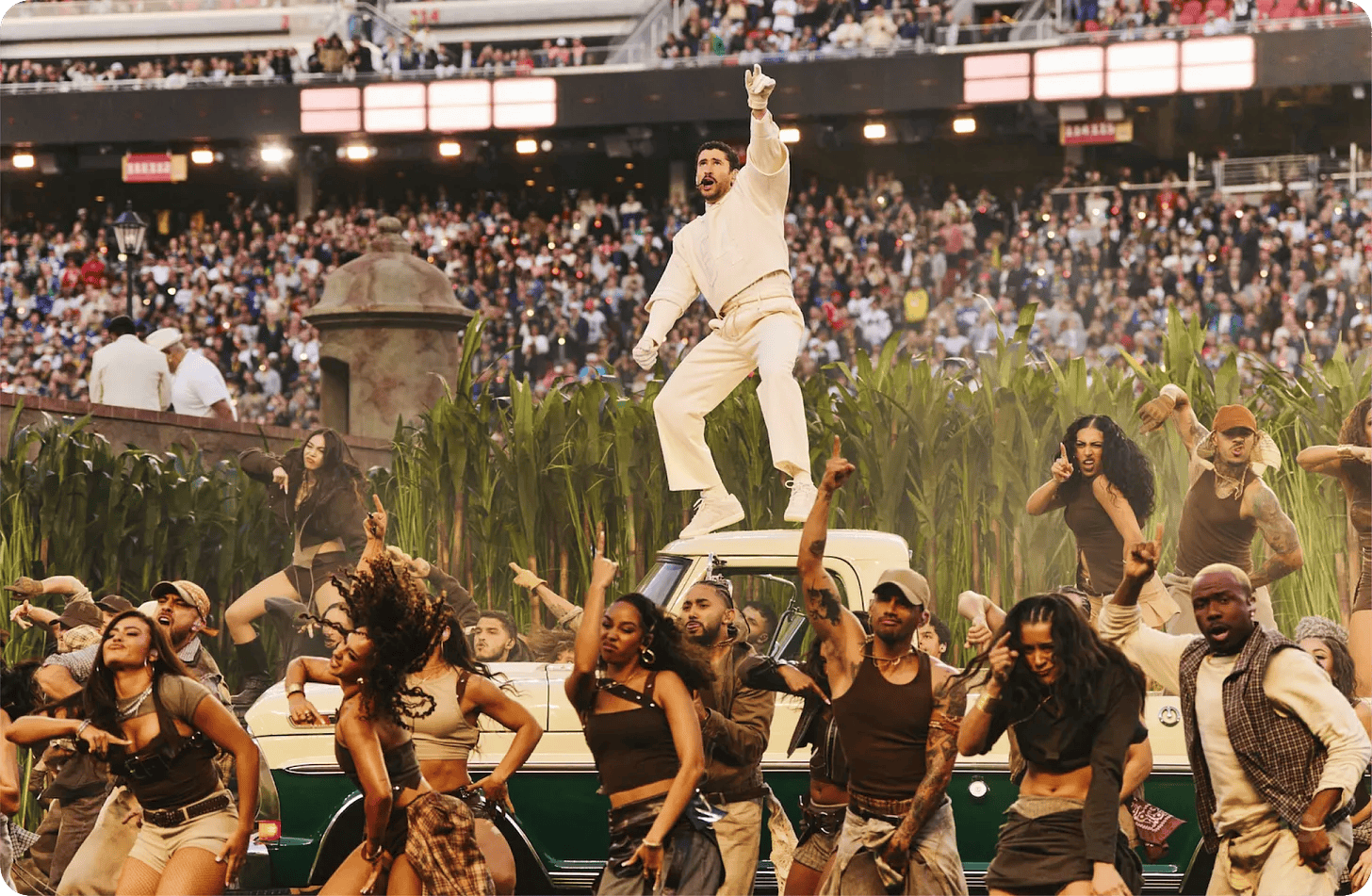

Blackpink at Coachella.

Blackpink at Coachella.Korean-American Idols

Korean-American K-pop Idols Eric Nam and Jessica Ho are the perfect examples of how their upbringing helped to set them apart in this highly competitive field and gain notoriety for being more outspoken and liberal. With a growing international K-pop fan base, the tendency is for both audiences and talent to become more diversified.

Jessi

Born in New York, Jessi is described as the Unnie (“big sister” in Korean) of K-Pop for being older (33) than your average Idol. Although modern Korean fashion is slowly becoming less modest, there are still reservations about showing cleavage, especially among Idols. Jessi’s style leans towards more Western tastes, favoring body-conscious silhouettes. This Idol has also been outspoken about cosmetic surgery, even though it’s not always well-received amongst K-pop fans. Jessi is a star who’s breaking down the barriers of what it means to be an Idol on the K-Pop stage today.

Korean-American K-Pop idol, Jessi.

Korean-American K-Pop idol, Jessi.Eric Nam

Having first found fame through a YouTube cover nearly ten years ago, Nam went from being an aspiring data analyst from Atlanta to one of South Korea’s most notable names in the entertainment industry. His appeal has been linked to his charismatic personality displayed in several television appearances in both Korean and American media. In more recent years, he has decided to concentrate his efforts on music again, which is paying off- his latest single, released in 2023, peaked on the Billboard 200 chart at No. 16.

An image of Eric Nam.

An image of Eric Nam.Breaking Protocols

From curating how they dress and act to creating limitations around personal relationships and sexuality, the K-pop industry has imposed its share of rules and protocols on Idols. However, a growing movement of artists is choosing to distance themselves from these expectations, even if that means being put under public scrutiny.

Jay Park

Park is a standout star in his style; an example of that can be seen in his carefree attitude towards tattoos, even though having ink is often frowned upon in Korean society - often associated with organized crime. So, for K-pop Idols, that means placing them where they are hidden or in more strict agreements, forbidden altogether.

Hyuna and Dawn

Soloist HyunA and Pentagon’s Dawn were fired from their labels after going public with their romance. As a result, they received a lot of support from fans. PSY-owned label P Nation has since signed them despite the controversy.

Holland

Holland is known as South Korea’s first openly gay K-pop idol. Although he is open about his sexuality, he has struggled to find an agency to support him. In the end, Holland decided to make his independent debut in 2018 with the single “Neverland.” The music video, in which Holland and his male counterpart are kissing, was rated 19+ in South Korea but still garnered over a million views within 24 hours. Holland then began to receive offers from labels but decided to go alone, later telling the Korea Herald he “didn’t fit into the typical entertainment agency system.”

An image of Jay Park.

An image of Jay Park.The Psy Effect

Music producer and singer PSY was responsible for South Korea’s most significant viral phenomenon, “Gangnam Style,” in 2012. However, his notoriety in the industry goes a lot further.

PSY’s extensive career in the music industry is demonstrated by his ability to stay relevant and keep up with trends. For example, in 2019, he launched his music label P-Nation and has since signed several talents redefining K-Pop, such as Jessi, Hyuna, and Dawn. Earlier this year, PSY joined TikTok after Gangnam Style began trending on the platform, coinciding perfectly with his comeback to music with the release of his single “That That” featuring BTS’s Suga.

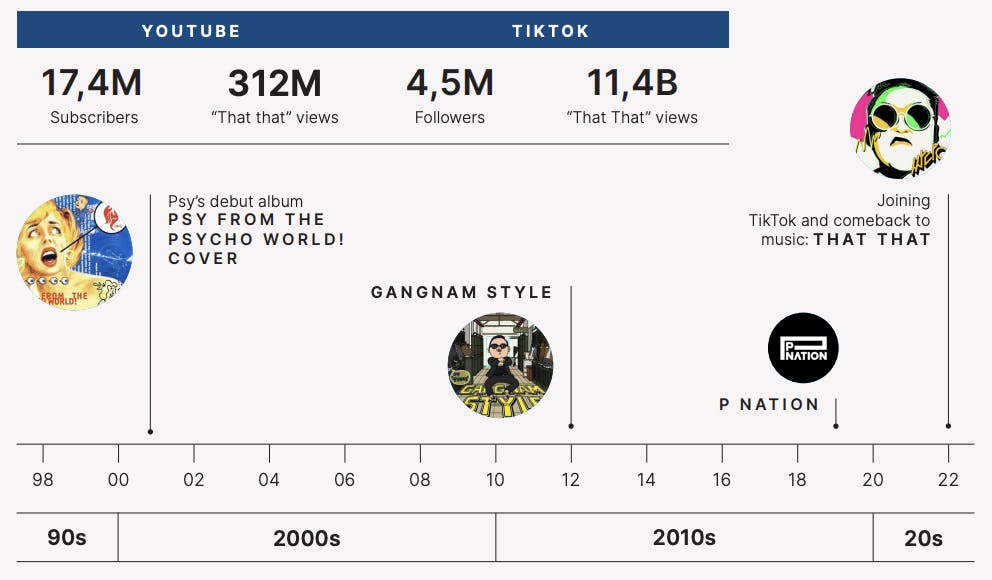

A timeline of Psy's music and production career.

A timeline of Psy's music and production career.The Fashion Effect

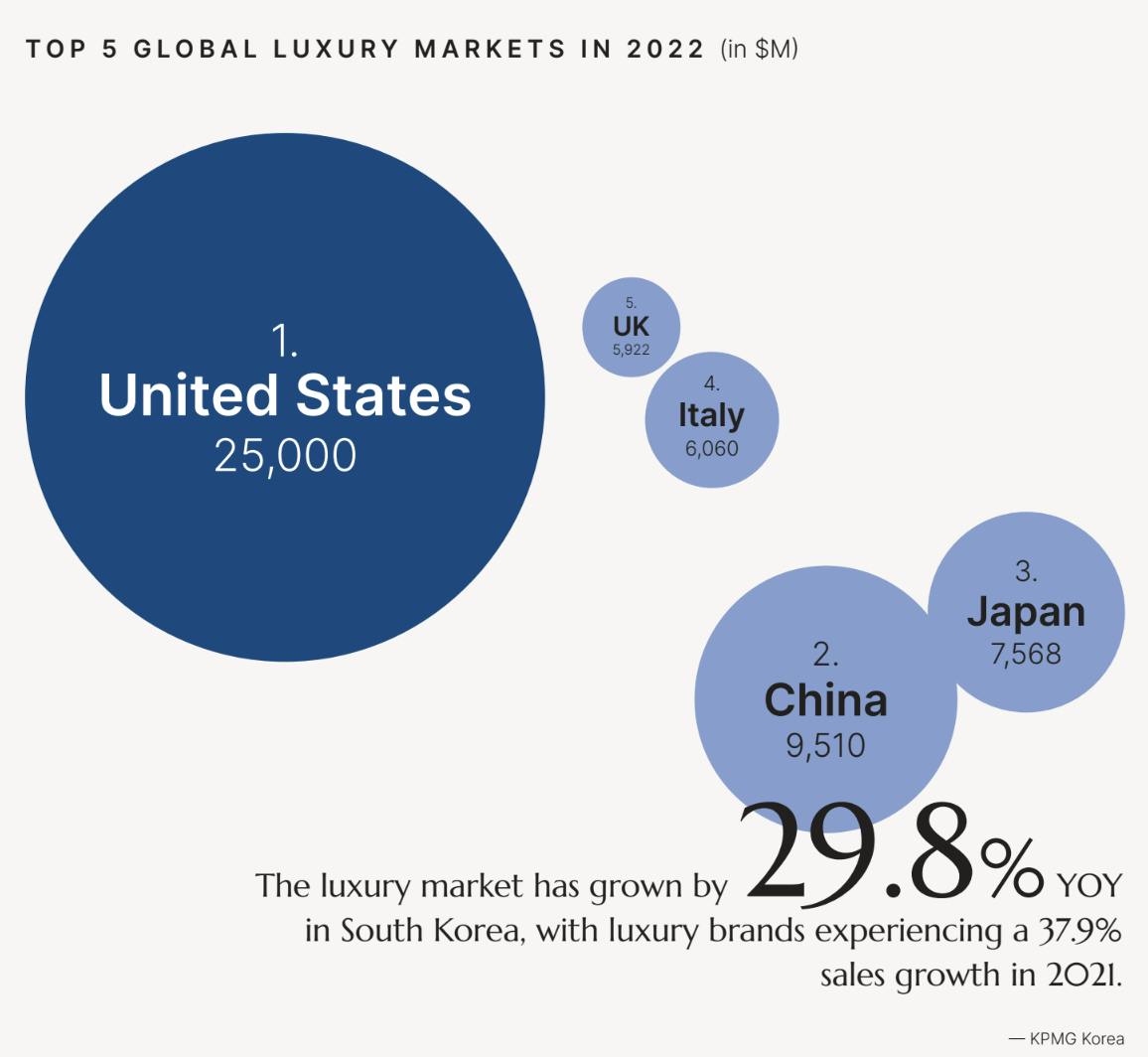

Today, the effect of Hallyu has impacted most consumer categories, including food, cosmetics, beauty and fashion. Locally in South Korea, the market for luxury goods is growing. According to a report by KPMG Korea, the country’s market size soared YOY by 29.6% to $5.8 billion in 2021. By 2024, it is projected to exceed $7 billion. Non-domestic luxury brands in South Korean department stores have seen a 37.9% sales growth in the same period, with the regions Gen-Z and Millenials fuelling interest in luxury goods post-lockdown.

A graphic of the countries with the largest luxury markets.

A graphic of the countries with the largest luxury markets. Leading luxury giants such as Balenciaga and Valentino have already begun to increase testing in this lucrative market with pop-up stores in the trendy district of Seoul. Such is the craze for brands such as Chanel (known as ‘Cha’), Louis Vuitton (‘Louis’), and Hermes (‘Her) in the city that a phenomenon called ‘open-run’ has broken outside stores, whereby customers rush to the stores at opening times to purchase the brand’s latest releases. Reuters reports that Chanel has had to begin screening clients to prevent bulk buying for resale, with the brand having to raise prices 5 times over 9 months to scale demand.

Not only do the stars impact their local and global markets, but they also have the power to impact fashion trends and boost brand awareness. For example, when Idol Suga from BTS wore a checked shirt designed by Virgil Abloh, fashion-technology platform LYST recorded a 120% uptick in searches for the item, while Dior received a 402% increase in website traffic when they announced they’d wardrobe the band for their world tour.

However, It’s not just luxury brands experiencing the benefit of K-Pop endorsement. KPop KOLs can turn a niche brand into an overnight success. Seattle-based hairclip company Chunks was spotlighted after Jisoo of Blackpink mentioned she carries a Chunks claw clip in a “What’s in My Bag” video for Vogue Korea. After the Vogue feature, orders for Chunks products increased by 3,000%.

"K-Pop Stars have the power to turn a niche brand into an overnight success with the capability to convert sales by 3000%."

BTS on tour.

BTS on tour.Social Media in South Korea

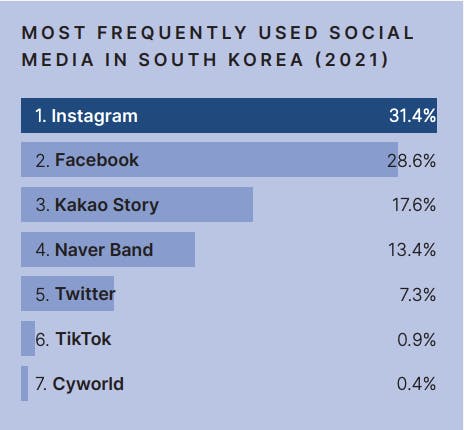

Regarding the region’s digital consumption, the country is home to some of the world’s most sophisticated internet users. In 2020, BOF reported that 99.6% of South Korean teenagers are digitally native and thus are a prime audience for influencer marketing. Brands must learn how to work alongside K-Pop stars and their native platforms to resonate with the growing influence of these idols.

Instagram, the region’s most popular channel, serves as a platform for K-Pop stars to communicate with global fans in real time via Instagram Live, cultivating a friendly, approachable image alongside glamorous lifestyle imagery.

X has helped stars reach international fanbases with more casual, immediate, and intimate interactions with fans. As such, the K-pop culture on X has transcended into its own pockets of fan culture, terminology, and memes.

In K-Pop, a key trend on YouTube is ‘FanCams’, which are recordings of celebrities taken by fans, usually during performances. It often follows a single group member and is an opportunity to increase a celebrity’s popularity. These videos rank one of the highest views in Kpop celebrity content, leading music program broadcasts to upload their versions of Fancam videos with high-definition quality.

Fans at a K-pop concert in South Korea.

Fans at a K-pop concert in South Korea.Although South Korea has no paparazzi culture, media such as Dispatch and many content creators on YouTube who follow K-celebrities serve as a gateway to further expand their influence. YouTubers with many followers expand a star’s reach by creating content on them or imitating their fashion and style.

Also popular across the region are native platforms Kakao Story, a social networking platform similar to Facebook, and Naver Band, which is used for group chats, much like WhatsApp.

For brands looking to reach new markets, the diverse platform distribution of South Korean KOLs could be the key to success.

A graph of the most used social networks in South Korea.

A graph of the most used social networks in South Korea.Key Ambassadors

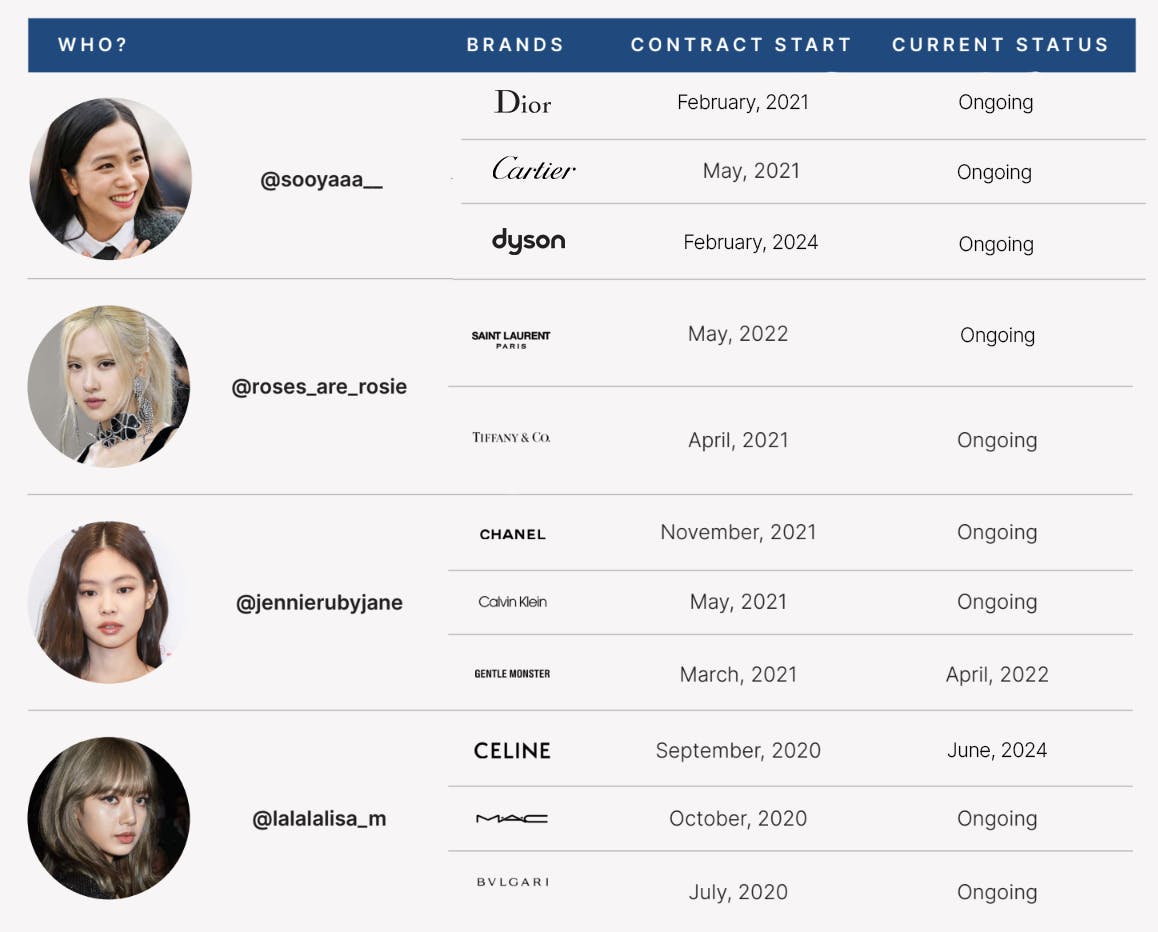

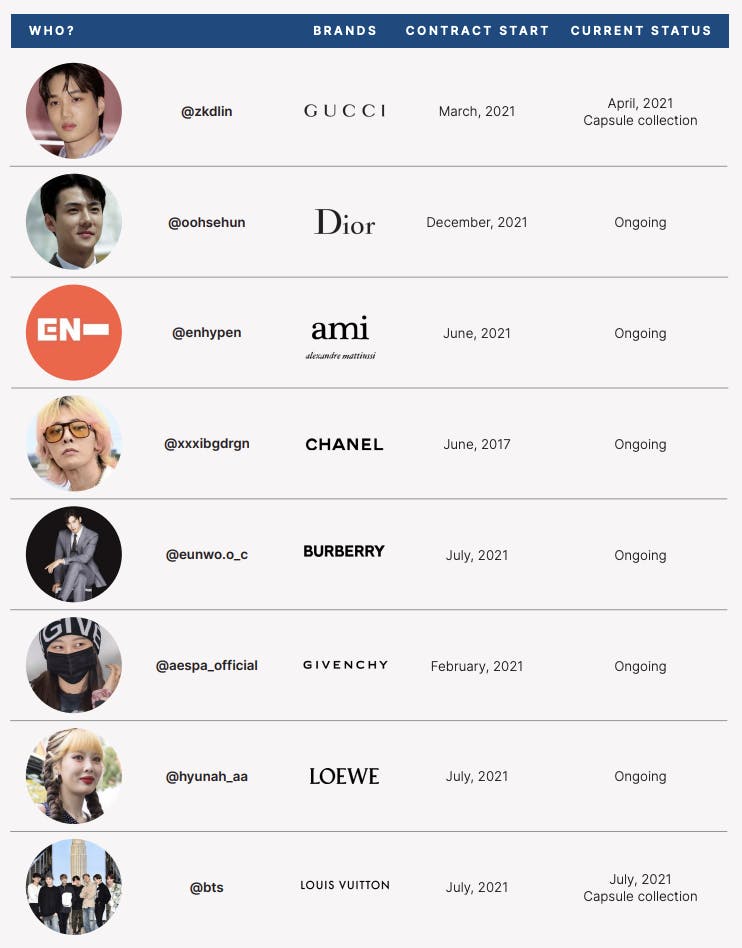

With the ever-growing influence of the Korean entertainment scene, brands are leveraging celebrities as either brand ambassadors or campaign models to strengthen the brand image and/or to drive and boost sales. This extends into brands’ global editorial campaigns, partnering with magazines such as Vogue, Bazaar, Elle, and GQ.

The photoshoot between BTS and GQ resulted in a circulation of over 300k—the average circulation is 70k. That being said, being endorsed as brand ambassadors and campaign models is a win-win strategy for both the brand and the celebrity, allowing them to level up their value in the entertainment market and have an international impact.

Blackpink's luxury ambassadorships.

Blackpink's luxury ambassadorships. K-Pop stars and their brand ambassadorships.

K-Pop stars and their brand ambassadorships.Case Study

Prada Symbole

Prada has been quick to align itself with South Korean celebrities, and as such, its sales in this region have followed suit. According to Retail in Asia, 2021 saw Prada’s regional APAC sales rise by 29% year over year, with a 90% increase coming from South Korea.

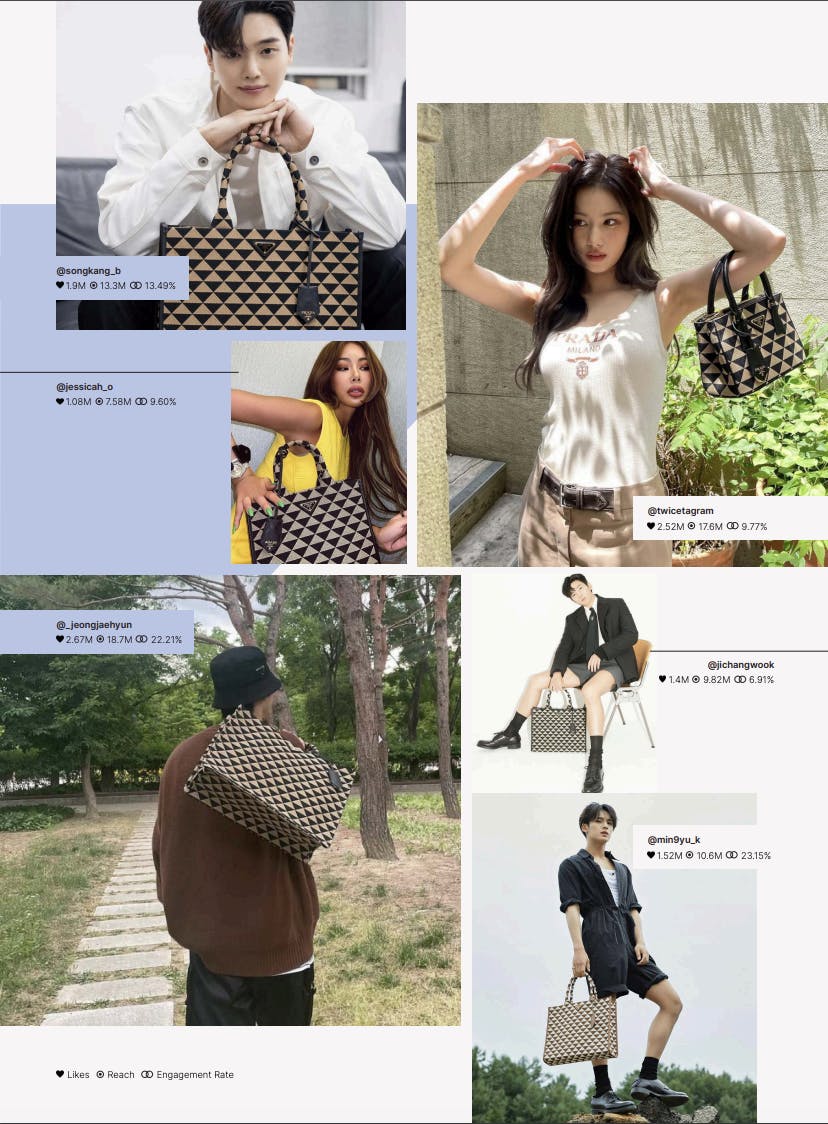

Their most recent Prada Symbole campaign paints a picture of how successful South Korean talent is for the brand. According to campaign analysis powered by Lefty, just 8% of the influencers in the Prada Symbole campaign were of South Korean origin, yet this small but mighty group generated $2.43M of EMV — over 50% of the EMV for the entire campaign.

How? Much can be attributed to their highly engaged audience. Whereas 3% is an average influencer engagement rate, these South Korean KOLs have over three times higher engagement, at an enormous 10.25%.

Statistics of K-pop stars posting content for the Prada Symbole campaign.

Statistics of K-pop stars posting content for the Prada Symbole campaign. Conclusion

The Korean Wave, or 'Hallyu,' has transcended cultural boundaries and reshaped global entertainment, fashion, and consumer behavior. From the historical roots of K-Pop in the late 1990s to its current monumental influence, South Korean artists like BTS and BLACKPINK have become economic powerhouses and cultural ambassadors. Their impact extends beyond music, fashion trends, luxury goods markets, and political dialogues. Brands leveraging K-Pop stars as ambassadors or campaign models are seeing unprecedented growth and engagement, proving that the phenomenon of Hallyu is not just a fleeting trend but a dominant force in global culture. As we look to the future, the synergy between K-Pop and various consumer industries will likely continue to evolve, creating new opportunities for innovation and collaboration worldwide.