Beauty Redefined: Influence in the Digital Age

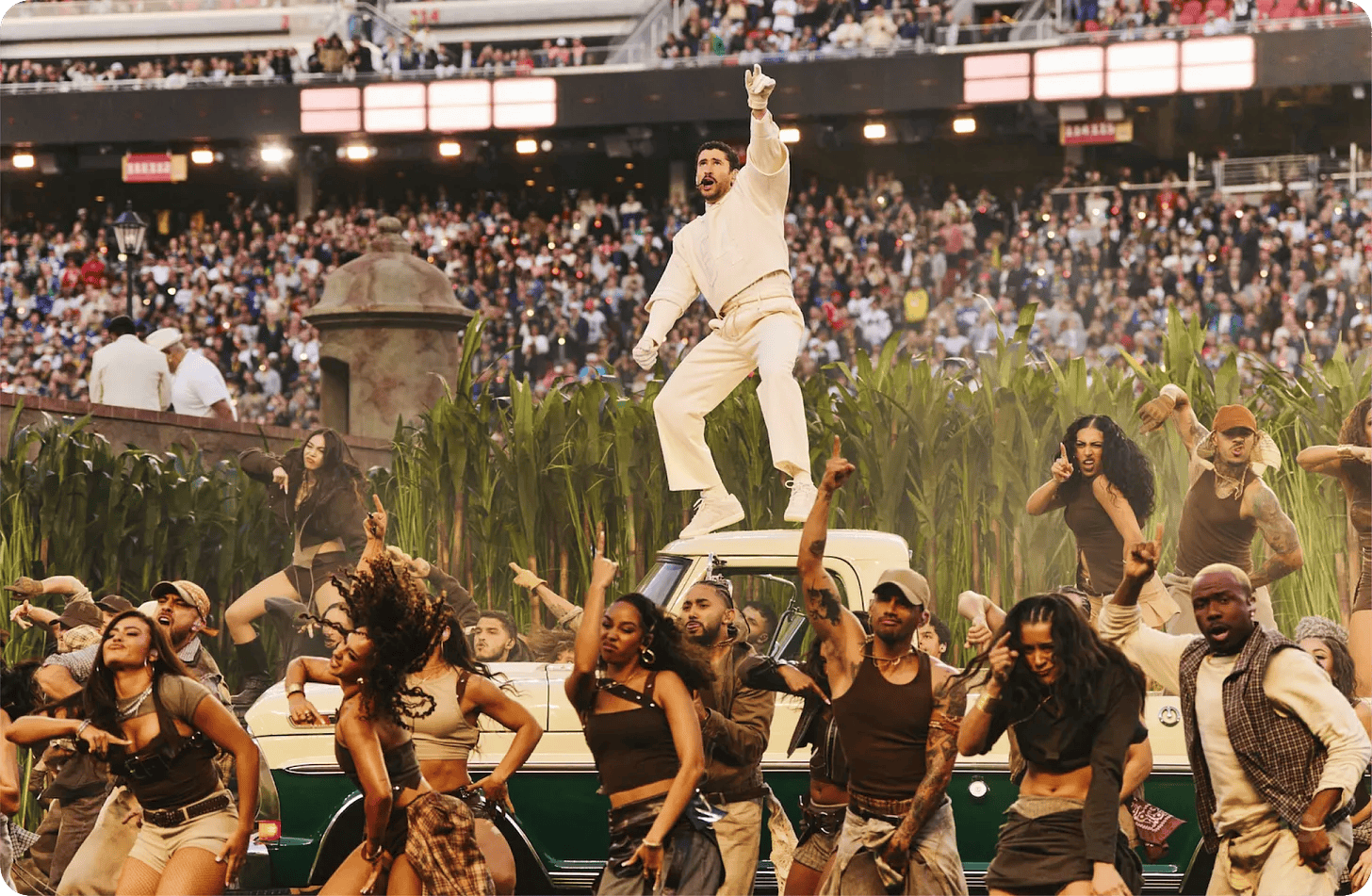

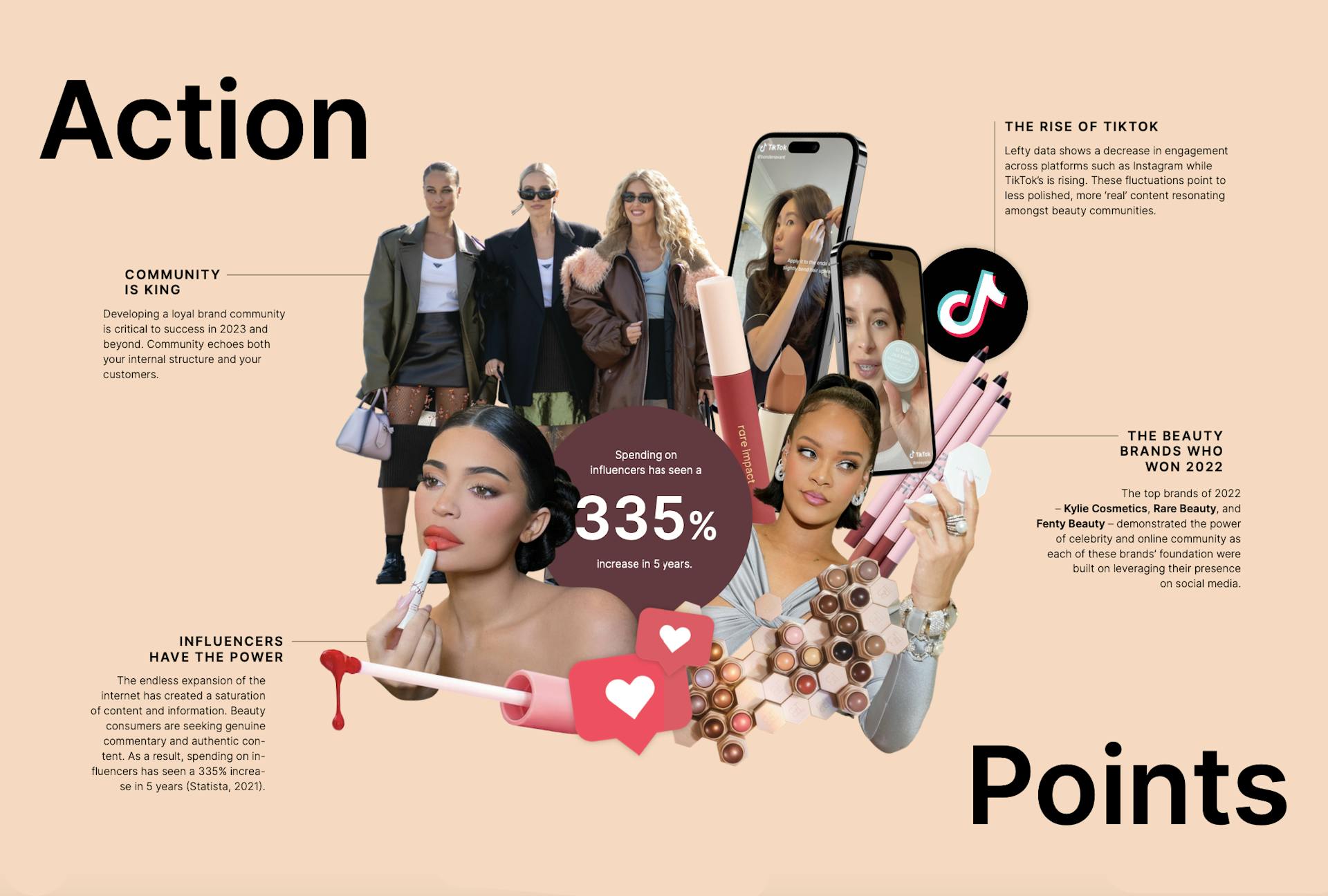

A graphic of the key trends for beauty influencers.

A graphic of the key trends for beauty influencers.Community is King

In 2014, Emily Weiss launched a brand that would forever change how the beauty industry thought about community. What started as a beauty blog, ‘Into the Gloss,’ quickly grew into a $1.2B company, thanks to a direct-to-consumer model and wealth of loyal community members, who resonated with their minimalist, millennial pink aesthetic and ‘skin-first, beauty second’ mantra.

Using their blog as a premise, Glossier was able to generate real-time insights and conversations around their communities’ preferences, informing everything from their packaging and formulations to campaign decisions. By engaging them within their brand journey, Glossier’s community quickly felt part of something bigger than a sales statistic: A beauty brand created by the community for the community.

Over time, Glossier has faced some challenges. Many ex-staffers foretold stories of a problematic work environment inside the brand's HQ following a round of layoffs. Meanwhile, their brand advocates voiced that new ranges failed to meet an inclusive range of skin tones. At the same time, non-sustainable packaging left the brand veering out of touch with its community's evolving needs, values, and expectations. “Glossier’s challenges present a lesson in the importance of understanding community: it’s one thing to build it, and another to keep it,” comments Madeleine Boyd, Vice President of Global Beauty at Karla Otto.

Glossier's "You" perfumes.

Glossier's "You" perfumes.Fast forward to 2022, and Weiss has stepped down in place of the appointment of Olivia Rodrigo - a move symbolic of Glossier repositioning their team with cultural relevance while trying to foster appeal amongst the ever-important Gen Z.

Despite their challenges, Glossier has paved the way for legacy and emerging brands to build on community as an integral business tool. From enhanced loyalty programs and influencer marketing to subscription models, embedding community-first strategies into a business improves retention, engagement, and conversion by up to 4-6 times more than average customer relations (Razorfish x Vice Media, 2021). For beauty brands globally, the case for community has never been more important.

Beauty & The Era of Influence

Over the past decade, as the internet has evolved, so has how brands communicate to and with their communities. The acceleration of the web has conjured a wealth of information and, with it, misinformation. Options are endless, and opinions — everywhere. Consequently, consumers are overwhelmed and seek authenticity and validation via commentary from trusted communities and peers.

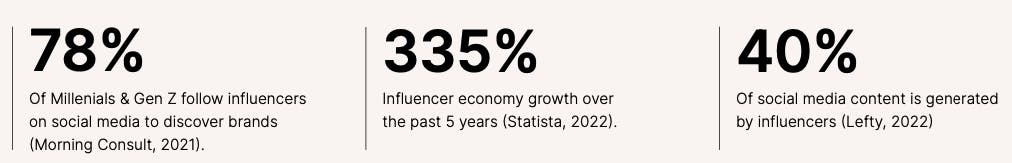

This sentiment is especially true for digital-first generations such as Millennials and Gen Z. A recent consumer study by Morning Consult shows that around 78% of this cohort follow influencers on social media to discover a new brand, while 82% of those trust the opinion of influencers or peers over brands.

“Trust and authenticity are key drivers for these cohorts, who are digitally native and savvier to a hard sale than other consumers,” comments Anna Ross, Head of Creative Insight at Karla Otto. “Products in the hands of an influencer who has already built a dialogue with their community just lands differently.”

A woman applying mascara.

A woman applying mascara.Meanwhile, the decline of print media coupled with COVID-19 proved the perfect storm for the impact of influencer marketing. As consumers pivoted to life at home, so did businesses’ marketing strategies. As other forms of OOH advertising became harder to activate, the relevance of influencer marketing became critical.

“The evolution of influencer marketing comes from a very logical place: consumers have moved from obtaining information from sources such as the internet, press, and television to social media and influencers,” explains Thomas Repelski, Co-CEO of Lefty.

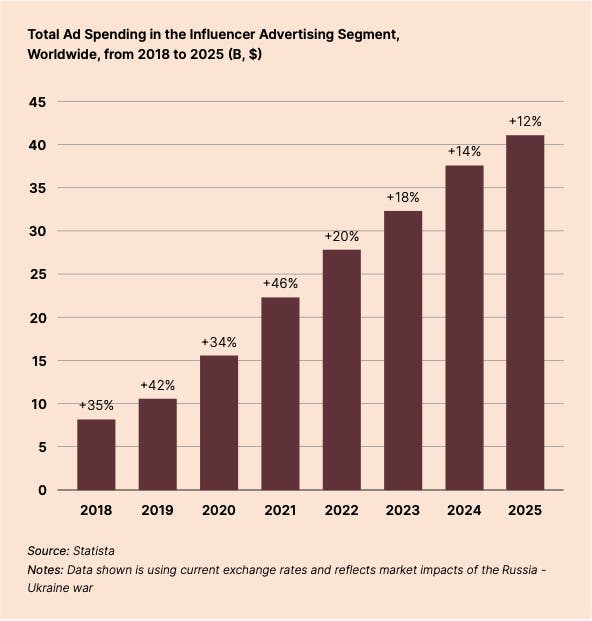

As a result, the influencer economy has witnessed a stunning 335% growth over the past five years, with brands forecasted to spend upwards of $32.5B on influencer marketing in 2024, up 18% from last year’s numbers and reaching an astonishing $48.8B by 2025 (According to Statista, 2022). It seems the only way is up for the evolution of influence.

But what makes influencers so successful at promoting products? Lefty’s Repelski pins the answer on the importance of community and authenticity. “There’s a turning point when you work with an influencer from the moment you initially send them a product to promote to the point they become extremely engaged and begin to post organically about your brand,” he explains. “The real value of influence lies in that organicity. This content will resonate more. Influencers only do this when they feel connected to the brand and its community.”

Total Ad spending in the Influencer Advertising Segment, Worldwide, from 2018 to 2025

Total Ad spending in the Influencer Advertising Segment, Worldwide, from 2018 to 2025Repelski suggests that influencers now generate 40% of the content on social media. “This is why influencer marketing budgets are increasing so dramatically — it enables brands to be visible on a much wider scale.”

In its simplest form, the power of influencer marketing and its recipe for success is clear: people buy from people.

Influencer growth statistics among Gen Z and Milennials on social media

Influencer growth statistics among Gen Z and Milennials on social mediaThe Social Shuffle

“Beauty lends itself naturally to influencer marketing,” comments Karla Otto’s Boyd; “So much of the category's consumer purchase behavior is driven by personal product reviews and recommendations, especially in skin care.”

Indeed, platforms like YouTube, for instance, have long-standing links with makeup tutorials, unboxing, and product reviews emerging across the video platform before the word ‘influencer’ even surfaced.

However, as the internet has evolved, the all-important trust factor has shifted. According to a consumer survey from GWI, there’s been an 11% decrease in consumer trust surrounding online reviews over the past two years. This statement is much higher amongst younger groups, who are more likely to seek out product reviews via vlogs, micro-blogs, and video sites, leaning less on traditional search tools. This mirrors recent data from Google, who have discovered nearly 40% of young people now look to TikTok or Instagram instead of using Google Search to find new information, surpassing the search engine and heading straight for community content.

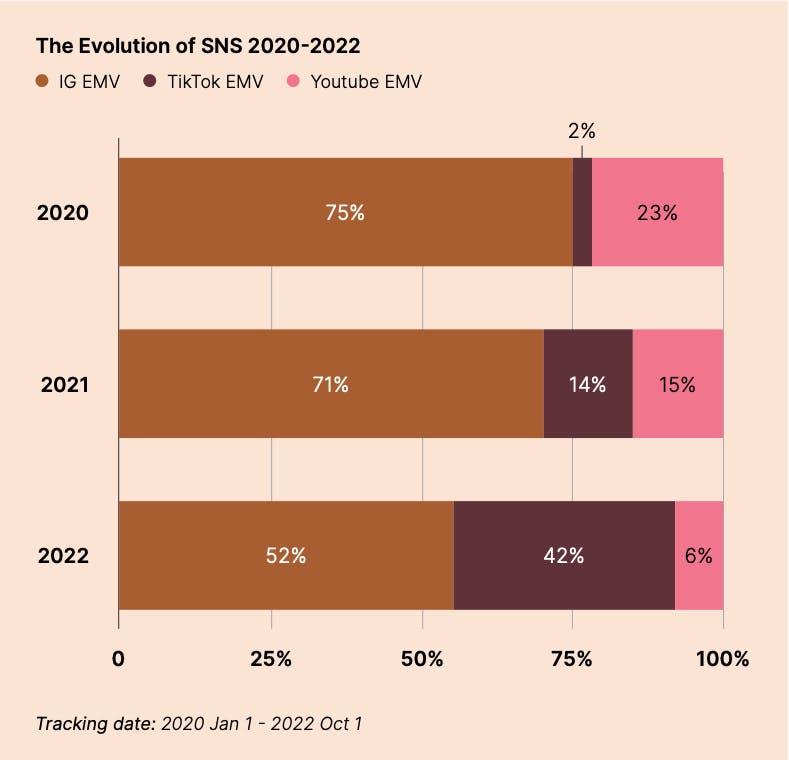

A chart showing the evolution of social networks from 2020 to 2022.

A chart showing the evolution of social networks from 2020 to 2022. "While influencer beauty content used to be dominated by long-form YouTube videos, today the landscape is all about short form; think TikTok, Instagram Reels, and YouTube Shorts. Capturing the audience’s attention in the first three seconds is paramount,” surmises Boyd.

Statistics of Gen Z and Milennials' affinity for influencers.

Statistics of Gen Z and Milennials' affinity for influencers.The Rise of TikTok

True to Boyd’s insights, Lefty analysts have uncovered a social shuffle showcasing a significant change in where beauty brands allocate budgets across influencer marketing — and where their communities are gravitating.

“As the entire social media ecosystem matures and competition across the beauty industry grows, we can see that the share of Instagram’s EMV [Earned Media Value] is declining year over year, while TikTok is gaining traction,” explains Lea Mao, Head of Marketing at Lefty. “So much so, TikTok gained 40% EMV share by the end of Q3 in 2022, forecast to overtake Instagram by end of 2022,” she states. As a result, the number of influencers beauty brands are partnering with is increasing on TikTok, with marketers deploying more of their budget towards the platform than ever.

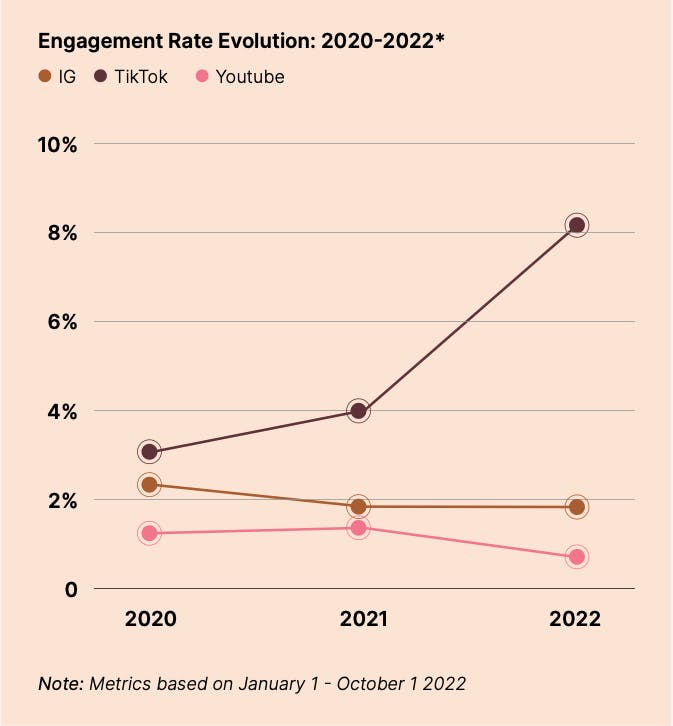

Engagement rate increases across social platforms from 2020 to 2022.

Engagement rate increases across social platforms from 2020 to 2022.TikTok is undoubtedly leading the way for the beauty industry, and Lefty’s data suggests this is down to the platform’s booming engagement levels. On Instagram, average engagement has steadily decreased over the past three years, starting at 2.19% in 2020 and falling to 1.93% in 2022.

Meanwhile, TikTok’s engagement continues to soar, with an average engagement rate of 8.07% this year (higher than Instagram has ever achieved, even in its heyday). Furthermore, TikTok is forecast to attract over 2/3 of online video content revenue by 2027 — more than Meta and YouTube combined (Omdia, 2022).

“TikTok has provided something with a much clearer value proposition: short videos and super-fun, engaging content, whereas Instagram is a melting pot of different things,” explains Lefty’s Repelski. Indeed, one only has to spend a few moments on the platform to notice the stark contrast between the two. Far from Instagram’s polished demeanor, TikTok thrives on off-the-cuff content that places humor and community trends at the fore. Meanwhile, its feed-first algorithm enables users to generate visibility more quickly, regardless of their following. “On TikTok, you are pushed content relevant to you — not just from people you follow — so in that way — it's much more dynamic. You can have creators that go viral but also brands that go viral, no matter their following. It creates an amazing opportunity for beauty brands,” explains Repelski.

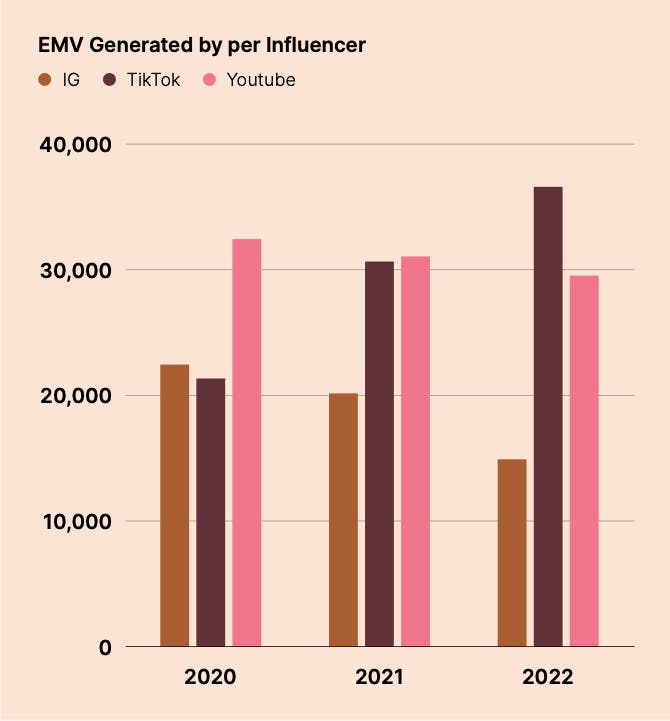

EMV generated per influencer across social networks.

EMV generated per influencer across social networks. Thus, brand partnerships within the TikTok sphere display a more diverse influencer community matrix than Instagram’s, relying less on Mega influencers (think celebrities or influencers with millions of followers) to generate that all-important visibility.

On TikTok especially, the quality of the content and how it resonates with your community is more important than scale. This learning is key for beauty brands looking to evolve and develop their online communities and work with influencers in 2023 and beyond.

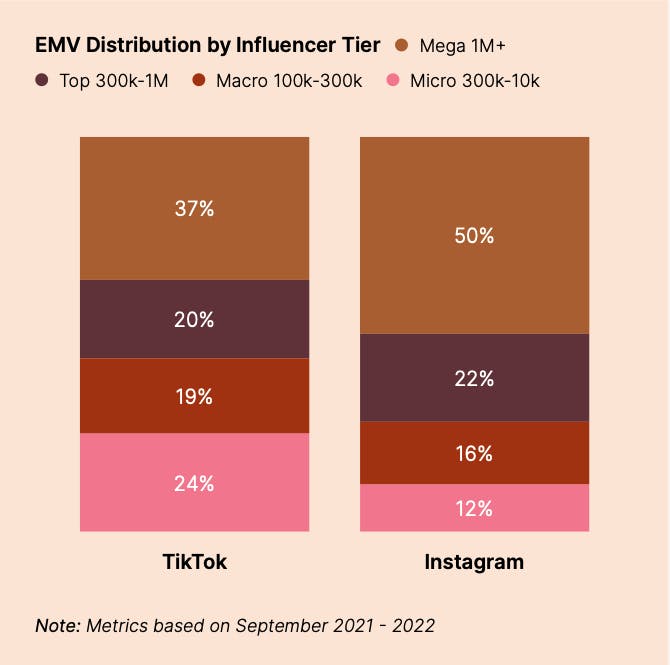

EMV distribution per influencer tier on Instagram and TikTok.

EMV distribution per influencer tier on Instagram and TikTok.The Brands & Influencers Who Won

Top Trends

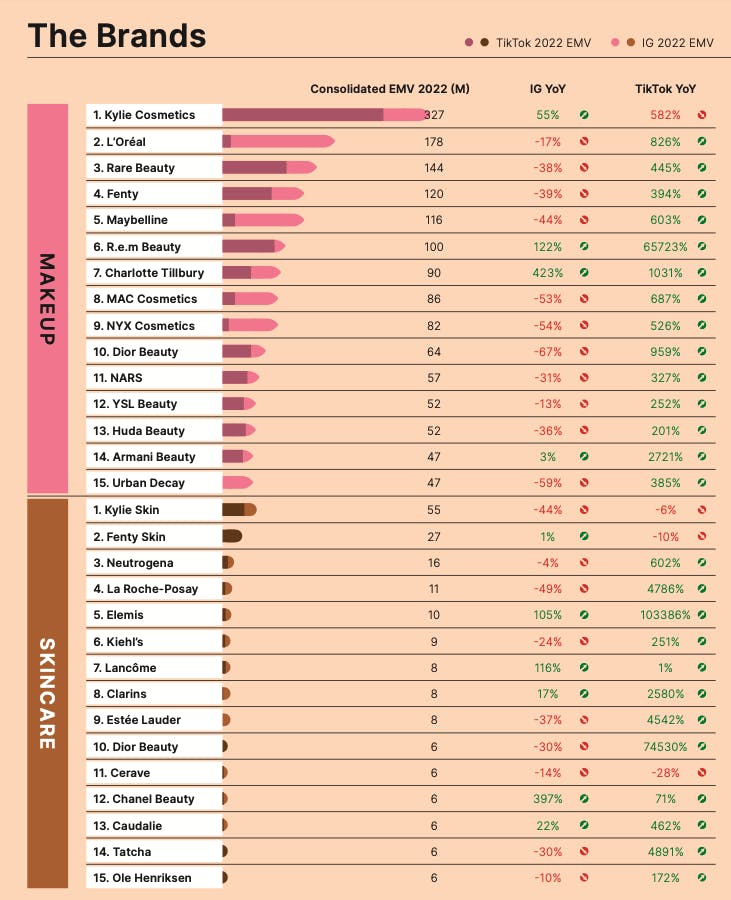

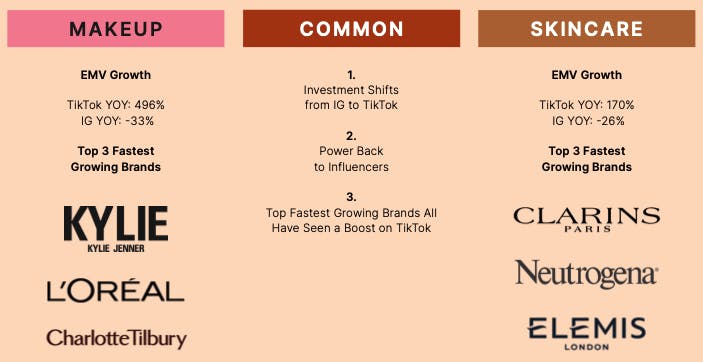

Throughout 2022, there has been a significant switch in how makeup and skincare brands market themselves. Lefty’s data suggests that TikTok has become an increasingly legitimate marketing channel, overtaking Instagram in EMV annually. So much so that brands who have invested more in TikTok than Instagram are growing faster in EMV, suggesting a continued trend toward TikTok as the platform to invest in and experiment with for social media marketing in 2023.

The power of celebrity remains a profitable marketing tactic for the beauty industry. Despite being new to the market, half of the top five highest EMV-grossing makeup and skincare brands (Kylie Cosmetics, Rare Beauty, and Fenty Beauty) are led by influencers or celebrities. The same trend parallels skincare brands, with Kylie Skin and Fenty Skin ranking first and second in EMV.

More important than star power is how these brands have chosen to market themselves with a social-first strategy. The real key to success for brands like Kylie Cosmetics (aside from having Kylie Jenner as the face of the brand) is consistently posting engaging content and building a community around the brand and its products. These celebrity brands have managed to tap into this new way of marketing that resonates with consumers - which is showcased in the results.

Celebrity-led brands generating vast amounts of EMV indicate two significant

themes:

1. The power of celebrity

2. A social-media-first, community lead mindset

Common trends between skincare and makeup brands.

Common trends between skincare and makeup brands.The Influencers

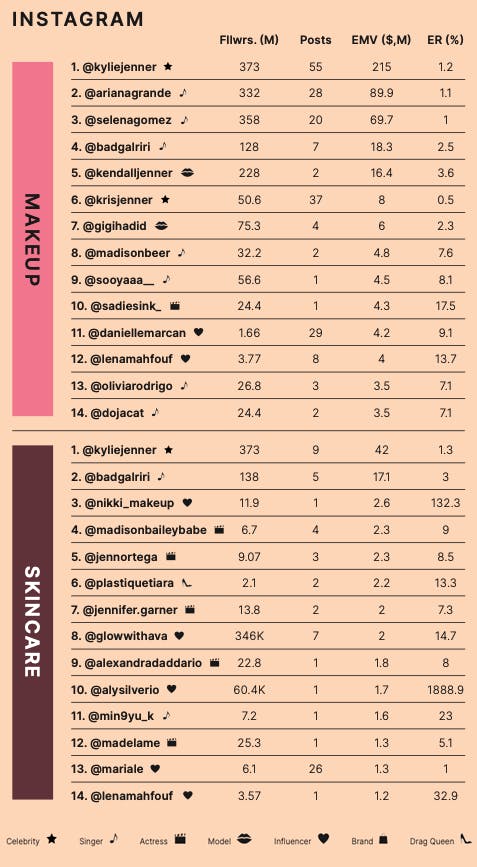

On Instagram, the trends among top makeup and skincare influencers vary widely, and they have only one thing in common: almost all have more than 1 million followers. The leading KOLs in the Instagram beauty space are musicians who have partnerships with beauty brands or own their own brands. These influencers frequently post sponsored content for brands, with 14 posts per influencer being the average. 73% of top influencers’ in-feed content is carousel posts or singular photos, which help to demonstrate makeup products’ highly visual and transformative nature.

Meanwhile, top Instagram influencers for skincare brands are more commonly actresses or influencers. However, the skincare category demonstrates a more diverse talent pool than make-up.

Additionally, the skincare category has more video content, echoing TikTok’s content trends. Skincare products require visual demonstrations to show their efficacy, creating a much higher percentage of video posts and generating higher engagement levels across the platform.

Influencer ranking on Instagram for skincare and makeup categories.

Influencer ranking on Instagram for skincare and makeup categories.The most successful KOLs on TikTok share

several characteristics:

1. High Engagement: Highly engaged with content (19.5%).

2. Varied Followings: Follower counts that range from 100K - 1M + followers.

3. Sponsored Content: They frequently post sponsored content.

TikTok content creators boast unprecedented levels of engagement, with an average amongst top influencers of 19.5%. The platform itself is less saturated by brands, meaning the influencers across the platform have had the opportunity to build relationships with their audiences centered around trust and transparency.

Additionally, TikTok’s dynamic algorithm helps audiences connect with content creators who are relevant to their interests, allowing them to cut through the platform's noise more easily.

As a result, top influencers like @justtnic, @amysedar, and @bondenavant obtain some of their highest engagement levels on brand-sponsored content, demonstrating their mastery in gaining their followers’ trust.

TikTok is a proven investment for beauty brands. Investing in TikTok can only mean success if the influencer casting is relevant to the target audience.

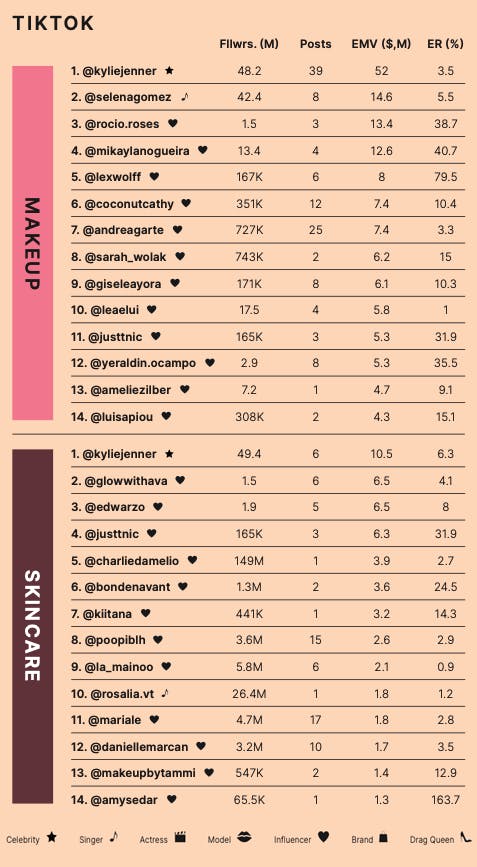

Influencer ranking on TikTok for skincare and makeup categories.

Influencer ranking on TikTok for skincare and makeup categories.Beauty Brands Ranked by EMV ($, M)

Lefty identified the selected brands for this study as significant players in the beauty industry operating in multiple international markets and with influencer marketing programs encompassing more than 500 influencers. This list ranks the amount of combined EMV generated by each brand on Instagram and TikTok from January 1 - October 1, 2022.

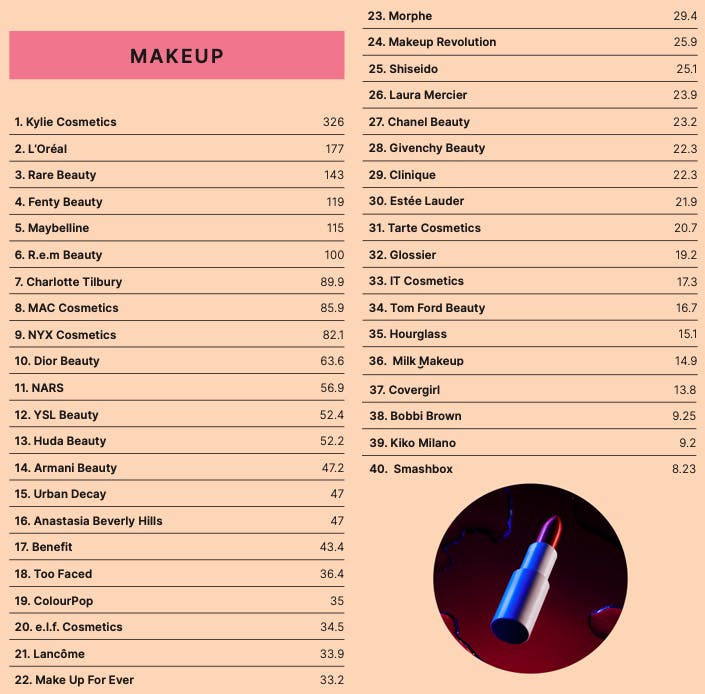

Beauty brands ranked by EMV.

Beauty brands ranked by EMV. Skincare brands ranked by EMV.

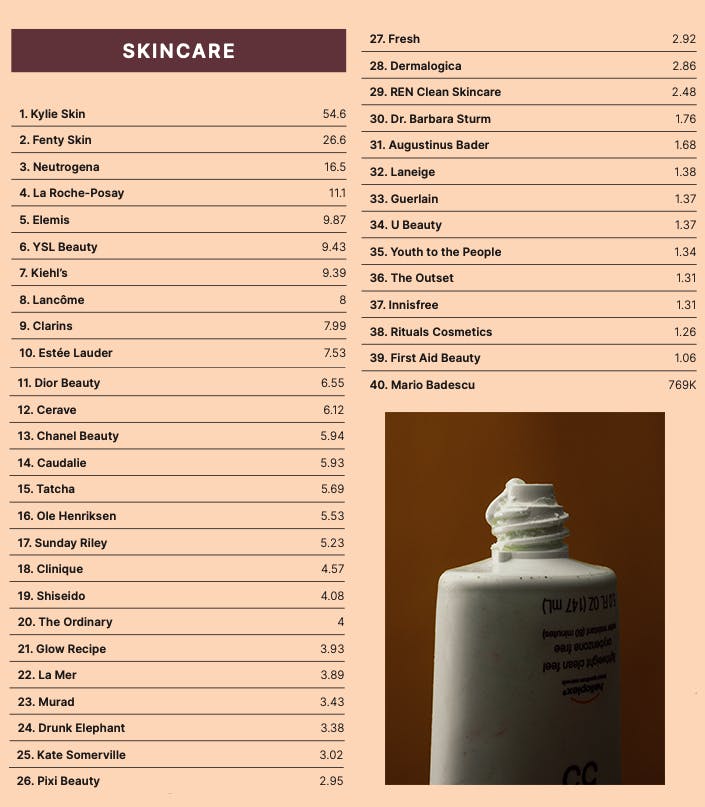

Skincare brands ranked by EMV.Conclusion

The Future of Beauty and Community

The top brands of 2022 – Kylie Cosmetics, Rare Beauty, and Fenty Beauty – demonstrated the power of celebrity. But what is the key to success for beauty brands in 2023 and beyond?

There are two parts to the equation:

First, developing a loyal community is critical, as this group will echo a brand’s internal structure and customer base. The community is the lifeblood of a brand’s business, providing feedback and support while evangelizing on its behalf. Companies can build trust and foster long-lasting relationships with their customers by making their community feel like an extension of the brand.

Second, a recent shift has occurred in how brands interact with customers. This is mainly due to the saturation of content and information available online. With so much noise, it is difficult for customers to differentiate between reliable sources and marketing campaigns. As a result, they are more likely to form personal connections with brands and people they trust. Brands must focus on creating a community that consumers can rely on for accurate information and product recommendations via user-generated content on social media, loyalty programs, or direct conversations.

A spread of different beauty products.

A spread of different beauty products.For Beauty, our data points to TikTok as the platform of choice for gaining new customers and reaching new communities in 2023, allowing marketers to tap into young consumers like never before. However, it’s important for brands to be aware of sensitive geopolitical tensions in certain markets. In India, the app is banned altogether, whereas in the US, more than 20 states have banned the app from government devices due to concerns about data protection and the potential for election interference. Brands who operate in these markets should stay vigilant to the geopolitical business context of the platform as a marketing tool as we head into 2023 and beyond.

“To succeed in what is now such a saturated category, beauty brands must refine their community strategies across channels such as Instagram and TikTok, learning what resonates, what doesn’t, and, importantly, how to be agile,” explains Karla Otto Boyd. “At Karla Otto, we specialize in supporting beauty brands to master the ever-evolving digital landscape and the surrounding community. We help brands build cultural capital and prepare for the future with creativity and authenticity at the fore”.

“No matter the format or the platform, our job at Lefty remains the same. We give brands a tool to measure their influencer relationships and help grow their communities,” surmises Repelski.