A Year in Data 2025: A Look Back and 2026 Trends Revealed

Decode the evolution of the digital landscape. From influencer to social platform shifts, get the trends you need to plan for 2026

Download reportAs the Cambridge Dictionary named ‘Parasocial’ its Word of the Year, the term found clear expression across the brand and marketing landscape. 2025 became the year celebrities and brands felt closer than ever, opening more of their worlds to online audiences globally. Timothée Chalamet appeared at his own lookalike contest; the cast of Severance brought the TV series to life in New York and London; KATSEYE, an American group tapping into K-Pop lore, began to redefine how fandoms are built and sustained; while brands like Dior invested in global brand ambassadors to drive the message of Jonathan Anderson’s arrival.

This shift points to a broader democratisation of what was once out of reach. TikTok – one of 2025’s fastest-growing social platform – has pulled back the curtain, offering unprecedented access to talent, culture and brands. Those that embraced TikTok-first strategies saw the strongest growth in media impact. Meanwhile, social-first personalities such as Lyas introduced a new community-first format across Fashion Weeks, the Watch Party, where the public was invited to join in IRL, with brands racing to get involved.

In this report, Lefty and Karla Otto join forces to decode the data and cultural signals behind the year’s most influential moments, translating them into strategic imperatives for the year ahead.

Talent Insights

KATSEYE, Talent of the Year

The Grammy-nominated girl band doubled its followers in 2025.

Girlband KATSEYE, formed through a reality competition series, became one of the first America-based groups to follow the K-Pop formula with catchy lyrics and synchronised, easy-to-replicate choreography. Born from the public vote, each member has a standout relationship with their fans, whom they can engage with directly through their management companies’ official platform, Weverse, fuelling the band’s continued growth and appeal.

Moreover, KATSEYE counts Humberto Leon as its creative director, cementing strong ties to the fashion world. After partnering with Coach and Fendi, they featured in Gap’s viral ‘Better in Denim’ campaign, with one video counting over 150M views on TikTok. With a new Grammy nomination and a confirmed slot at Coachella 2026, the band’s influence is expected to grow, making them a standout partner for luxury brands looking to align with new pop culture icons.

KATSEYE for Gap (Instagram).

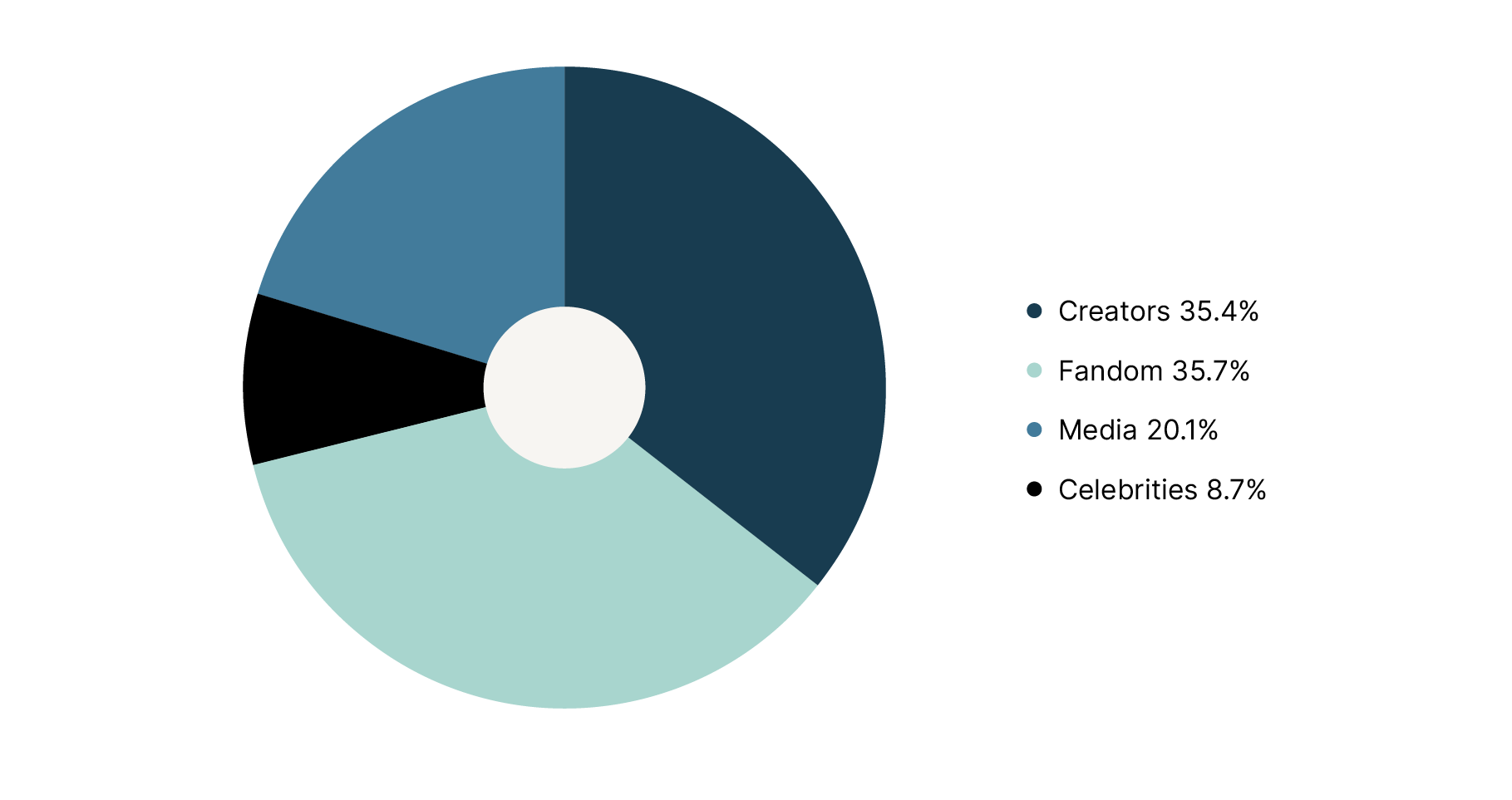

KATSEYE for Gap (Instagram).Fandoms Shape the Fashion Week Conversation

Fandoms were the #1 EMV driver for brands in 2025.

Overtaking influencers, fandoms have become the most significant driver of engagement and visibility across platforms, especially throughout fashion month. APAC talent continue to drive the most noise; however, the most recent SS26 fashion season marked a notable shift. Thai drama actresses Orm and Lingling claimed the top positions across fashion month, the first time K-Pop stars have been outranked since we began tracking FROW attendance in 2022.

Fandom is a lucrative ecosystem for both talent and fans: while celebrities rely on fan engagement to boost their visibility at events and attract brand deals, it is reported that about 10% of Gen Z now earn income from fan activities online (Music Radar, 2024). Fandom content has become so powerful that some entertainment companies are taking ownership of fan content, as seen with KATSEYE’s official fan account, the ‘Eyecons’. For brands, this could open new avenues to align with the very audiences that amplify visibility each season.

Fastest-Growing Profiles

Across platforms, top-growing talents pair unique skills with authentic personality. Discover who’s leading—and why—by downloading the full report, where more insights are revealed.

Download reportTop 5 Talent Trends

As audiences increasingly become disillusioned by traditional forms of influence, they’re seeking individualist profiles with unique points of view, standout talent and personality.

- Film Industry Professionals: As more industries—particularly fashion and jewellery—continue to court the world of film, they are increasingly blurring creative boundaries by enlisting acclaimed film directors, producers, and music composers not only to walk their shows, but also to shape their campaigns, infusing cinematic storytelling, emotional depth, and narrative ambition into the way brands present themselves.

- The Personality Hire: Humour, a distinctive tone of voice, and instantly meme-able mannerisms—such as Timothée Chalamet’s now-viral “schwap” in the Marty Supreme video promo—are increasingly valuable traits to look out for in your next talent partnership, as they help create cultural moments that travel effortlessly across social platforms, spark organic conversation, and embed a brand into internet culture beyond the lifespan of a single campaign.

Timothée Chalamet in Marty Supreme (Instagram).

Timothée Chalamet in Marty Supreme (Instagram).- The Multi-Hyphenates: Influencers are increasingly vying for more traditional forms of fame as audiences grow more selective, gravitating toward creators who demonstrate genuine, transferable talent beyond social platforms. From TikTok star Addison Rae evolving into a Grammy-nominated musician, to Benito Skinner successfully translating his YouTube comedy into a scripted Amazon Prime series with Overcompensating, the line between influencer and mainstream entertainer continues to blur—reshaping how cultural relevance and credibility are built.

- The Curators: In a world saturated by endless content, the ability to spot, frame, and elevate what’s truly special has become increasingly influential. From stylists and art directors to Substack writers and moodboard accounts, a new generation of style curators is emerging—offering audiences a distinct, highly personal lens on culture, taste, and aesthetics, and shaping how trends are discovered, contextualised, and shared.

- Commentators Become Critics: From Lyas to Hanan Besovic, the social commentators we first called out in SS23 have evolved beyond online personalities, stepping into the role of trusted cultural critics who are now increasingly recognised by the industry. By offering sharp analysis, context, and unfiltered perspectives, they influence conversations around fashion, media, and power—signalling a shift toward commentary-led credibility in the cultural landscape.

Lyas at La Watch Party in Paris (Diora Muslimova).

Lyas at La Watch Party in Paris (Diora Muslimova).Social Media

Chinese Networks and TikTok Grow

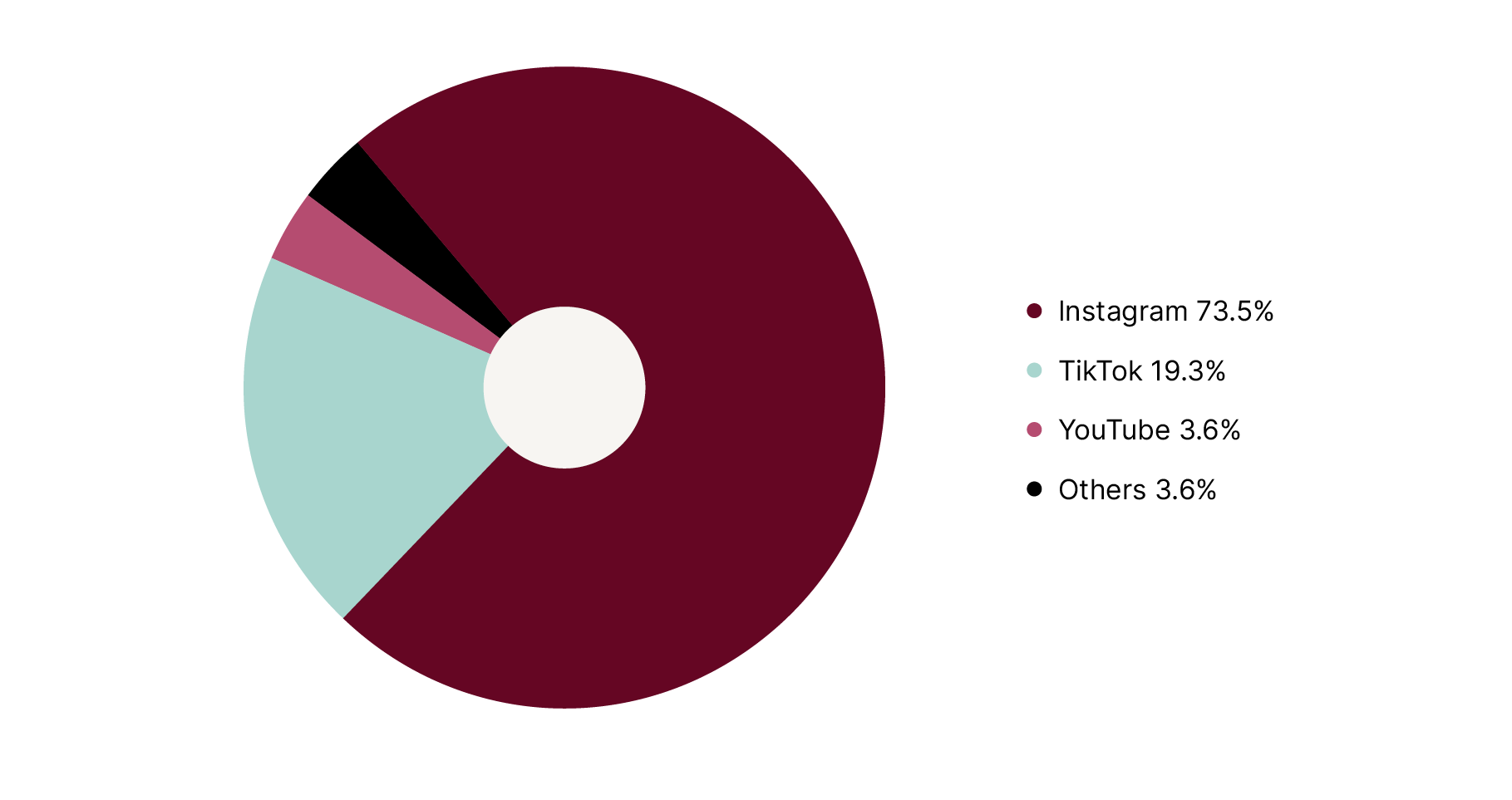

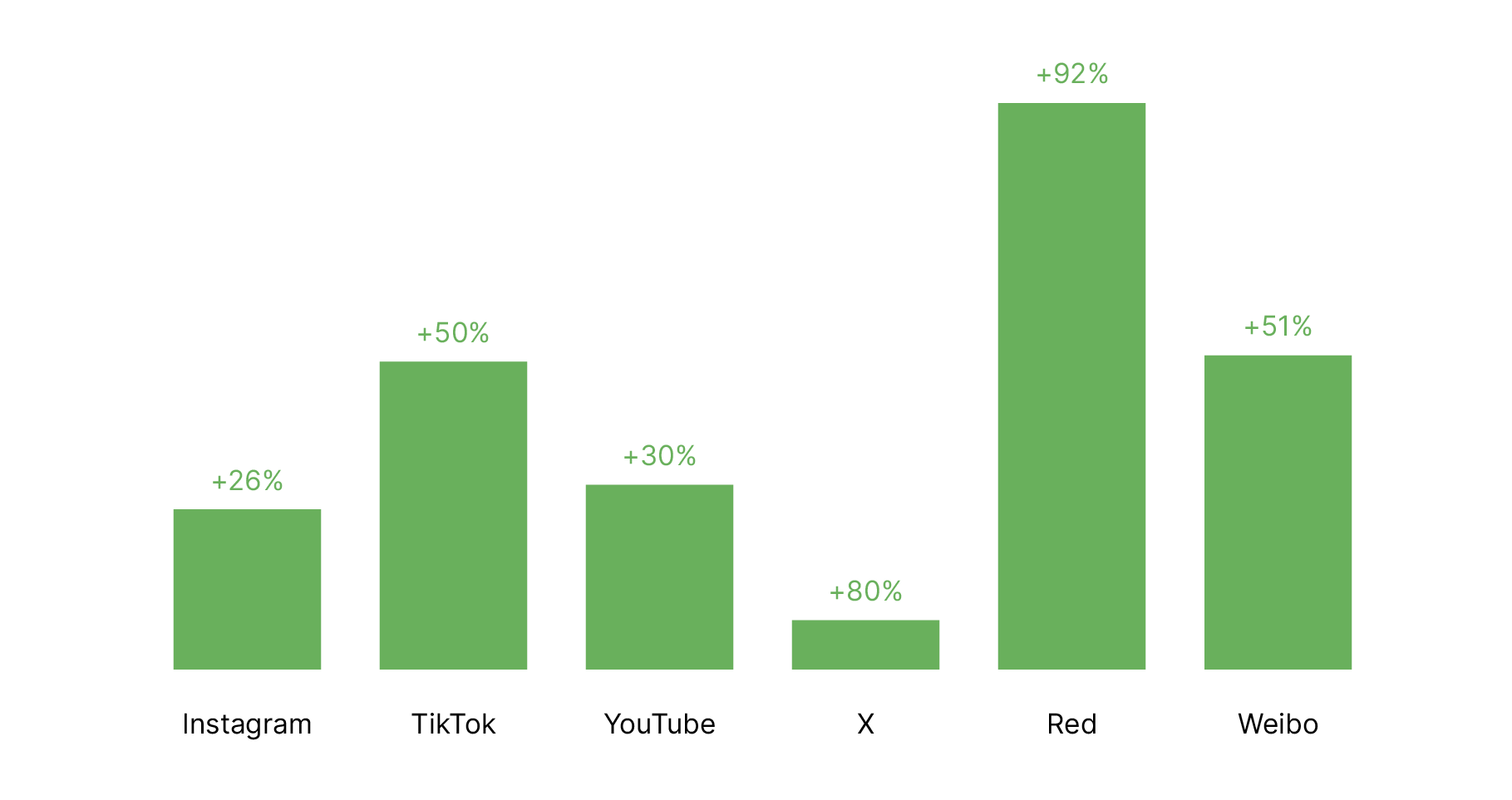

As the influencer marketing landscape continues to evolve, talent activations increased across all major social platforms.

While Instagram remained the leading platform, capturing 73.5% of total Share of Voice (SoV), TikTok recorded a notable acceleration in activity, with the number of activated creator profiles increasing by more than 50% year over year. This growth highlights TikTok’s rising strategic importance for brands seeking cultural relevance and deeper engagement, particularly among younger and trend-driven audiences.

At the same time, against the backdrop of China’s ongoing consumer spending slowdown, brands increasingly turned to talent-led strategies to stimulate demand and re-engage audiences. Influencer activations expanded across key local platforms such as Weibo and Red, underscoring the role of trusted creators in rebuilding momentum and driving brand desirability in a more cautious market environment.

Looking ahead, the greatest opportunity lies in nuance rather than scale alone. As audiences shift toward discovering inspiration through niche creators and highly aspirational profiles, brands will need to adopt more refined influencer strategies—ones that are carefully tailored to the dynamics of each platform and the expectations of distinct audience segments. Mastering this balance will be critical for navigating the increasingly complex and fragmented influencer landscape as it continues to evolve into 2026.

Category Breakdown

TikTok is Fragrance’s New Playing Field

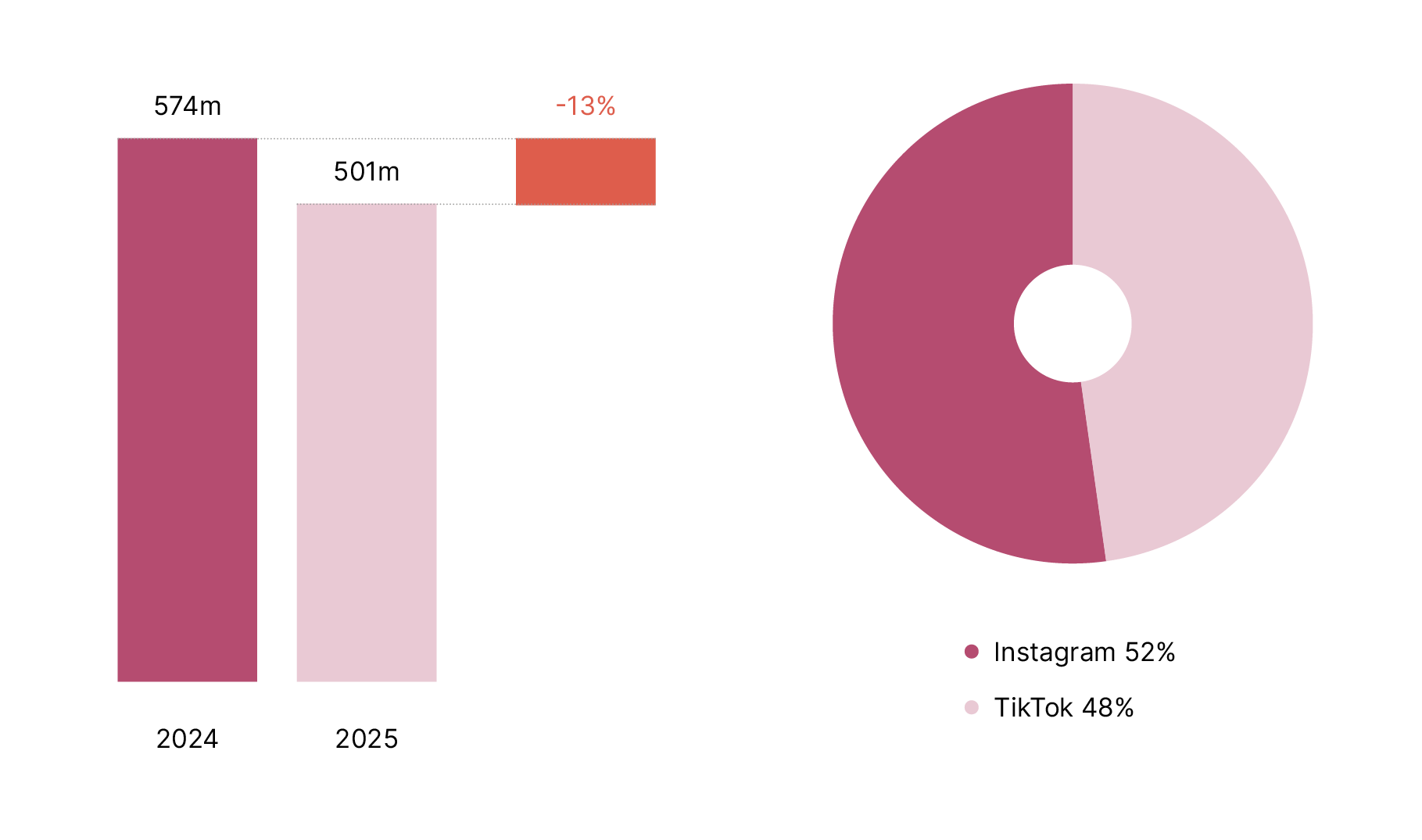

The fragrance industry boasts near equal visibility on Instagram and TikTok.

As highlighted by The Business of Fashion and McKinsey’s latest The State of Fashion report, fragrance is projected to be a key growth driver for the beauty sector through 2026. This momentum is being fueled in large part by the rising appeal of high-end niche fragrances, as consumers increasingly seek distinctive scents, artisanal storytelling, and a stronger sense of personal identity through fragrance.

Social media—particularly TikTok—has played a pivotal role in accelerating this shift. With more than 26 billion viewsunder the hashtag #PerfumeTok, the platform has become a powerful discovery engine, introducing a new generation of Gen Z consumers to both emerging and niche fragrance brands. Through reviews, “scent profiles,” layering routines, and emotional storytelling, creators have transformed fragrance from a traditionally offline purchase into a highly engaging, digital-first category.

Jo Malone Raspberry Ripple Cologne (Instagram).

Jo Malone Raspberry Ripple Cologne (Instagram).According to Lefty data, fragrance brands significantly increased their traction on TikTok in 2025, expanding their share of voice (SoV) by 4% year over year. As a result of this sustained growth, fragrance emerged as the only beauty category studied to achieve near parity in earned media value (EMV) between Instagram and TikTok, underscoring TikTok’s growing influence in driving visibility and engagement for scent brands.

Although overall EMV across beauty declined in 2025, fragrance brands are well-positioned to regain momentum. By leaning into their niche positioning, emphasizing authenticity and sensorial storytelling, and adopting TikTok-first content and creator strategies, brands can continue to capture consumer attention, deepen cultural relevance, and drive long-term growth in an increasingly competitive landscape.

Top Fragrance Brands

Discover the top fragrance brands by EMV and their year-over-year performance.

Download reportHow Fashion’s Reset Played on Social

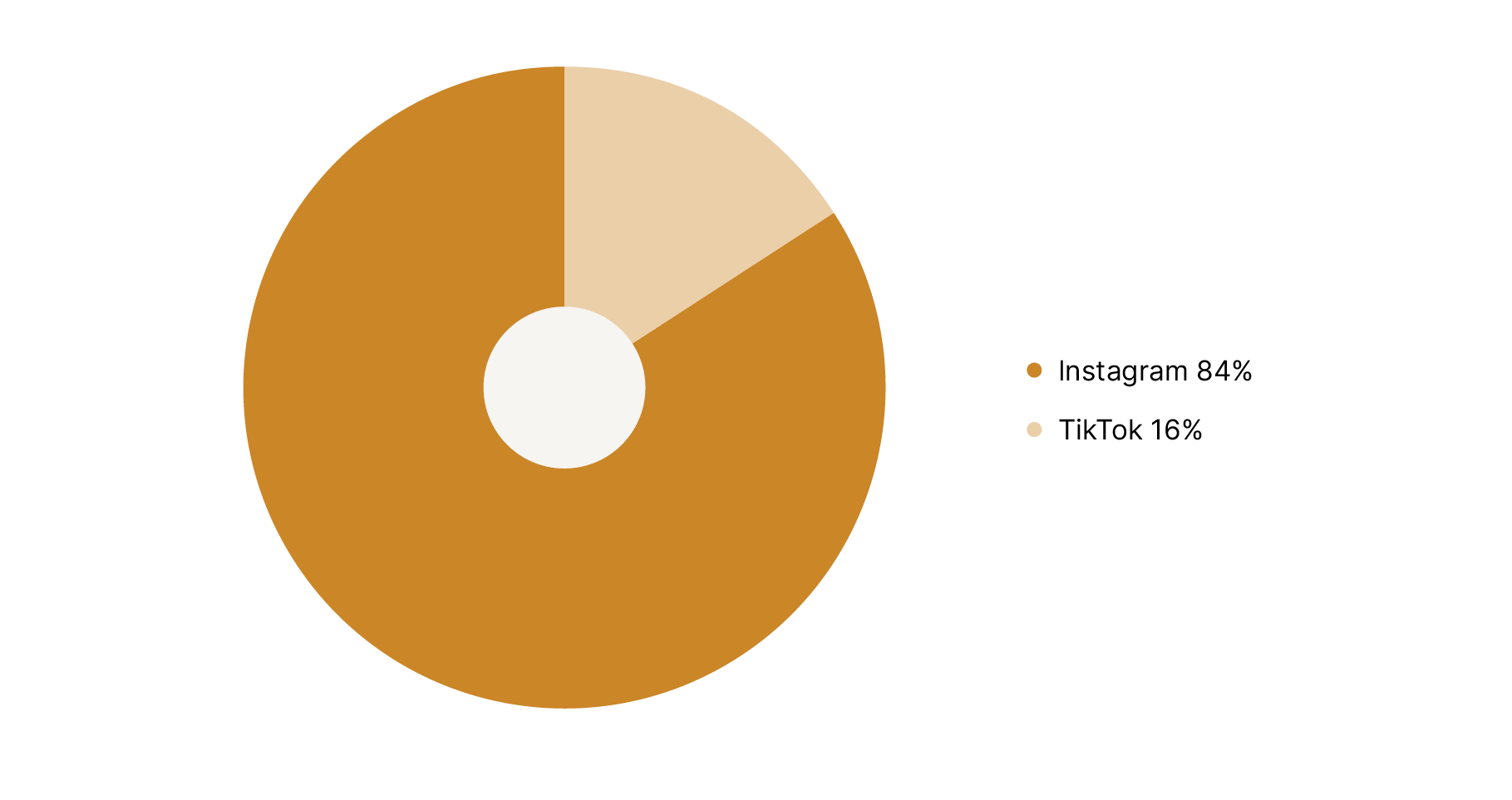

Audiences in 2025 craved newness and began seeking inspiration beyond fashion, which decreased the industry’s overall online visibility.

In tandem with a wider luxury slowdown, the fashion category’s visibility online experienced a notable decline, dropping -8% YoY. The contraction reflects broader market pressures, including cautious consumer spending and the slowing momentum of post-pandemic digital hype. In response, many luxury groups sought to recapture attention by embracing a new creative guard—designers and creative directors who prioritized spectacle and innovation over tradition. These leaders dazzled audiences with entertainment-first runway shows, unconventional talent collaborations, and highly cinematic campaigns that blurred the lines between fashion, performance, and storytelling.

Chanel, under the new creative direction of Matthieu Blazy, was among the few brands that managed to defy the trend, registering an increase in visibility in 2025. Blazy’s debut show in October drew widespread acclaim, thanks in part to its combination of star power and inventive presentation. High-profile attendees like Thai actress Becky Armstrong added global appeal, while the show’s social-first runway scenography demonstrated a sophisticated understanding of digital audiences, generating shareable moments that extended far beyond traditional fashion media.

Chanel SS26 Fashion Show (Spotlight).

Chanel SS26 Fashion Show (Spotlight).Meanwhile, emerging social platforms are reshaping how fashion content is consumed and shared. TikTok, in particular, has grown in strategic importance, contributing 13% more visibility to the category over the past year. Historically, Instagram has served as the dominant hub for fashion conversations, but a notable shift is underway. A new generation of creators, characterized by their humor, speed, and unpolished authenticity, is redefining what it means to engage audiences online. For brands, this signals both a challenge and an opportunity: success will increasingly depend on the ability to translate luxury’s aspirational messaging into formats that resonate with fast-moving, socially savvy audiences who value relatability and immediacy as much as prestige.

Top Fashion Brands

Discover the top fashion brands by EMV and their year-over-year performance.

Download reportFashion’s Top Moments

2025 was bursting at the seams with designer debuts, new acquisitions and disruptors gaining traction.

- Dior, the Most Impactful Brand: Under Jonathan Anderson’s new creative direction, Dior refined its global talent roster with precision, blending heritage elegance with contemporary vision. The brand’s focus on Menswear SS26 proved particularly impactful, generating $98.1M EMV, making Dior the most impactful brand of the season. Strategic casting and theatrical presentation helped Dior create moments that resonated across both luxury and digital audiences.

Dior SS26 Fashion Show BTS (Spotlight).

Dior SS26 Fashion Show BTS (Spotlight).- Gucci, the Standout Entertainment Strategy: Gucci embraced a cinematic approach to launch Demna’s new creative vision, turning Womenswear SS26 into an entertainment-first spectacle. This strategy generated $31.7M EMV, highlighting the effectiveness of storytelling-driven campaigns. Gucci’s blend of bold narratives, high-profile collaborations, and immersive runway experiences ensured the brand remained culturally relevant and visually captivating.

- Chanel, the Key Designer Debut: Matthieu Blazy’s debut at Womenswear SS26 reinforced Chanel’s luxury dominance, generating $42.8M EMV. The show combined star-studded attendance with social-first runway scenography, creating highly shareable moments across digital platforms. Chanel’s careful balance of aspirational messaging and innovative presentation solidified its position as a leader in luxury womenswear.

- Doublet, the Fastest Growing Menswear Brand: Doublet achieved an extraordinary +1,338% YoY EMV growth at SS26 Menswear. Clever casting, including Raul from J-Pop group Snow Man, tapped into a dedicated fanbase, generating excitement and amplifying the brand’s visibility. Doublet’s success underscores the impact of cultural crossovers and influencer-driven engagement for emerging labels.

Doublet (Instagram).

Doublet (Instagram).- Sergio Hudson, Fastest Growing Womenswear Brand: On the womenswear side, Sergio Hudson stood out as the fastest-growing brand, achieving +813% SoS EMV growth at SS26. The brand’s rise reflects a combination of bold, distinctive aesthetics and digitally amplified campaigns, positioning it as a breakout name for the new generation of designers.

- Gap, Fastest Growing Brand on TikTok: Gap achieved +87.6% follower growth over 180 days. The brand’s strong performance demonstrates the power of social-first strategies and platform-specific content, proving that heritage brands can successfully engage younger, highly digital audiences.

On Cultural Time: Fine Watches & Jewellery

Leading watches and jewellery brands are embedding themselves in culture to command attention over time.

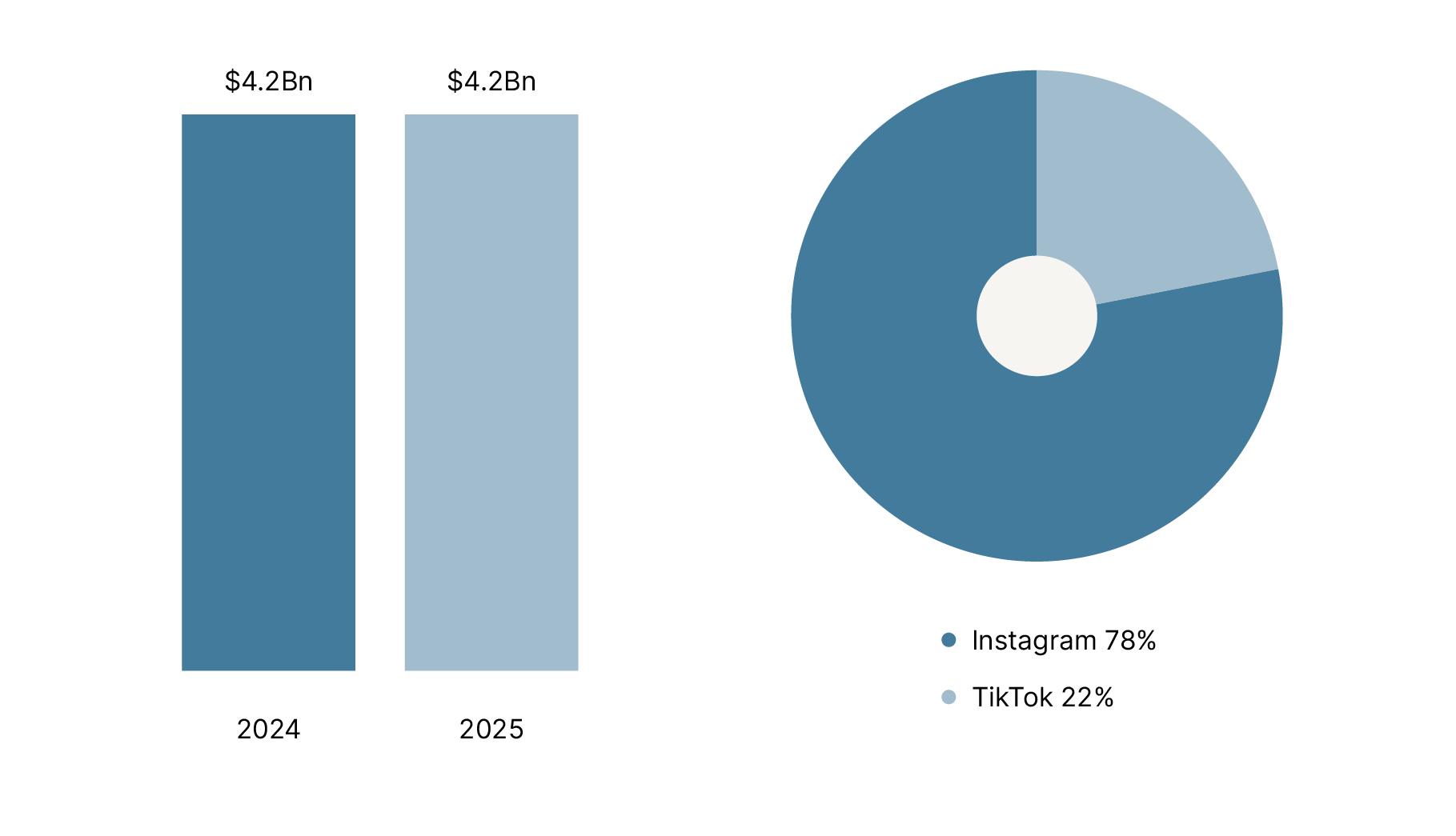

While overall demand for luxury goods has softened, certain categories—particularly fine jewellery and watches—continue to experience steady market growth. Consumers are increasingly gravitating toward pieces that offer long-term value, combining craftsmanship with investment potential. This trend reflects a broader shift in luxury consumption, where buyers are prioritizing quality, heritage, and longevity over trend-driven items.

Yet online, the landscape tells a more complex story. Even though the number of influencers producing content increased significantly—up by 30% compared with the previous year—average earned media value (EMV) per post dropped by 22%, suggesting that while more voices were participating, the resonance of each post declined. This points to a saturation effect in digital luxury content, where sheer volume no longer guarantees impact, and audiences respond more selectively to narratives that feel authentic, culturally aligned, or aspirational.

Carlos Alcaraz for Rolex (Instagram).

Carlos Alcaraz for Rolex (Instagram).Brands that have mastered this balance demonstrate the power of strategic, culturally grounded engagement. Rolex and Cartier, for example, each captured 16% of total category visibility, leveraging ongoing talent partnerships embedded in wider cultural moments. Rolex maintained its position through high-profile sports ambassadorships, aligning with globally recognized athletes and events that reflect both excellence and precision—core brand values. Cartier, meanwhile, leaned into the entertainment sector, creating visibility through red-carpet collaborations, filmmaker awards, and curated masterclasses that positioned the brand as a patron of culture rather than merely a product seller.

These strategies underscore a crucial lesson for luxury brands: success is no longer about appearing everywhere at once, but about investing consistently in cultural ecosystems. By embedding themselves authentically in sports, arts, and entertainment, brands not only increase visibility but also build legitimacy, trust, and long-term relevance. The takeaway is clear—luxury resonance today is cultivated over time through sustained, meaningful engagement rather than fleeting digital moments.

Top Watches and Jewellery Brands

Discover the top watches and jewellery brands by EMV and their year-over-year performance.

Download reportCultural Moments of 2025

Leveraging the Cultural Calendar

How do leading brands create impact across major moments?

In an increasingly saturated media landscape, cultural moments have become critical touchpoints for brands seeking relevance and scale. From global sporting events to red-carpet institutions, moments like the Super Bowl, UEFA championships, and the world’s most influential cultural gatherings offer unmatched visibility—but only for brands that show up with purpose. Leading players are moving beyond one-off sponsorships, instead embedding themselves into the cultural calendar through long-term partnerships, talent alignment, and storytelling that resonates before, during, and after the event.

This section explores how brands created impact across the defining moments of 2025, turning major cultural events into sustained engines of visibility, relevance, and earned media value.

Super Bowl

Super Bowl 2025 generated $38.3M in total EMV, with visibility heavily concentrated around the halftime performance, headlined by Kendrick Lamar, which drove 70% of total EMV. Advertiser presence was dominated by Food & Beverage brands, representing 52% of all advertisers, reinforcing the category’s strong alignment with mass cultural moments.

Met Gala

The Met Gala 2025 dazzled with $258M in attendees’ EMV and $292M in media accounts’ EMV, reflecting its unmatched cultural impact. Social buzz surged, achieving an impressive 8.5% average engagement rate. Celebrities, fashion, and media converged to create one of the most talked-about nights in global pop culture.

Cannes Film Festival

Cannes 2025 dazzled with $206M total EMV, +72% YoY growth. L’Oréal shone brightest, boosting EMV +334% and cementing its elevated presence at the festival.

The Full Cultural Calendar

See how leading brands turned 2025’s biggest cultural moments into impact. Unlock the Full Cultural Calendar to drive relevance, visibility, and earned media.

Download report