The Allure of Luxury Hospitality

A Shift From Ownership to Experience

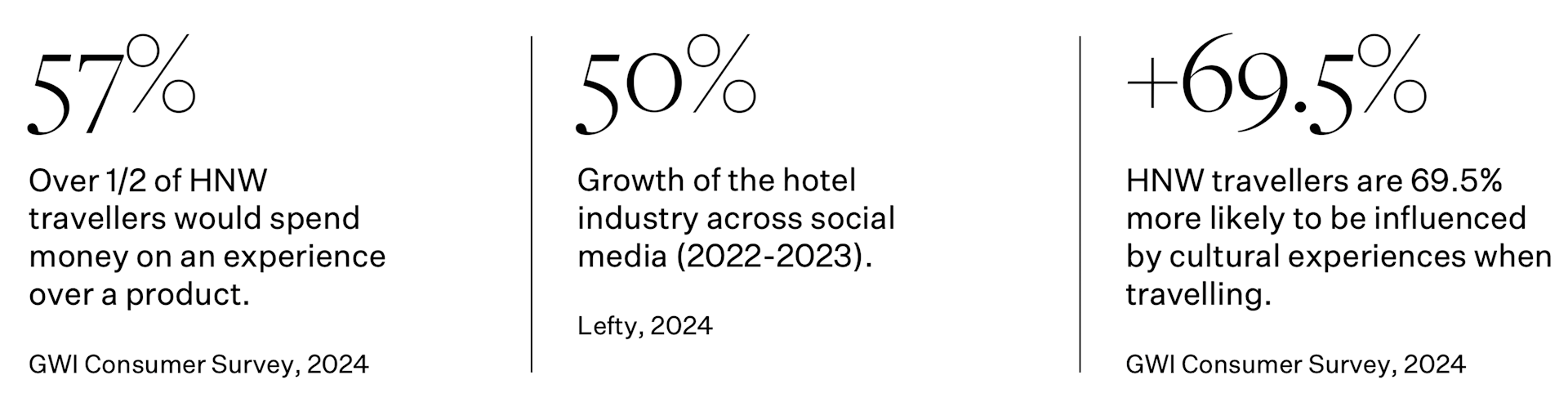

Post Covid, the travel and hospitality sector has seen unprecedented growth. What was initially dubbed as ‘revenge travel’ resulted in sustained impact, especially luxury travel which, according to Technavio, is forecast to grow to $703.14bn from 2022-2027. This comes at a pertinent time in the consumer landscape, where a sense of experience is now valued more highly over possession, and lifestyle has become a buzzword for luxury brands. According to GWI, this is especially prevalent for high- net-worth travelers: over half (57%) would rather spend money on an experience over a product. And what better vehicle of experience than travel?

Digital Drives Consumer Desire

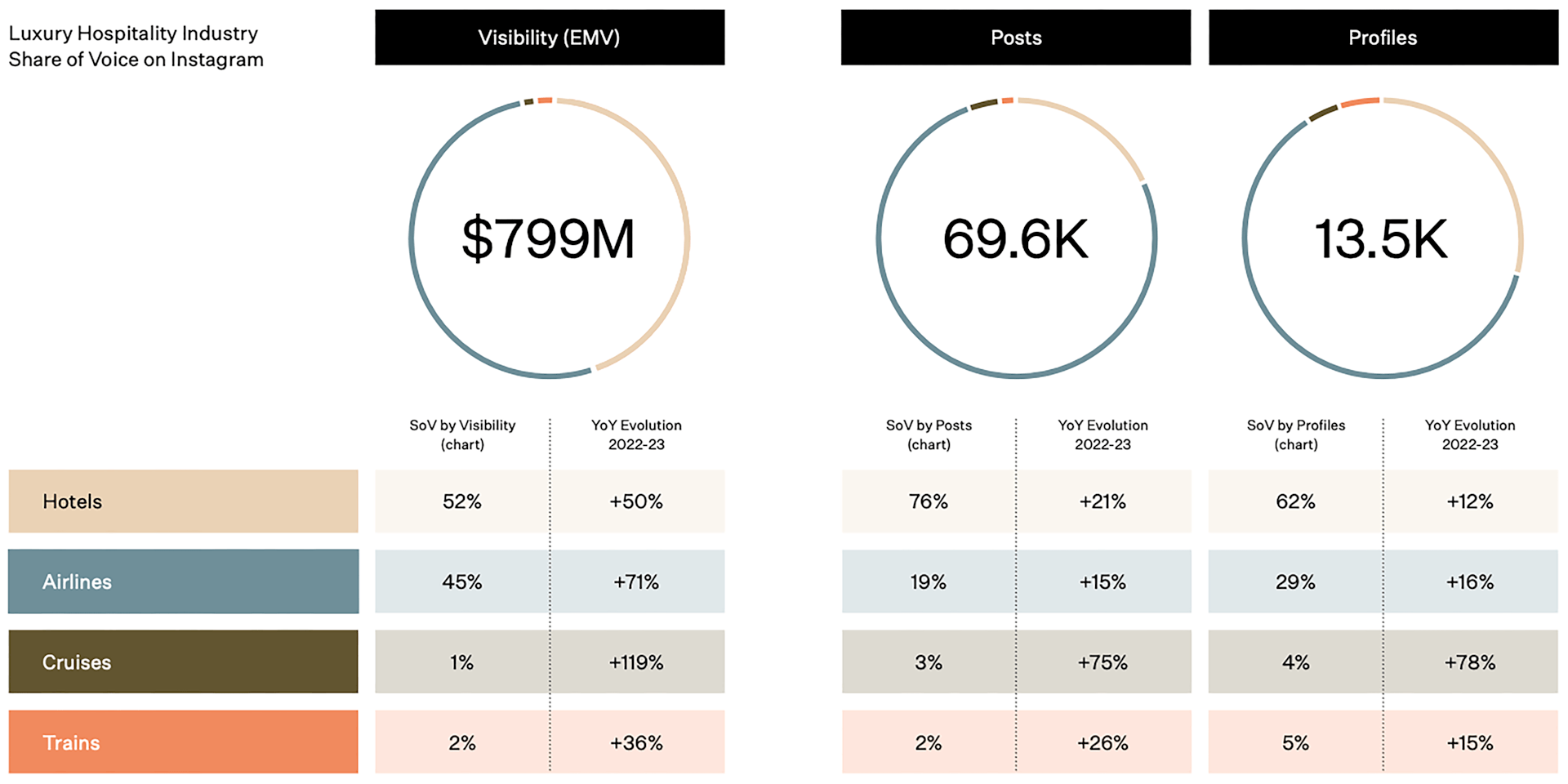

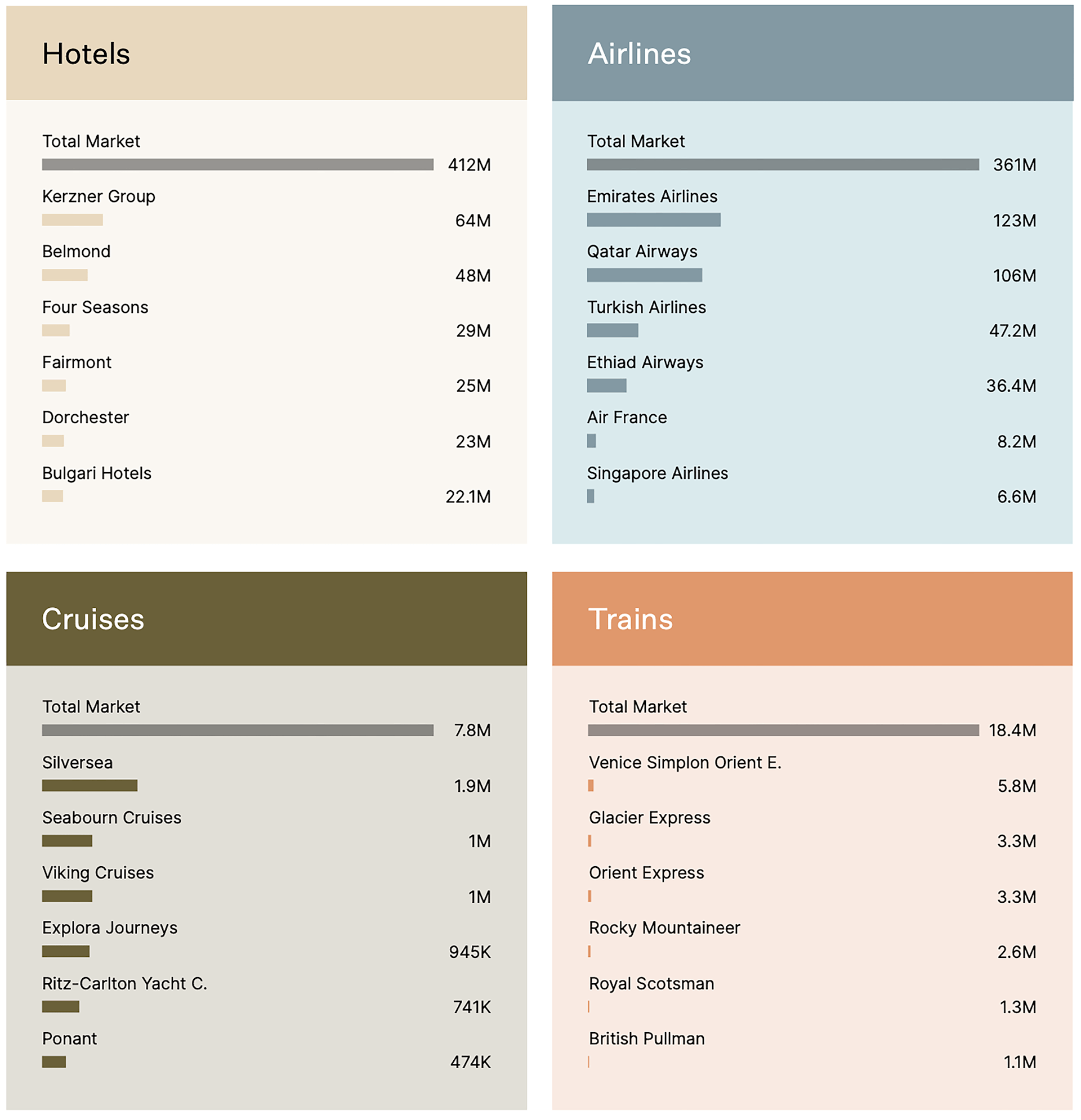

Incidentally, a well-travelled lifestyle has become the ultimate social media clout. According to Lefty data, key hospitality sectors such Hotels, Airlines, Boats and Trains have seen a significant uptick in share of voice across socials. The luxury hotel industry grew by 50% from 2022 to 2023, and shows no sign of slowing: for H1 2024 we observed that in 6 months, the industry has already reached 64% of the visibility created in 2023. For luxury travel by air, boats and trains there was an average in increase in visibility of 76% from 2022 to 2023, and for H1 2024 we observe a major increase in monthly EMV for the boat (53% more EMV per month) and airline industry (30% increase in monthly visibility).

Key statistics about the state of the hospitality industry.

Key statistics about the state of the hospitality industry.A Partnership Boom

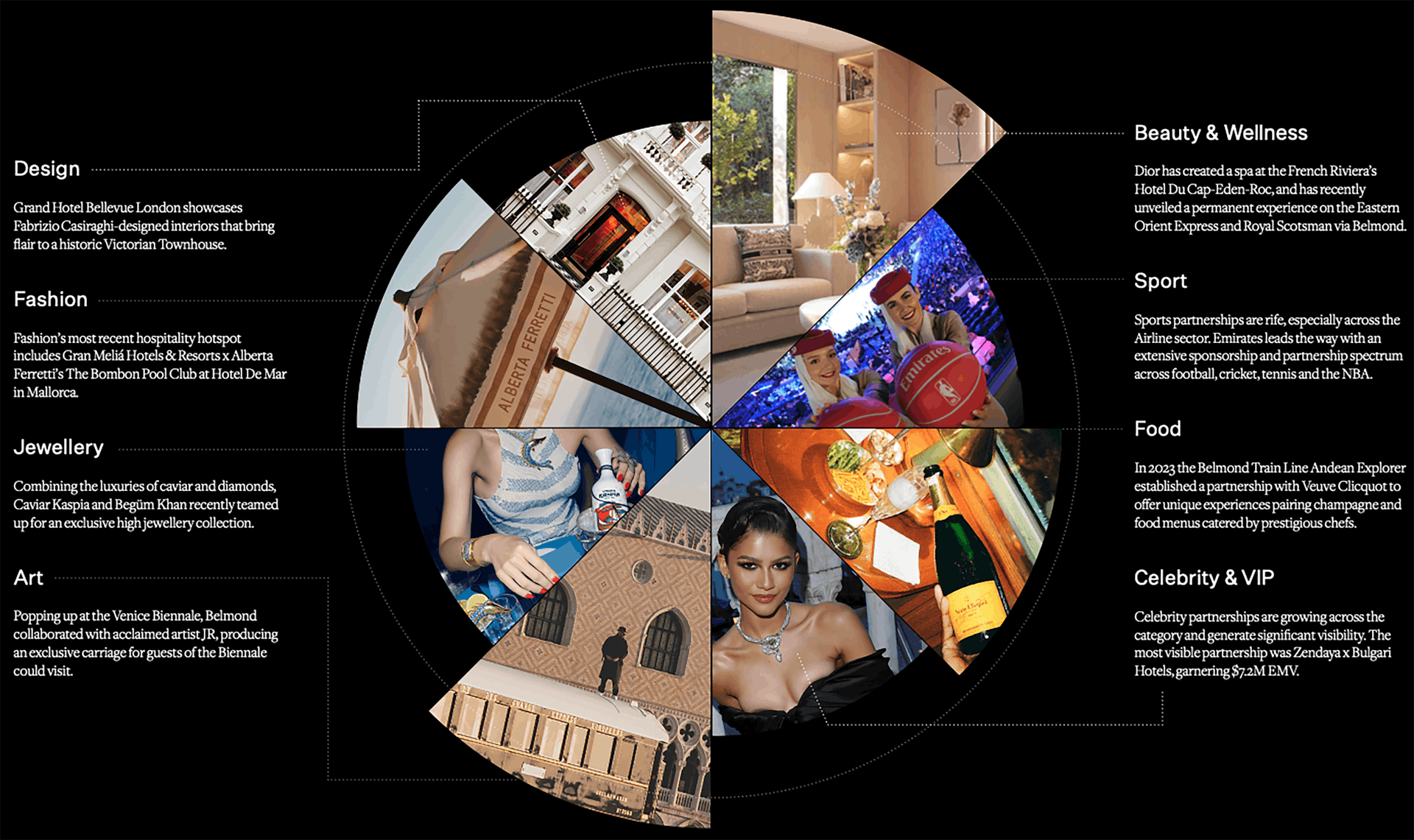

As a result of this shift in mindset from ownership to experience, and a boom in the digitisation of the sector, brands across verticals are vying for a piece of hospitality’s unwavering consumer allure and market buoyancy. In the past two years, we’ve witnessed a flurry of branded beach pop-ups, hotel takeovers, hospitality collaborations and influencer partnerships. But what worked best?

Lefty and Karla Otto’s Insights teams join forces with the expertise of Karla Otto’s Hospitality department to uncover how consumer behavior and digital media have impacted the luxury sector, unveiling how brands across verticals can strategically tap into the ever-growing breadth of hospitality, with data-driven validation.

Key Data: Consumer & Digital Landscape

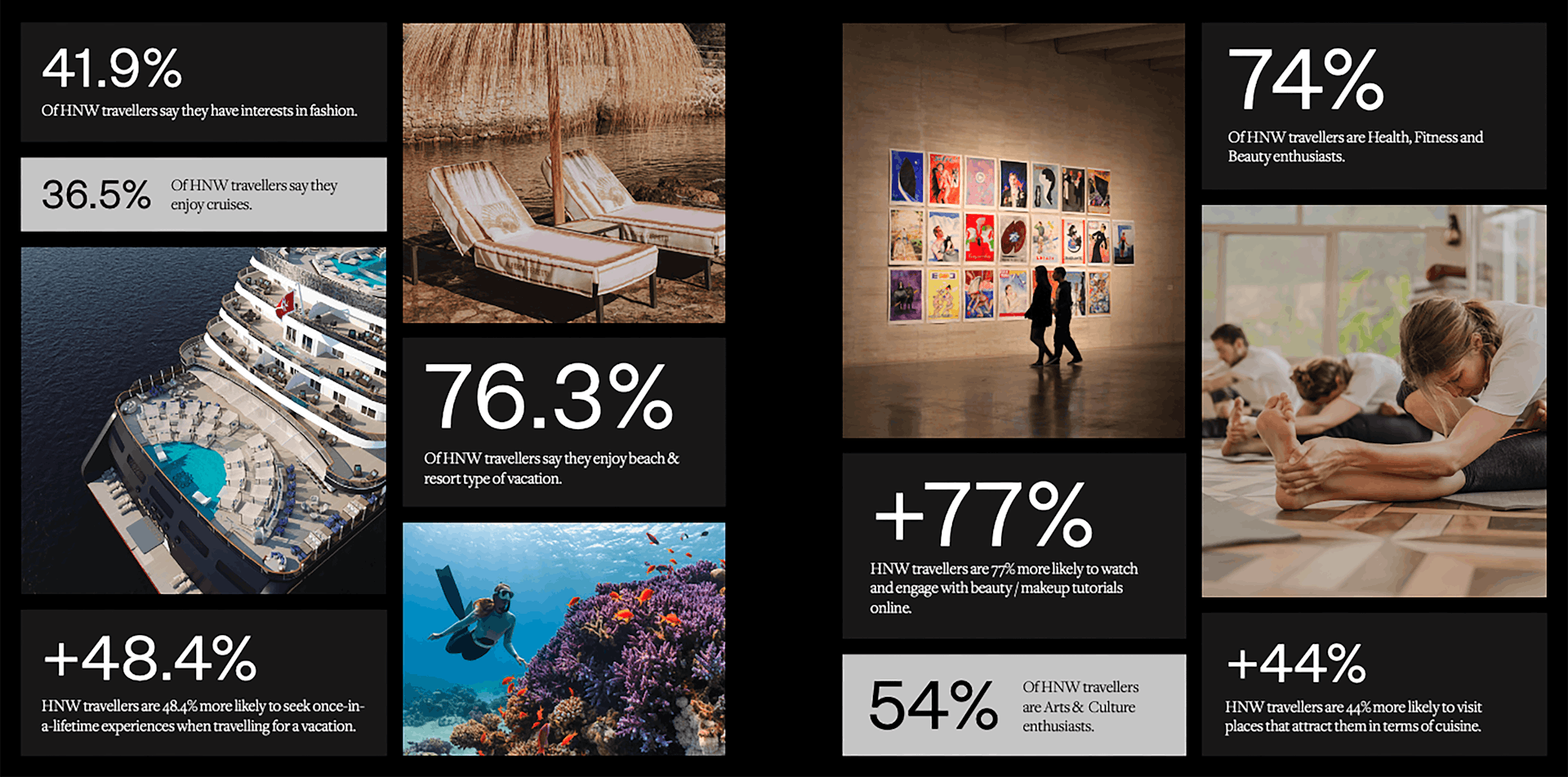

Utilizing primary data from GWI’s Consumer Survey from 2024, we lift the lid on travel triggers for the HNW (High Net Worth) traveler. The results showcase this demographic’s interest in experiences, art, culture and wellness.

The Luxury Traveler: Mindset & Preferences

Statistics about the preferences of high net worth travelers.

Statistics about the preferences of high net worth travelers.Hospitality's Digital Landscape

The share of voice of the hospitality industry on Instagram.

The share of voice of the hospitality industry on Instagram. The top hospitality brands on Instagram in 2023.

The top hospitality brands on Instagram in 2023. The most visible types of profiles on Instagram for hospitality.

The most visible types of profiles on Instagram for hospitality.Key Insights & Trends

Hospitality Partnerships: The State of Play

The different industries partnering with hospitality brands.

The different industries partnering with hospitality brands.Fashion & Jewelry: Fashion Flocks to Hospitality

The Beach Club Boom

As the desire for experience booms, fashion brands have been quick to align themselves with the buoyancy of the travel and hospitality sector. The past few years have seen a flurry of beach clubs and branded summer capsules appearing across the world, looking to gain share of voice while the consumer soaks up the sun. The fashion and hospitality alignment is crystal clear — and appears to work both ways — especially for luxury consumers, of whom, according to GWI, 42% have interest in fashion.

Haute-Spitality

The hybridization of hospitality and luxury lifestyle brands has expanded to physical hotels, with several brands building permanent presence within key cities and destinations across the globe to root the brand in travel and the wider lifestyle sector. Amongst leaders such as Bulgari and Armani Hotels, leading brands like Chopard have renovated the floors above its 1, Place Vendôme boutique into a lavish micro hotel; while 2023 saw shoemaker Christian Louboutin open a boutique hotel in a remote destination in Portugal.

Poolside at Louboutin's Portugal hotel.

Poolside at Louboutin's Portugal hotel.Fashion Flies Sky High

With the journey being just as important as the destination, Hotels aren’t the only sector seeing gains due to fashion partnerships. Air travel has also seen a plethora of collaborations across the fashion sector: Missoni and Moschino have both provided branded amenity kits for Delta and China Airlines, while Louis Vuitton opened their first airport lounge in Doha, with dishes by Chef Yannick Alleno. More recently, hospitality has had a Haute makeover: Riyadh Air and Ashi Studio collaborated to create a collection that was unveiled during last Haute Couture week in Paris, generating $1M EMV via Riyadh Air’s owned media around the partnership.

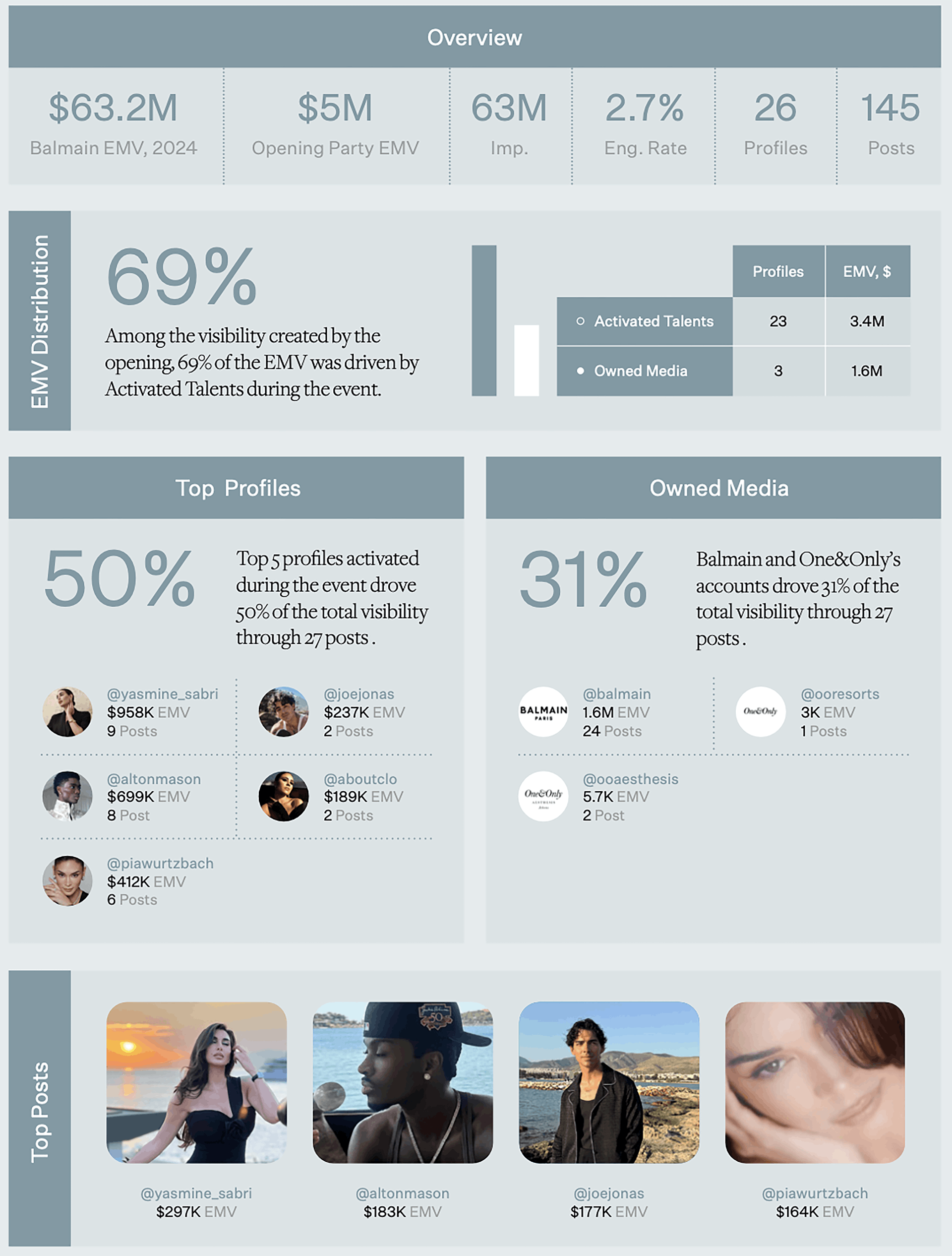

Case Study: One&Only x Balmain

The Kerzner Group collaborated with Balmain to transform its beach club in Greece with the iconic Balmain monogram design. The One&Only Aesthesis pool channeled the artistic energy and signature prints of the iconic Balmain house. Stars then gathered for pinnacle moment of the One&Only Aesthesis Grand Opening Party and brunch hosted by Creative Director Olivier Rousteing to unveil the special collaboration.

Key data points from the One&Only x Balmain campaign.

Key data points from the One&Only x Balmain campaign. The Food Fusion

The Rise of Culinary Tourism

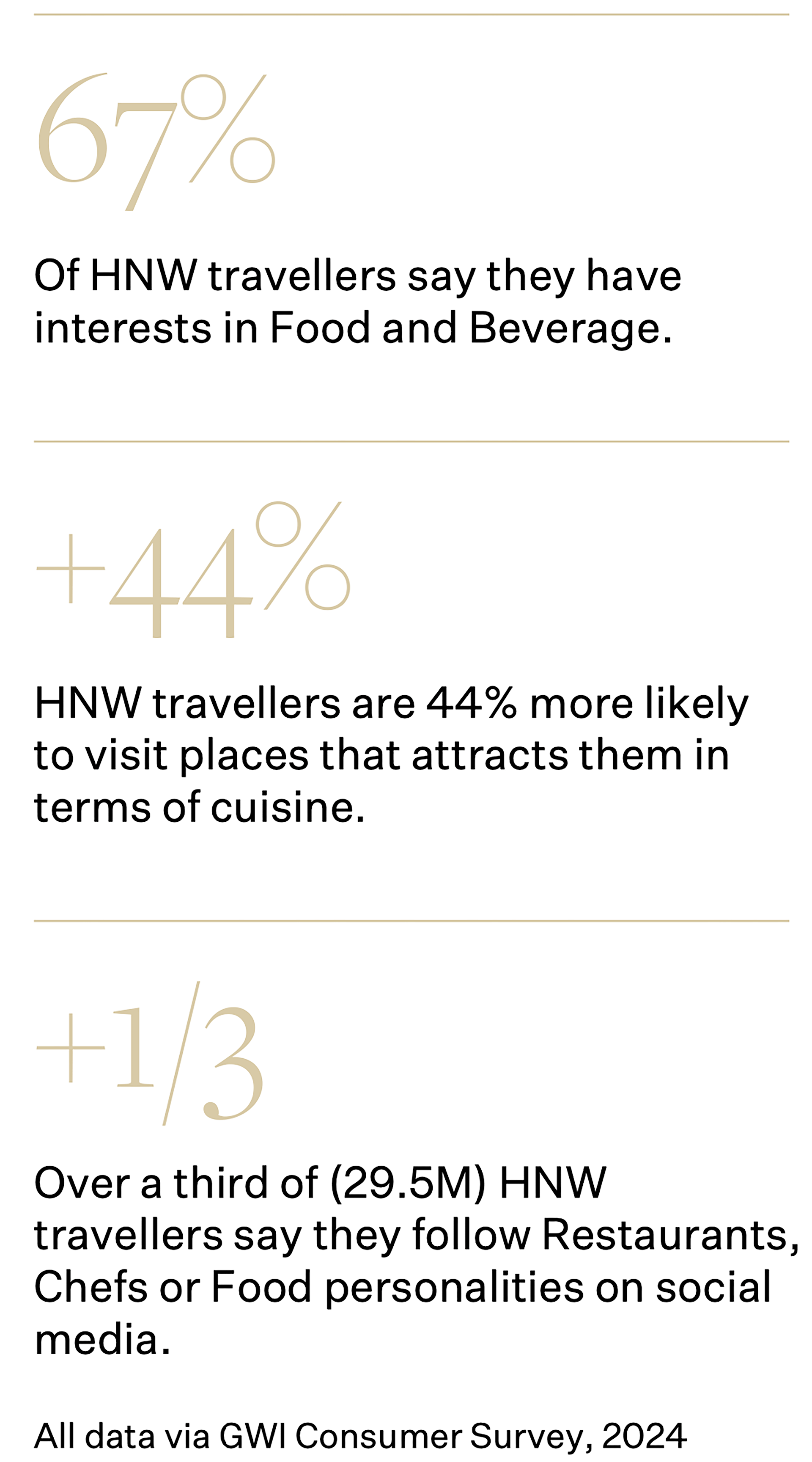

While hospitality and food have always intertwined, there’s been a marked growth in culinary travel in the past five years, with Grand View Research reporting that the sector is expected to see a CAGR of 19.7% from 2024, reaching a value of $40.5B by 2030. This data is particularly pertinent for high-net-worth consumers, who are +44% more likely to visit places that attracts them in terms of cuisine, according to consumer surveys from GWI.

Gen Z's Appetite for Luxury

In the same vein as lifestyle becoming centralised to the all-important ‘experience’ economy, for many consumers, especially Gen Z, food has become a status symbol and a more price-accessible way to experience a luxury brand. According to a 2022 survey by Sodexo, titled ‘What I Eat is Who I Am’, Gen Z spend 40% of their disposable income dining out (ahead of fashion at 35%). Concurrently, #FookTok now boasts 174.6 billion views on TikTok —-proving how social media is driving hype for the category. In fact, according to GWI’s study on high-net-worth travellers, over 1/3 said they follow restaurants, chefs or food personalities on social media.

Hospitality data points from GWI.

Hospitality data points from GWI.Chefs Gain Celebrity Status

In fact the rise of ‘hype’ food and chefs growing in social media gravitas means there is greater focus on hotels’ restaurants. Nowadays, all big hotel groups have to align with a celebrity chef to stay in the lead. “Cuisine is now as important as having spa services,” comments Karla Otto’s Vice President of Hospitality, Sara Henrichs. With food being ever-more central to the pulling power of the destination, hotels partnering with significant culinary talent are driving digital visibility and cultural relevance.

Case Study: The Cedric Grolet Effect

Tapping Cult, Social-Savvy Chefs

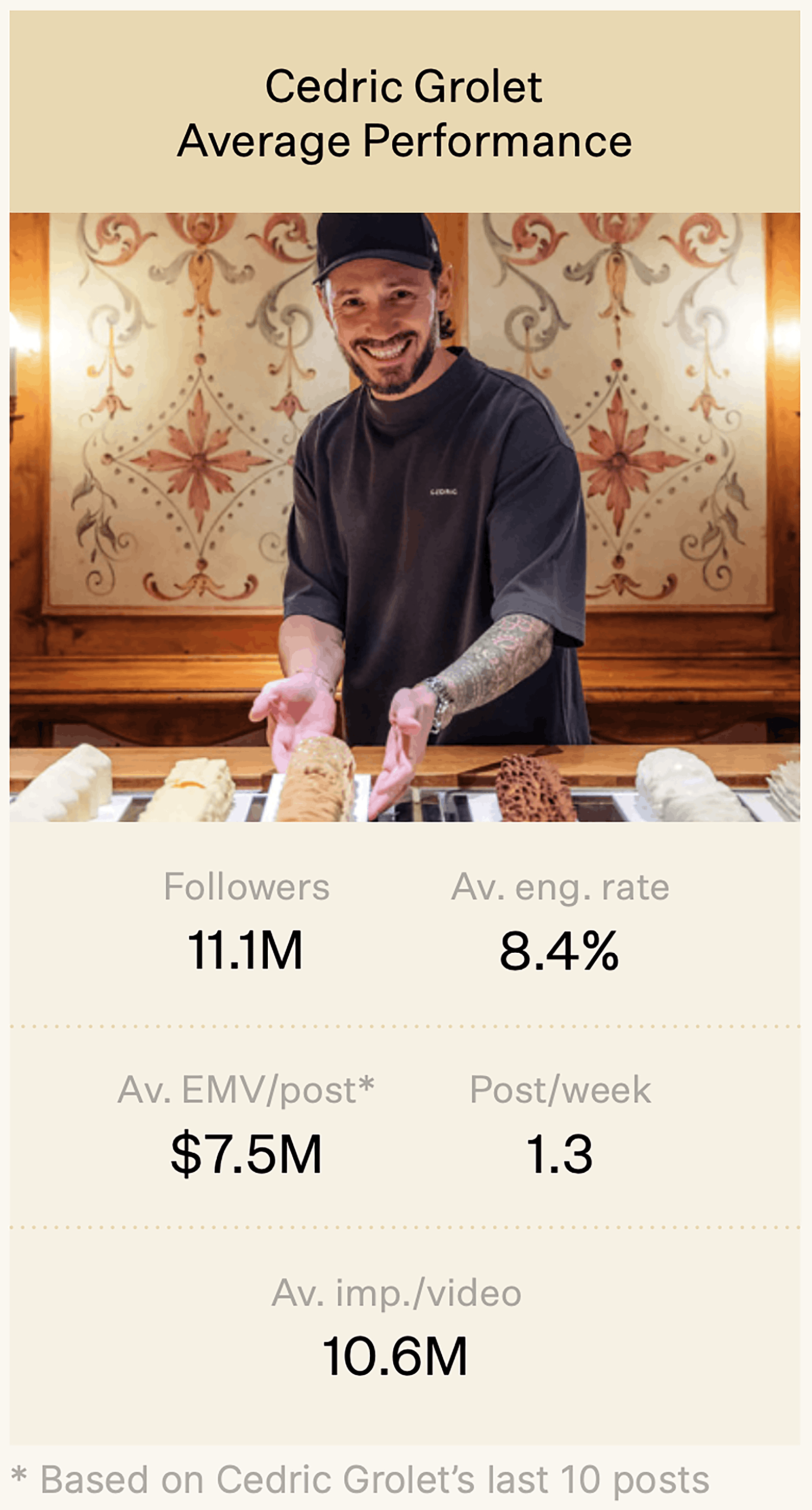

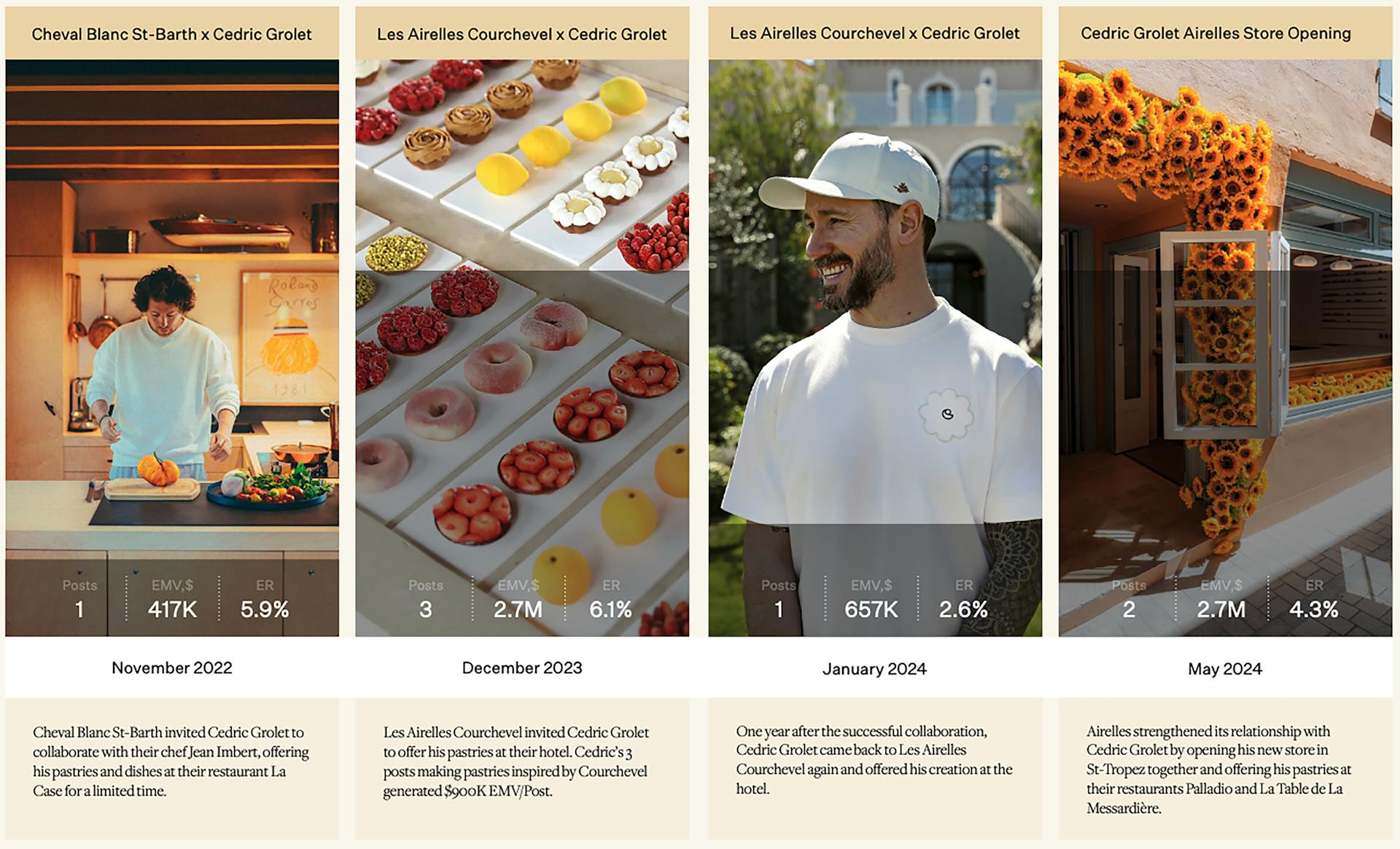

Luxury hotels such as Cheval Blanc and Airelles Collection are tapping into the popularity of Cedric Grolet, the renowned French pastry chef known for his trompe-l'œil pastries and viral cooking videos. Per post, Grolet generates an average $7.5M EMV. After the successful collaboration, Airelles opened a permanent collaborative store with Cedric Grolet in St- Tropez.

Cedric Grolet's performance on Instagram.

Cedric Grolet's performance on Instagram. Timeline of Cedric Grolet's hospitality partnerships.

Timeline of Cedric Grolet's hospitality partnerships.Star Power: Celebrity & VIP in Hospitality

Jennifer Lopez performing.

Jennifer Lopez performing.Celebrities Drive Over 1/2 of Hospitality's Visibility

The Entertainment Economy

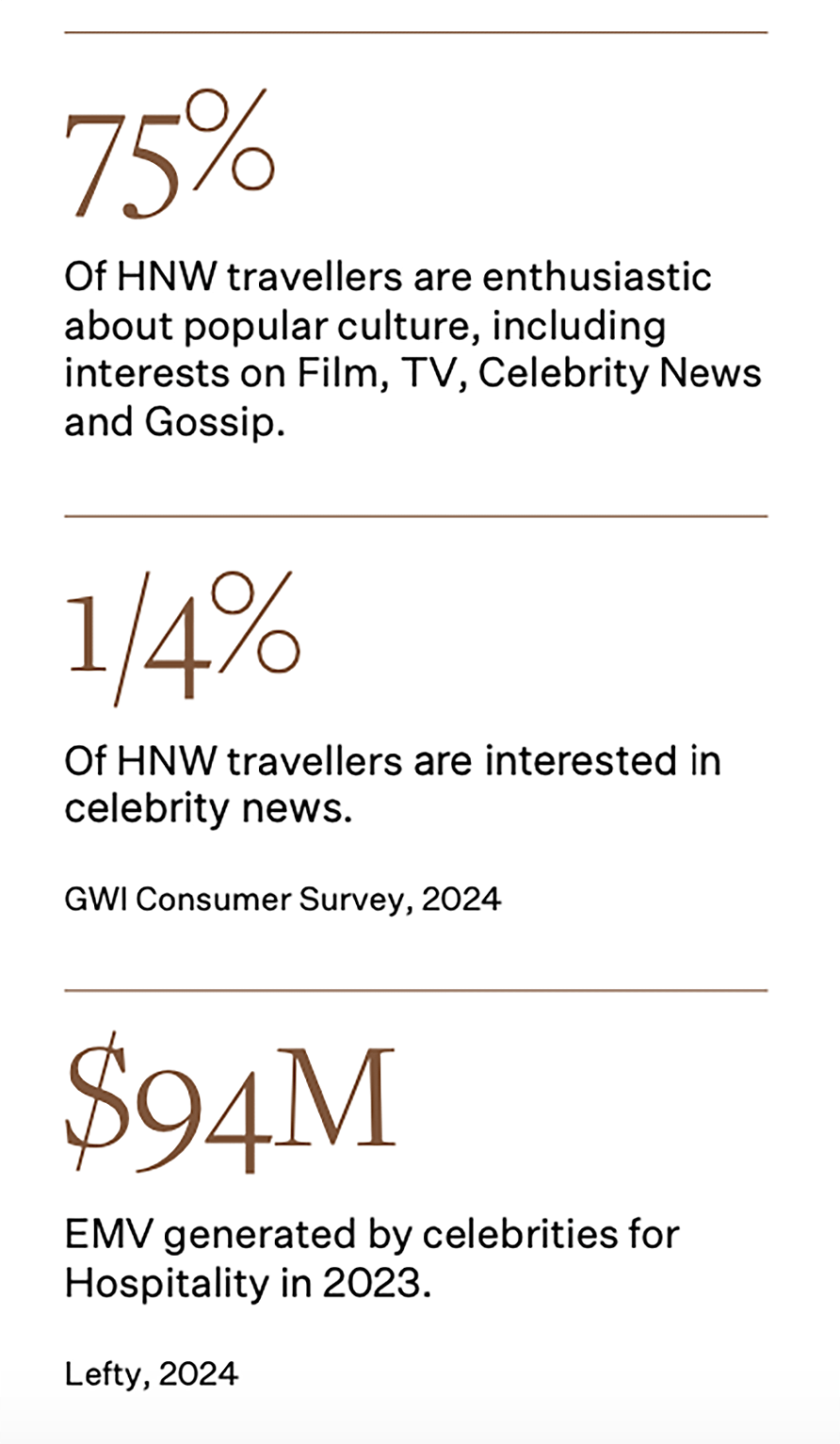

Celebrity status has enormous pulling power for the consumer in the hospitality world. According to GWI, 75% of high-net-worth travellers are enthusiastic about popular culture, citing categories such as film, TV, celebrity news and gossip as core interests. It’s no secret that the power of ‘fandom’ is on the up, especially in the travel and hospitality sector. According to a study by Kearney, 27% of those surveyed said that they have spent money on travel because of the influence of fandom.

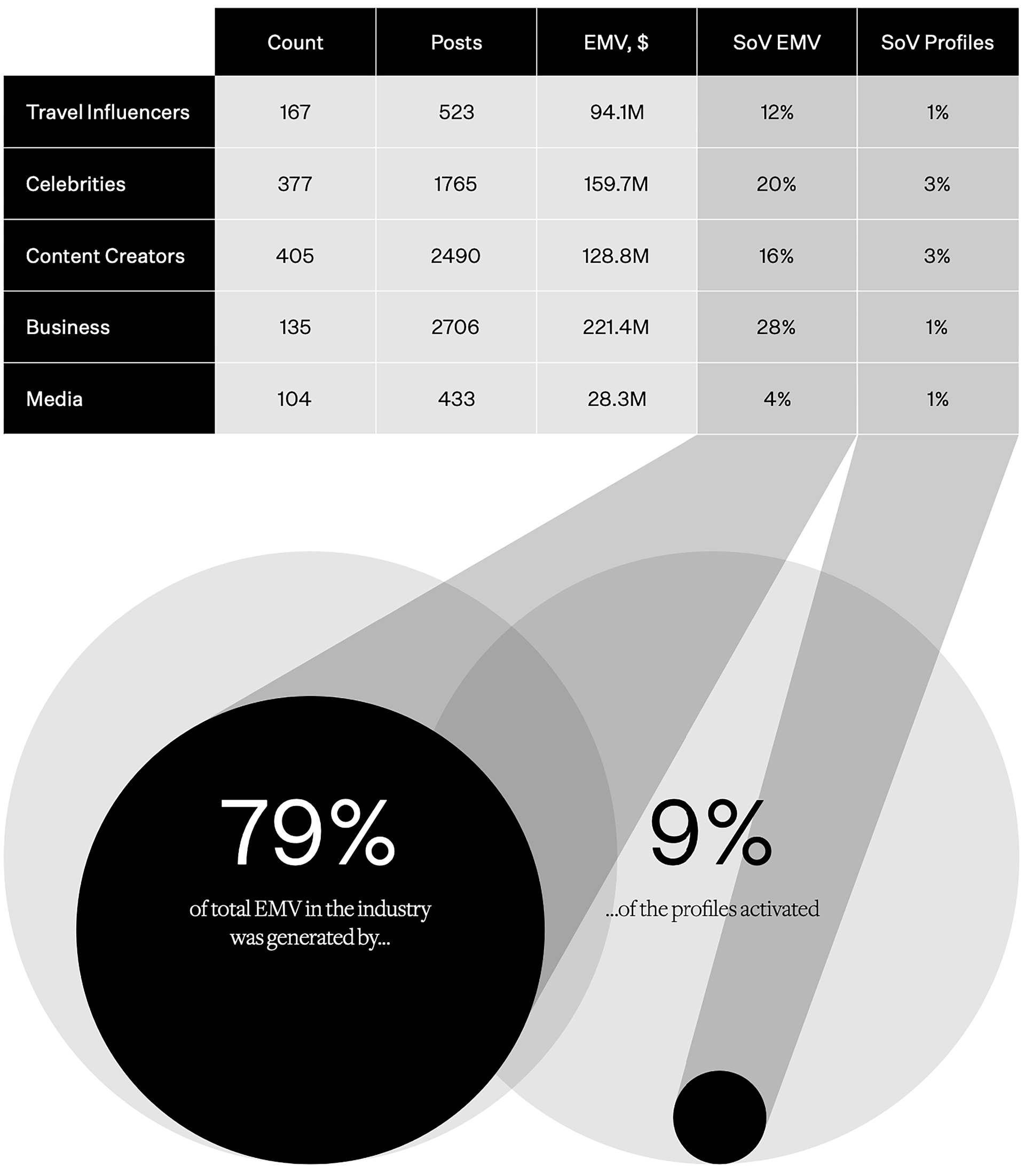

Celebrity Status Drives Statistics

Whereas influencer marketing and celebrity partnerships are well-versed in verticals such as fashion, hospitality has often shied away from such types of pairings. However, new data from Lefty showcases the potential of high- profile talent relationships. Whereas generalist content creators were the most frequently activated category of profiles by the luxury hospitality industry in 2023; the most visible type of profiles were celebrities with an average visibility per post 4x higher than general content creators, and 4.4x than travel content creators. As a result, nearly 1/4 (22%) of the total EMV across socials in the hotel industry in 2023 was generated by 5% of the profiles posting about the brands.

Statistics about the power of celebrities on the hospitality sector.

Statistics about the power of celebrities on the hospitality sector.Unique Casting Strategies

In this study, we noticed that different verticals have unique talent relationships. Whereas hotel groups invested the most in celebrity talent, airlines opt for sports teams , train companies opt for travel influencers and cruises lines work with more general content creators.

Talent Strategy Tiers: Hospitality

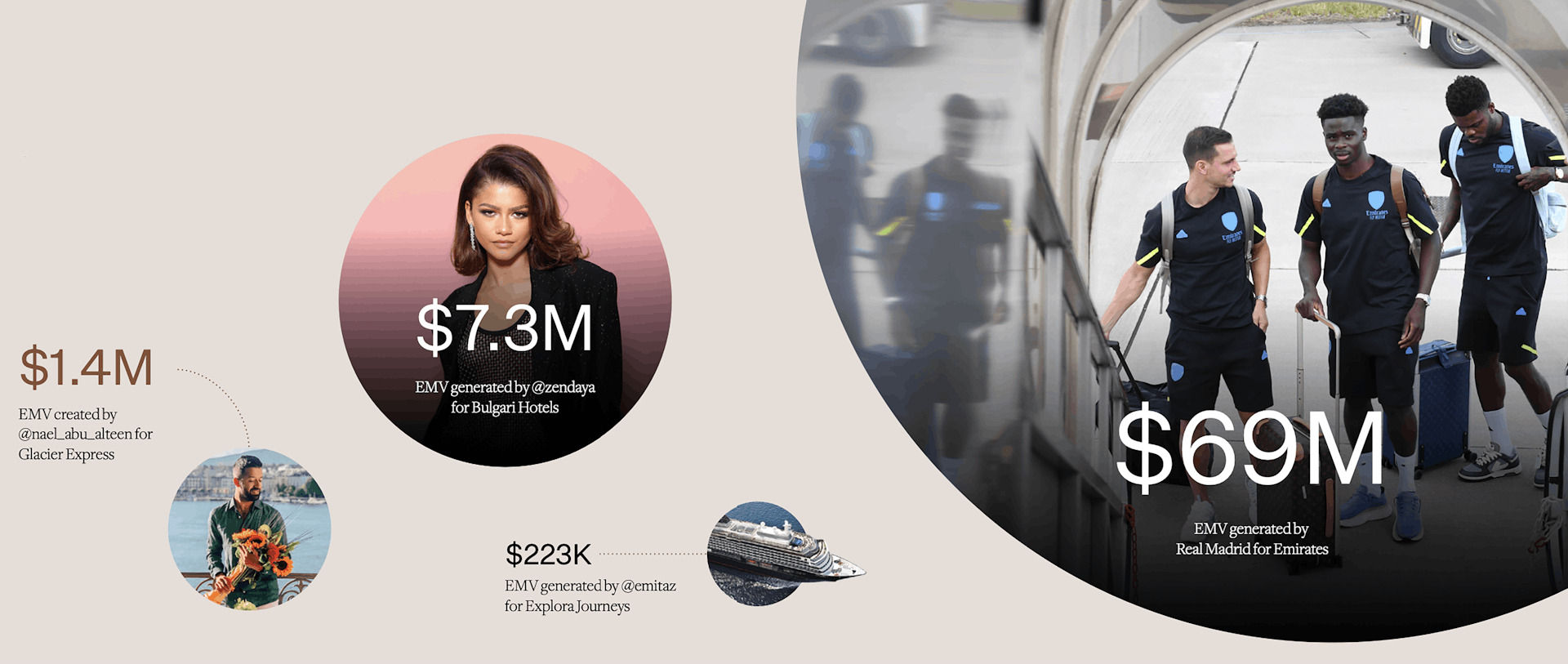

Trains Travel Influencers Go Full Steam Ahead

Travel influencers were the most frequently activated category of profiles by the Luxury Train Industry in 2023. Among top profiles, travel influencers generated 48%

of 2023’s visibility, while top celebrities generated 9% of the visibility.

The most visible travel influencer of 2023 was Nael Abu Alteen, who, with a 1.72M strong following, generated $1.38M in EMV for Glacier Express.

Hotels Win With Celebrity Strategy

Hotels boast the most impactful celebrity strategy, with 54% of the EMV generated by celebrity profiles.

This type of content has an average visibility per post 4x higher than general content creators. The brand with the most successful celebrity strategy is Bulgari, whose partnership with actor Zendaya contributed $7.3M EMV in 2023.

Statistics of key celebrity partnerships among hospitality sectors.

Statistics of key celebrity partnerships among hospitality sectors.Cruises Content Creators Take to the Seas

Content creators were the most activated category of profiles by the Luxury boat industry in 2023, generating 43% visibility. Explora Jouneys lead the way: their #1 profile was Emelie Natascha (aka Emitaz) who’s 3 on-board posts created $223K EMV.

It’s worth noting that the most visible type of profiles by average EMV/post was media. This showcases the potential for partnerships in the cruise sector, especially as we see consumer demand rising in luxury.

Airlines Opt for Athletes

Although content creators were the most numerous profiles mentioning airlines companies, with a total of 131 profiles in 2023, business profiles generated the most significant media value for this category. Their secret is the sports industry, levered by football accounts, which contributed by 67% to the total visibility in the global airlines market. Emirates is a clear winner, opting to sponsor key sports teams around the world, such as Real Madrid, who generated a staggering $69M EMV in 2023 with 70 posts.

The Art of Travel

Driving Cultural Credibility

An image of a modern building.

An image of a modern building. With experience being key to luxury travel, cultural enrichment plays an ever more pivotal role in hospitality and travel choices for the consumer. GWI found that over half of HNW travellers are arts and culture enthusiasts globally, while, according to Embark Beyond, arts and culture are now as influential on travel choices as food. They found that locations with an art or design scene are among the most requested experiences.

Artist in Residence

Of course, hospitality is no stranger to partnering with key names within the art and design sector. Take Paris’ hotel Les Deux Gares, designed by Luke Edward Hall; the wealth of hospitality partnerships with the prestigious Dimore Studios; KLM’s collaboration with Dutch designer Marcel Wanders for its Business Class plates and service ware; or Hauser and Wirth’s collection of masterpieces housed at The Fife Arms, Scotland. However, hospitality sectors are becoming increasingly aware of the growing allure of culture at large and are utilising the cultural calendar to show up at events around art, design, theatre and music to garner attention and align with the world of culture.

Utilising the Cultural Calendar

Champagne brand Veuve Cliquot hosted a full-scale takeover at Milan Design Week, featuring a collaboration with Magnum Studios and multiple pop-up experiences throughout the city, earning them just shy of $1M EMV, according to Lefty data. So too did luxury ocean travel brand Explora Journeys, where visitors found themselves on the imaginary deck of EXPLORA II, furnished with the bespoke sofas from the new Davos collection by renowned Italian manufacturer Unopiù.

Case Study: Belmond x JR

A Work of Art in Motion

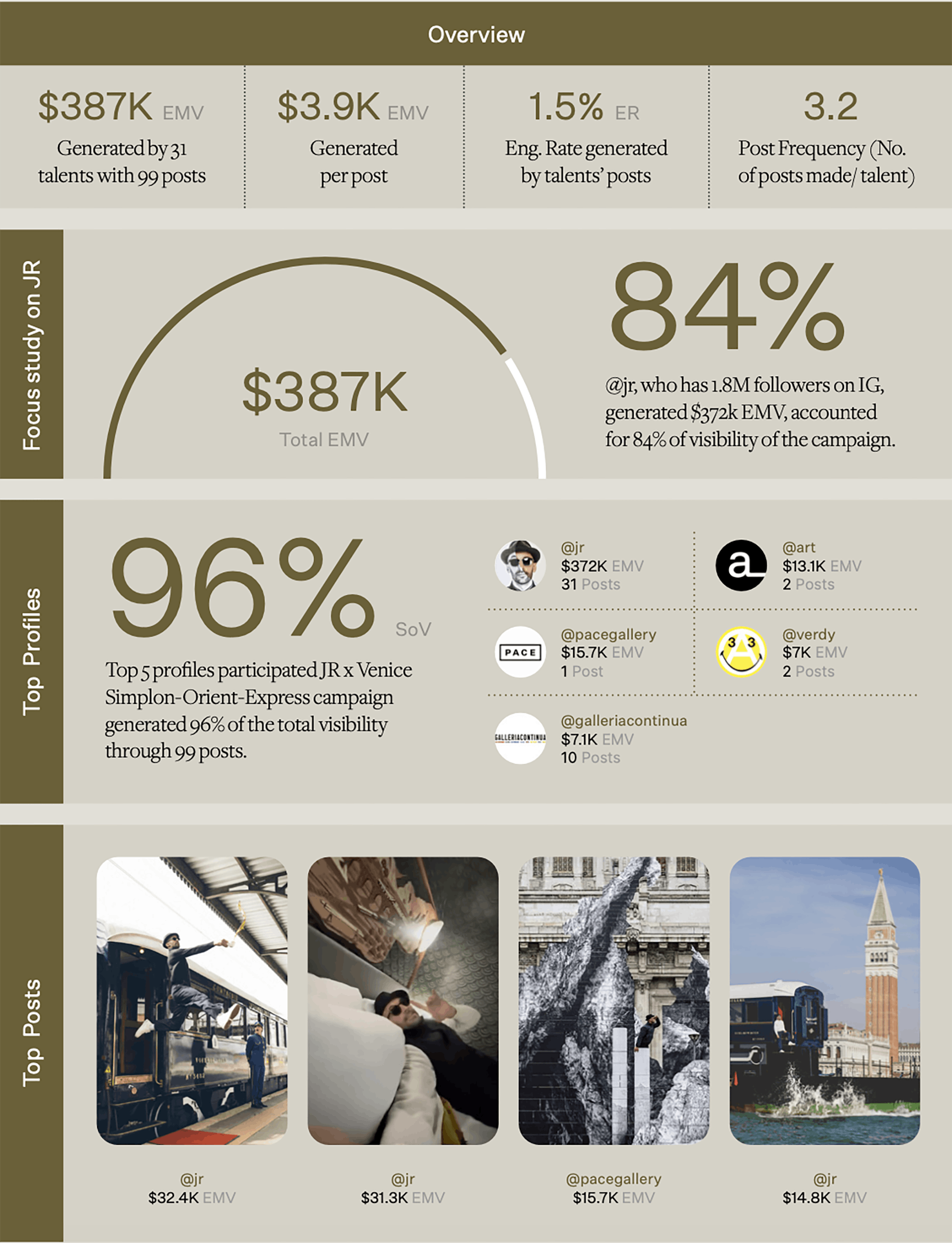

Unfolding across an entire carriage on board Belmond’s Venice Simplon-Orient-Express train, ‘L’Observatoire’ is a one-of-a-kind space conceptualised in collaboration with renowned artist JR, set to debut on the rails in 2025.

Inspired by astronomical observatories, JR has crafted a suite that invites guests to look up, seamlessly blending exceptional craftsmanship from both established masters and emerging talents.

A man on a Belmond train.

A man on a Belmond train. JR Accounted for 84% of the Campaign's Visbility

This partnership generated a total $387K EMV on social media but it was even more powerful thanks to its choice of artist. JR is an artist who’s known for large-scale street projects, opening and democratising the world of art for everyone to see. With over 1.8M followers on Instagram, he generated $372k EMV, which accounted for 84% of the campaign’s visibility online.

Belmond x JR campaign statistics.

Belmond x JR campaign statistics. Beauty & Wellness

Riding the Wellness Wave

Wellness Tourism Surpasses Pre-Pandemic Levels

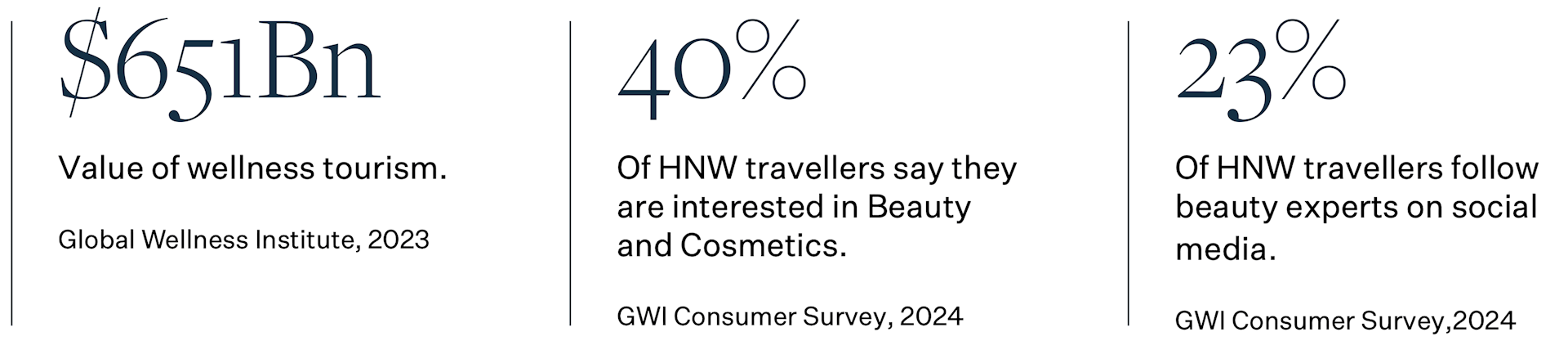

Hospitality, beauty and wellness have long gone hand in hand, offering a respite from everyday life and a chance to reset via spas and beauty treatments. But since the pandemic, which saw consumers prioritising physical and mental health, this category has skyrocketed. Now valued at $651 billion, according to the Global Wellness Institute, Wellness tourism is part of a wider Wellness economy, worth $5.6 trillion and expected to grow 8.6% by 2027. These figures, which have surpassed pre- pandemic levels, mean there is a huge opportunity for hospitality brands to capitalise on the Wellness wave.

High-Net-Worth Travellers Are Beauty Enthusiasts

With 63% of High Net-Worth travellers saying they take care of their appearances, and 40% interested in Beauty and Cosmetics, according to GWI, there’s a lucrative potential for partnerships within the category. And yet, few have tried to break the mould. Beyond various spa treatments, now a must in most hotels, there is a real op- portunity to partner with renowned makeup artists and beauticians to offer guests once-in-a-lifetime experienc- es – think ‘a day in the life’ with celebrity makeup artists, masterclasses with famous dermatologists and bespoke treatments created by experts, tailored to one’s skin.

A man in a bathrobe looking at an ocean view.

A man in a bathrobe looking at an ocean view.The Social Effect

It is widely known now that beauty resonates especially well on social media. Due to its try-and-tested nature, consumers seek advice from trusted sources online and look up tutorials. And in fact, GWI found that 23% of HNW travellers say they follow beauty experts on social media. Hospitality brands looking to resonate with their audiences online have a real chance to set themselves apart by leveraging their standout surroundings to create unique beauty content.

Statistics about HNW travellers and wellness.

Statistics about HNW travellers and wellness. Case Study: Hospitality & The Beauty Potential

Guerlain is one brand that’s seeking to capitalise on the beauty x hospitality opportunity, thinking outside the box when curating spas and products for hotels. Through its collaborations with Belmond, Cheval Blanc and Airelles, Guerlain positioned itself as a key brand that’s strategically enhancing traditional hospitality services through unique sensory experiences.

Belmond x Guerlain

Guerlain x Maroma

Guerlain x MaromaIn May 2024, Guerlain collaborated with Belmond’s Maroma hotel, in Mexico’s Riviera Maya, for a special event celebrating World Bee Day x First Belmond SPA in Latin America. This event highlighted the natural essence of both brands, offering guests the opportunity to discover the secrets of bees, immerse themselves in the jungle’s majesty, and experience Guerlain spa treatments and products. This unique adventure promised an unforgettable experience, blending the best of Belmond and Guerlain.

On social media, the campaign activated 9 influencers, generating $1.8M EMV, according to Lefty data.

Cheval Blanc x Guerlain

Cheval Blanc x Guerlain

Cheval Blanc x GuerlainCheval Blanc has been collaborating closely with Guerlain across various prestigious locations, where the beauty brand offers exclusive face and body treatments specifically tailored for Cheval Blanc, drawing inspiration from local specialities to create a unique spa experience. In December 2023, Guerlain launched a series of fragrances in partnership with Cheval Blanc, enhancing the magical experience at Guerlain Spas in five locations: St-Tropez, Courchevel, Randheli, St-Barth, and Seychelles. The collection featured five editions, each adorned with a signature jewelled cap and labelled with the location’s name.

The Sports Opportunity

Airlines, Hotels and the Stars: A Power Play in Travel

Travel is more than just a necessity for sports teams and athletes. From attending matches to finding the perfect accommodation for away games, the right partnerships between hotels, airlines and athletes can make all the difference.

Since 2022, data from Lefty shows footballers as top partners for the airline and hospitality sectors. These collaborations thrive due to athletes’ vast social media followings and loyal fans. Over the past two years, hotel- athlete partnerships, particularly with football players or teams, have accounted for 73% of the visibility in this sector.

Airlines like Emirates invest heavily in athlete partnerships, often sponsoring various teams and tournaments. Emirates’ affiliations with clubs like Real Madrid, AC Milan, Arsenal and S.L. Benfica accounted for 63% of Emirates’ EMV, underscoring their significance. Additionally, Emirates sponsors global events like the International Cricket Council (ICC) and tennis tournaments, aligning its brand with global sports

Emirates airlines and their football partners.

Emirates airlines and their football partners.Bet on the off Season

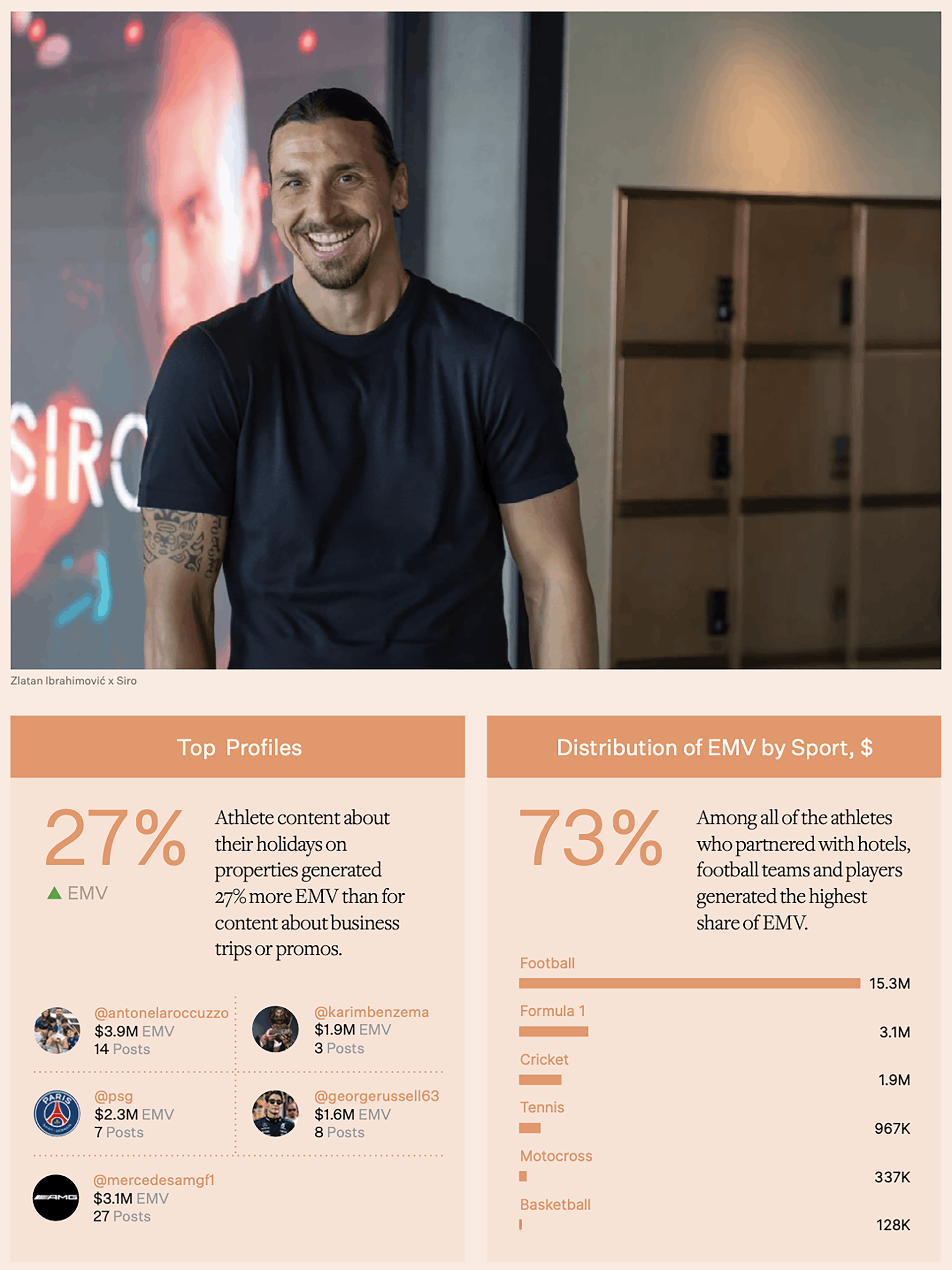

Athletes’ private holidays attract the most online attention, surpassing business travel. Lefty data shows posts about leisure hotel stays have led to a 27% increase in EMV, despite only 28% of athlete posts focusing on leisure travel. These posts achieve a high engagement rate of 5.9%, presenting a unique opportunity for airlines and hotels to invest in athletes’ downtime.

Sponsoring athlete-leisure travel engages HNW followers by aligning with their interests. GWI reports that 33% of HNW travellers follow athletes and sports teams on social media. Furthermore, 63.4% consider themselves health-conscious, and 59.1% are highly interested in fitness and exercise. These statistics reveal a significant overlap between the lifestyles and interests of athletes and HNW travellers, with influenced followers likely to choose the same locations for their vacations.

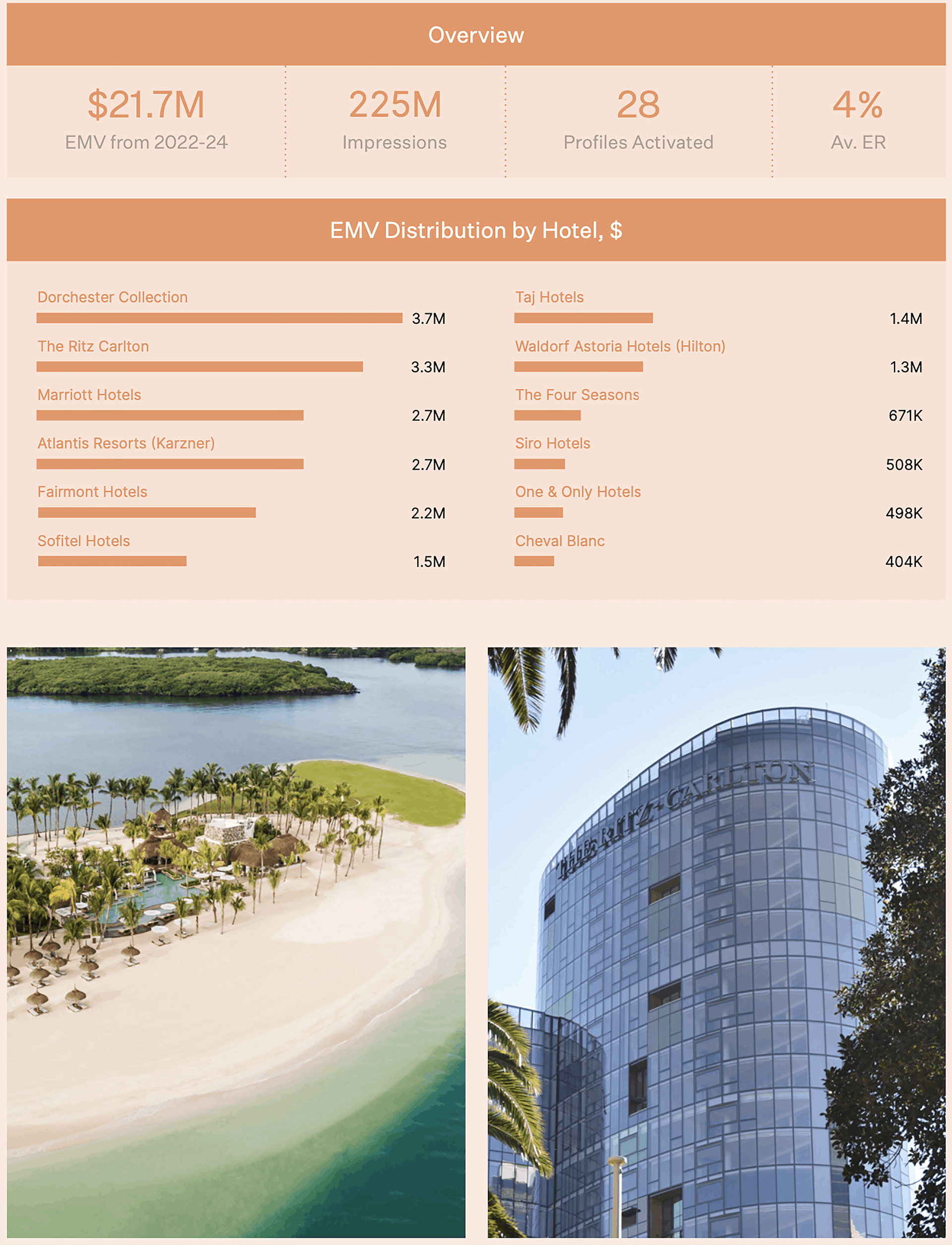

Sports x Hospitality statistics.

Sports x Hospitality statistics. Case Study: Pivoting from Posts to Partnerships

The influence of sports remains unbeaten: and several hospitality brands are taking collaborations a step further, moving from branded collaborations into full blown partnerships:

Siro: Team Athlete

A venture by the renowned Kerzner International group, SIRO is a high-end fitness and wellness hotel concept. The SIRO ambassadors include British- Somali professional boxer and humanitarian, Ramla Ali, alongside world class football team A.C. Milan and British Olympic swimmer Adam Peaty, who each play an advisory role in the development of the brand, from its bespoke training programs to recovery, nutrition and wellbeing.

More than brand ambassadors, SIRO has unique access to the routines, programs and strategies of these professional athletes, technicians as well as wellbeing experts.

Zel x Rafael Nadal: From Courtside to Pool Slide

Created in collaboration with Meliá Hotels International, ZEL hotels take the power of athlete x hospitality partnerships to the next level by co-partnering with world renowned Tennis player Rafa Nadal.

This partnership moves beyond inviting a celebrity, through to launching with a celebrity, playing homage to the power of Nadal’s profile and brand alignment.

Hospitality x athlete partnerships data.

Hospitality x athlete partnerships data. Hospitality x athlete partnerships data.

Hospitality x athlete partnerships data.